Transmission – The Bottleneck We All Saw Coming

by Paula Mints

Transmission and distribution is the process of getting electricity from the point of generation to the point of use. Unfortunately, upgrades, maintenance, and the need to extend the electricity infrastructure from point a to point b are often ignored. Also ignored are infrastructure designs that support a distributed grid with renewable energy sources of electricity.

Transmission bottlenecks are the utterly foreseeable consequence of accelerated solar and

wind deployment. As countries worldwide were announcing RE goals, holding auctions, and providing incentives, system operators everywhere were warning about the need to add new and upgrade existing infrastructure while also warning about...

Discom-fort: Barriers to Renewables in India

by Ishaan Goel

Energy is crucial to India’s policy agenda. Millions of households are yet to gain reliable access to electricity, hampering their potential for economic growth. Severe pollution issues create widespread health problems. Renewables are prioritized as viable solutions across the political spectrum, with their low costs and ease of installation in remote regions. The current administration has ambitious plans for renewable energy (RE), targeting an almost 4x increase in installed capacity to 450 GW by 2030 and introducing a spate of tax and investment reforms.

At the heart of the Indian power supply chain lie distribution companies (discoms). The...

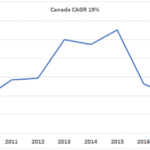

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...

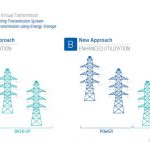

Energy Storage as Transmission Explained

by Blackridge Research

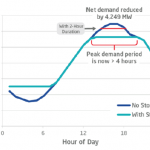

The latest trend is that power transmission companies around the world are increasingly looking at energy storage technology to defer or replace transmission system upgrades. How this works is energy storage is placed along a transmission line and operated to inject or absorb power, mimicking transmission line flows. Going with names like “virtual transmission” in Australia and “GridBooster” in Germany, projects totaling over 3 GW of capacity are poised to increase system efficiency and reliability across the world.

Storage as transmission offers an array of benefits over traditional transmission infrastructure. They are faster to deploy, have smaller footprint,...

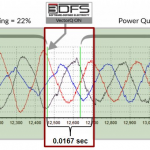

Digital Electrification: Less Waste, More Capacity

One potentially huge contributor to decarbonization of the economy could come from dramatic efficiency gains obtainable from digitally improving the power quality of electricity, as it is being generated, transmitted & being consumed. The enabling technology is emerging from developments in computing that is associated with the Internet of Things (IOT).

DOE estimates indicate that approximately 38.2 quads of electricity are produced, from all sources, but that 25.3 quads, or 66.2% is deemed “Rejected Energy”, so only 33.8% of generated electricity is actually being used. Within that 66% a distinction is recognized between “Losses” & “Waste”:

Loss is non-recoverable, I2R...

Democratizing the Grid

by Daryl Roberts

In a previous article I investigated the question of whether private sector capital was being stimulated sufficiently enough to build out renewable infrastructure on pace to reach climate goals. I found that on the upper end, giant institutional funds were only mobilizing a tiny fraction of their total Assets Under Management, due to regulatory constraints and uncompetitive yields. On the lower end, smaller scale funding seemed to be growing, with facilitation from intermediaries, fintech aggregation services, and increased access at lower levels to complicated derisking strategies.

But I now find reporting that capital is over-mobilized, that solar may...

Advanced Energy: Overlooked and Undervalued

Investors interested in renewable energy often get singularly focused on innovators new energy sources at the expense of companies that provide the nuts and bolts of the energy infrastructure. Advanced Energy Industries (AEIS: Nasdaq) is a stalwart of the electric power network, providing power conversion and control components that convert energy to the proper current for use by consumers and business. The company has a broad product line that has applications with a diverse customer base, including semiconductor manufacturers and chemical processing plants. The 2017 acquisition of Excelsys Holdings Ltd. based in Ireland added products targeted at medical and industrial applications.

As popular as Advanced...

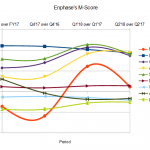

Hopping Off The Short Enphase Bandwagon

by Tom Konrad, Ph.D., CFA

Last week, I wrote that I'd taken a short position in Enphase Energy Inc. (ENPH). I have now closed out that position and don't intend to go short again.

My decision to go short was based on four factors:

I'm worried about risk in the overall market, and so am considering opportunistic short positions as a hedge.

Prescience Point Capital Management released a report accusing Enphase of earnings manipulation. The report seemed well-researched from a purely accounting point of view.

My favored indicator for avoiding companies which might be engaging in earnings manipulation, Beneish M-Score was...

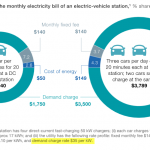

EV Fast Charging Disincentives

by Daryl Roberts

DC Fast Chargers (DCFCs) and Tesla superchargers are a key element in electric vehicle (EV) charging infrastructure that could facilitate wider adoption of EVs by enabling recharging that comes to resemble the time currently taken for gas station stops, and thereby reducing “range anxiety” for drivers.

However, the pricing structure for electrical costs incurred at commercial DC fast chargers is currently prohibitive, because it includes a special fee called a “demand charge”. Rate design in a number of states includes this additional charge, based on the “peak rate” on electric power consumed in kW. In New York,...

Introducing PERGY

Impressed by the number of stocks in the Crystal Equity Research alternative energy indices that have delivered exceptional price appreciation, the last few posts have been on a quest to find fundamental characteristics that could give an advance signal of a future star. The post “Alternative Returns” on May 8th introduced the series identified future growth as a precursor of strong stock performance. The next post “Quest for Growth” on May 11th looked at stocks with above average growth predictions. Then the post “Alternative Bargains” looked at stocks in the alternative energy indices that are trading at below average price-earnings multiples.

There is a...

Bargain Priced Alternative Energy Stocks

A review of Crystal Equity Research’s novel alternative energy indices found a number of companies that have delivered exceptional price appreciation over the last year. Several were reviewed in the recent post “Alternative Returns” on May 8th. Expectations for growth appeared to be driving the price movement, so the last post “Quest for Growth” featured four companies from the indices for which analysts have posted high growth predictions. Not unexpectedly some investors have already bid higher the stocks of those promising companies.

In this post we go back to the lists to find the companies with both high growth predictions and low price-earnings...

List of Wind and Solar Inverter Stocks

This article was last updated on 12/20/2022.

Inverter stocks are publicly traded companies that manufacture or are suppliers to companies whose products, called inverters, convert power from direct current (DC) to alternating current (AC). Inverters are used to allow power from solar, wind, and batteries to feed the electric grid. They are also included in the list of electric grid stocks.

Advanced Energy Industries (AEIS)

Darfon Electronics Corporation (8163.TW)

Enphase Energy, Inc. (ENPH)

Hoymiles Power Electronics Inc. (688032.SS)

Schneider Electric (SU.PA, SBGSF, SBGSY)

SMA Solar Technology (S92.DE)

SolarEdge (SEDG)

If you know of any inverter stock that is not listed here and should be, please let us know by...

List of Smart Grid Stocks

Smart grid stocks are publicly traded companies that use or enable information technology to operate the electric grid more efficiently. They are also included in the list of electric grid stocks.

This list was last updated on 3/21/2022.

Advanced Energy Industries (AEIS)

AMSC (AMSC)

Arrow Electronics (ARW)

Digi International (DGII)

Echelon Corporation (ELON)

EnSync, Inc. (ESNC)

ESCO Technologies, Inc. (ESE)

Fluence Energy, Inc. (FLNC)

Itron (ITRI)

Kontrol Energy (KNR.CN, KNRLF)

Landis+Gyr Group AG (LAND.SW)

Schneider Electric (SU.PA, SBGSF, SBGSY)

SMA Solar Technology (S92.DE)

SolarEdge (SEDG)

Superconducting Technologies, Inc. (SCON)

Wallbox N.V. (WBX)

If you know of any smart grid stock that is not listed here and should be, please let us know by leaving a comment. Also...

List of Electric Grid Stocks

Electric grid stocks are publicly traded companies whose business involves electric infrastructure, including transmission, distribution, pricing, conversion, and regulation. Includes the list of smart grid stocks.

This article was last updated on 8/12/21.

ABB Ltd (ABB)

Advanced Energy Industries (AEIS)

AMSC (AMSC)

Avangrid, Inc. (AGR)

AZZ Incorporated (AZZ)

China Ruifeng Renewable Energy Holdings Ltd (0527.HK)

Companhia Paranaense de Energia - COPEL (ELP)

Custom Truck One Source, Inc. (CTOS)

Digi International (DGII)

Echelon Corporation (ELON)

EMCORE Group, Inc (EME)

ESCO Technologies, Inc. (ESE)

Fortis, Inc. (FTS, FTS.TO)

General Electric (GE)

Hammond Power Solutions Inc. (HPS-A.TO, HMDPF)

Hubbell, Inc. (HUB-B, HUB-A)

Itron (ITRI)

Landis+Gyr Group AG (LAND.SW)

MasTec Inc. (MTZ)

MYR Group Inc. (MYRG)

National Grid PLC (NGG)

Prysmian S.P.A (PRI.MI, PRYMF)

Quanta Services Inc...

Is AMSC Ready to Get Back to the Future?

Last week a jury found in favor of the United States government in a suit brought in 2013 by the Obama Administration against the Chinese wind turbine producer, Sinovel Wind Group (601558: Shanghai). Sinovel was found guilty of stealing technology from American Superconductor (AMSC: Nasdaq) that had supplied Sinovel with converter hardware and software solutions. Sinovel may have to pay hefty fines when the final sentencing step is completed in June 2018.

American Superconductor (now called AMSC) had already brought a private suit against Sinovel in China two years before the Justice Department filed its case. The China court dismissed the case for lack of...

How Energy Deregulation Affects States and Stocks

by Elaine Thompson

Bloomberg New Energy Finance, in an executive summary of its New Energy Outlook 2017 report, predicts renewable energy sources will represent almost three-quarters of the $10.2 trillion the world will invest in new power-generating technology.

Analysts outline several reasons for this increase in spending, such as the decreasing costs of wind and solar and consumers’ increasing interest in solar panels. Competition between power sources also continues to grow, with products like utility-scale batteries upsetting coal and natural gas’s roles in the marketplace.

But more importantly, state-driven renewable portfolio standards pave the way for additional ventures in renewable energy technologies, particularly...