Advantage Biodiesel

By Tom Konrad, Ph.D., CFA

Because of rising fertilizer prices, farmers are planting more soybeans than corn. Soybeans are a legume, meaning that they can fix their own nitrogen in the soil, meaning that they need less nitrogen fertilizer, the price of which is spiking due to rising natural gas prices. Corn, in contrast, needs more nitrogen than most other crops.

High gas prices are rising because of Putin’s war on Ukraine, which is also preventing Ukrainian farmers from planting this year’s wheat crop, while sanctions are likely to disrupt wheat supplies from Russia as well.

Corn and (to a lesser extent,...

A Disappointing Supreme Court Biofuel Decision. Why It’s Not Over Yet

By Jim Lane

The case

Last week’s decision stems from a May 2018 challenge brought against EPA in the U.S. Court of Appeals for the Tenth Circuit by the Renewable Fuels Association, the National Corn Growers Association, National Farmers Union, and the American Coalition for Ethanol, working together as the Biofuels Coalition. The petitioners argued that the small refinery exemptions were granted in direct contradiction to the statutory text and purpose of the RFS and challenged three waivers the EPA issued to refineries owned by HollyFrontier Corp. and CVR Energy Inc.’s Wynnewood Refining Co.

The case is HollyFrontier Cheyenne Refining, LLC v....

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

Covanta Earnings

(published August 2nd)

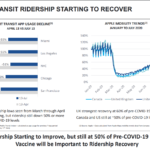

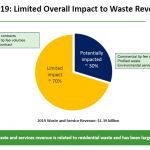

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

Biofuel Industry Reacts To EPA New Renewable Fuel Standard

Yay or Nay for EPA? RFS Volumes out for 2020, Biodiesel for 2021 – What’s the reaction from industry?

by Jim Lane

What’s the reaction from industry? Coal for Christmas?

Should Santa bring coal for EPA’s stocking this year? Do the biofuels and agriculture industries think the EPA just put coal in their stocking? Is it thumbs up or thumbs down from biofuel industry advocates on last week’s U.S. Environmental Protection Agency renewable fuel volumes? What about the exempted volumes?

The Ruling – Rotten or Respectable?

First, a bit on the EPA ruling that establishes the required renewable volumes under the Renewable Fuel Standard (RFS) program for...

North American Outlook on Biofuels Challenges and Opportunities

Challenges and Opportunities in Biofuels

By Steve Hartig, Former VP of Technology Development at ICM

The North American biofuels market can be split into three main segments all of which have major dynamics. What I would like to do is give a high-level overview of what I see as some of both the challenges and opportunities across these.

Ethanol which is a produced from corn and sorghum in about 200 plants mainly across the Midwest and blended at about 10% with gas. Majors such as POET, Green Plains, Flint Hills, Valero, ADM and Cargill do a bit more than half of the 16...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

Green Plains’ Cattle Drive

As quickly as the ethanol producer jumped into the cattle business, Green Plains (GPRE: Nasdaq) has sold off half of its Green Plains Cattle Company to a group of investment funds for $77 million. Operating at six locations in Colorado, Kansas, Texas and Missouri, the company has the capacity to feed 355,000 head of cattle each year. The cattle business contributed $271 million to total revenue in the most recently reported quarter ending June 2019, delivering a modest operating profit near $7.3 million.

There has been considerable stress in the feed cattle industry. The number of cattle in feedlots is down compared to last year, an unusual development...

Trump Takes Down Ethanol in Pincer Move

by Debra Fiakas, CFA

The Trump Administration is using tariffs on China goods as a trade war tactic to pressure China into relenting to U.S. trade policy demands. Unfortunately, the fallout has been heavy and widespread. Farmers have taken the heaviest hits as China has dropped orders for corn and soybeans. Ethanol producers have been ensnared in the trade war skirmish as well and in recent weeks have been caught an uncomfortable ‘pincer-like’ squeeze by the Trump Administration.

Trump’s Environmental Protection Agency has continued its practice of granting waivers to oil and gas refiners, eliminating the requirement to blend biofuel with the refiners’ petroleum...

Beyond ZEVs: The Negative Emission Vehicle

by Jim Lane

Wandering the halls at the BIO World Congress and later to be seen again at ABLC NEXT this November, we ran across one of the most interesting technologies relating to ethanol production and markets we have seen in a month of Sundays, perhaps two months’ worth.

The problem

First, let’s revisit the problem. There’s simply too much ethanol being produced for the markets to absorb, given the Trump Administration’s massive cutbacks in US ethanol targets —In the resulting massively oversupplied market, the inevitable has happened, ethanol producers, growers and the Midwestern economies are being crushed. And they thought they...

Enzyme Breakthroughs From The Majors

by Jim Lane

Three big product announcements just in…

DSM (e) breaks through on yield, efficiency with new yeast, enzyme offerings for corn fiber conversion.

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) launches breakthrough techs “Fortiva” and “Innova Force”.

DuPont (DD) extends with corn oil extraction tech.

In Indiana, DSM leads the news out of the Fuel Ethanol Workshops with their latest yeast and enzyme offerings, eBOOST GT and eBREAK 1000F.

Up to 60 percent GA reduction

We’ve seen the eBOOST brand over the past year — so here’s a significant cost savings opportunity in the form of a line extension. eBOOST GT, which has been tested and qualified at commercial...

ADM Separates Ethanol Business

Prelude to a spin-off?

by Jim Lane

The Archer Daniels Midland Company (ADM) is breaking news of breaking off their ethanol unit…and a tumbling 40% decline in profit.

In Chicago, Archer Daniels Midland Company reported their financial results for the quarter ended March 31, 2019, but most interesting to us, they are looking at separating their ethanol business with the option of spinning it off completely. They are also taking other actions to restructure and deal with challenges they say include weather issues and trade pressures.

ADM announced a “series of measures to continue to underpin long-term-value creation” which included:

“First, to meet growing customer...

Biofuels Industry Reacts To The New RVO Requirements

by Jim Lane

What a whirlwind weekend after the U.S. Environmental Protection Agency announced their final renewable volume obligations (RVO) under the Renewable Fuel Standard program for 2019. “It’s just numbers,” some say, but oh no, not in the biofuels world. It’s never just numbers. This time it’s about waivers, fixing the damage done, and ensuring a bright future for biofuels. It’s about hollow chocolate bunnies and two steps back for some.

French mathematician Rene Descartes is best known for “I think, therefore I am,” but he also said “Perfect numbers, like perfect men, are rare.” So true in this case as not...

Report Alleges EPA Tests Skewed Against Ethanol By Oil Industry Influence

by Jim Lane

In Washington, researchers for a report published by the Urban Air Initiative contend that “technical data that shows the nation has been exposed to decades of flawed test fuels and flawed driving tests, which in turn means flawed emissions results and mileage claims”. The complete Beyond a Reasonable Doubt series from UAI is available here.

Further, EPA emails obtained under the Freedom of Information Act reveal that, according to a report from Boyden Grey & Associates, the Agency appears to have directly solicited financial contributions and technical input, “especially on the fuel matrix,” from an oil industry controlled research organization.

Of the...