by Debra Fiakas, CFA

After years of promises Ocean Power Technologies (OPTT: Nasdaq) is finally realizing revenue from its ocean wave power innovations. Sales in the quarter ending January 2020, was $725,000 – more than double the same quarter in the previous fiscal year. Driving the top-line is the sale of one of the company’s signature PowerBuoy ocean wave power generation system to Enel Group (ENEL: BIT; ESOCF: OTC), Italy’s premier energy company.

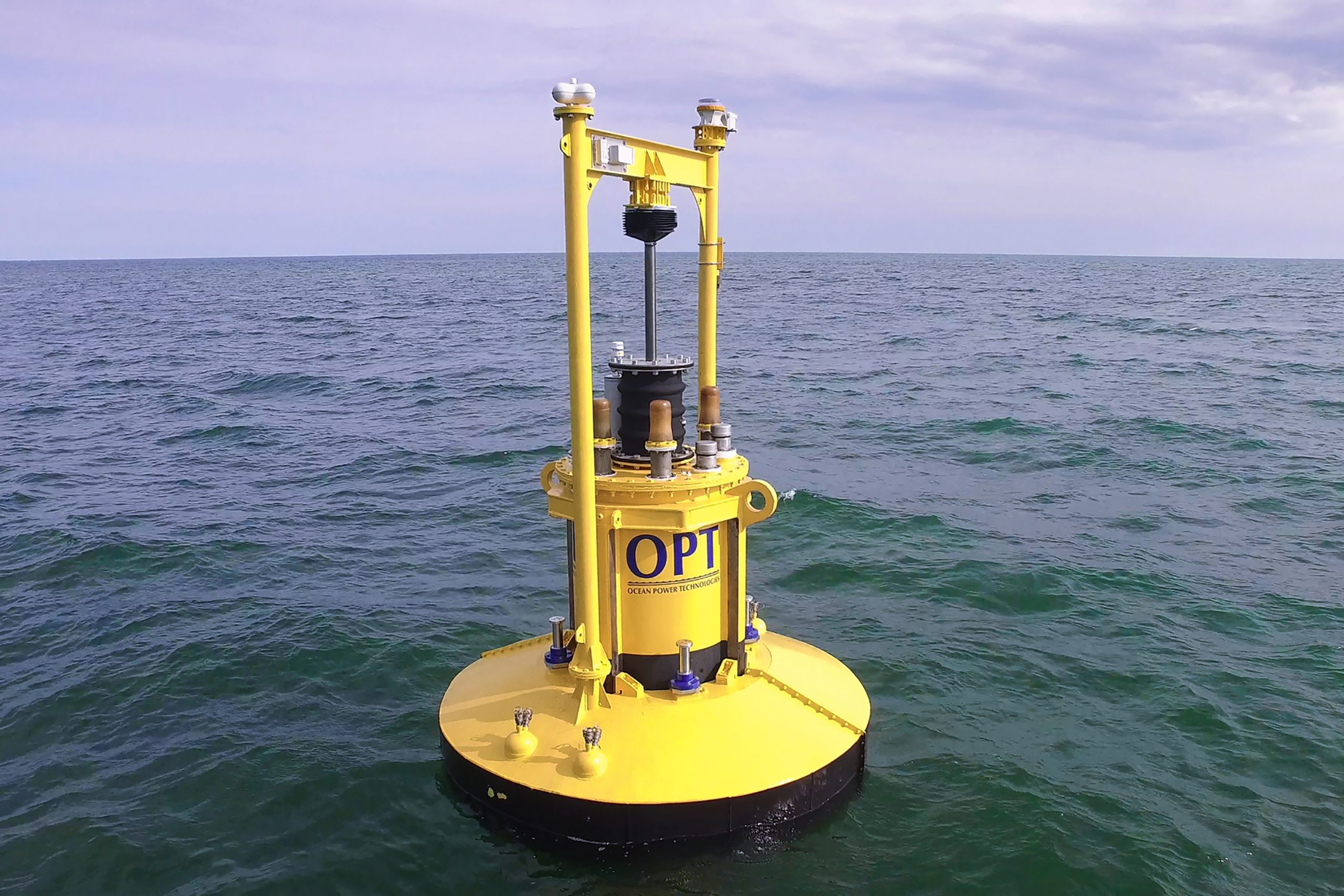

Some investors might find Enel an unlikely customer for a renewable energy device like the PowerBuoy. Designed to convert the mechanical energy in ocean waves to electrical energy, the PowerBuoy has been years under development. Ocean Power has long touted the potential in the device to generate energy free of carbon emissions.

Yet the first commercial customer, Enel, is using the PowerBuoy power data gathering and communications for its offshore oil and gas operations. Maintaining communications with off-shore installations has often been frustrated by the expiration of power sources, leaving remove installations dark and no longer functional. Extracting power from the ocean itself is a major step forward in solving this problem for producers with off-shore oil and gas assets. Yet, it can hardly be considered a step toward a carbon free world if a renewable power source simply facilitates fossil fuel extraction.

Disappointment over the strategic direction of Ocean Power may have played a part in the dramatic decline in the stock from a high of $7.76 in April 2019, to its current level under a dollar. Of course, the stock price today reflects the stress and uncertainly in our economy due to work stoppages to combat the coronavirus health threat. It also reflects the company’s struggles to keeps it bills paid until cash begins to flow from operations.

The company has $9.9 million in cash on its balance sheet at the end of January 2020. That might seem like a tidy sum until investors consider that management has been using on average $2.9 million in cash each quarter to support operations. For the most part, expenditures are for sales and marketing activity as well as product development work.

The cash kitty was built up by sales of stock through an equity line of credit and an at-the-market stock sales agreement. The company sold 2.3 million shares under these two arrangements in the first nine months of fiscal year 2020. Shares outstanding have mushroomed from 5.4 million in April 2019 to 8.7 million at the end of January 2020. It is likely the dilutive effect of the stock sales has also been dragging down the OPTT stock price.

Ocean Power Technologies might be very much like the company’s flagship PowerBuoy devices – there is alot more under the water than you might think. That said, worries for one investor may be creating an opportunity for others. Those who expect Ocean Power to score additional sales opportunities of the PowerBuoy might find the hand wringing over dilution as overreaction. For those with a tolerance for risk at the top-line, the current stock price may be a compelling value.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 3/10/20.