A secular shift in the transportation paradigm?

by Tom Konrad, Ph.D., CFA

I’m continually surprised at the strength and length of the stock market recovery in the face of a worsening pandemic in the US.

The stock market may not be the economy, but it’s not totally divorced from the economy either. Perhaps the Senate’s unwillingness to even talk about another aid package and the subsequent failure to pass one until after the benefits in the initial CARES act expire will trigger the market reversal I’ve been expecting at least since late April. Or it won’t. I have a long track record of being too early on my calls for market corrections, but this is getting ridiculous.

In any case, the long rally has given me ample opportunity to take gains in winners and losses in companies likely to take permanent damage from the pandemic. I’ve also been selling covered calls and otherwise positioning the Green Global Equity Income Portfolio, which I manage, for a renewed market downturn.

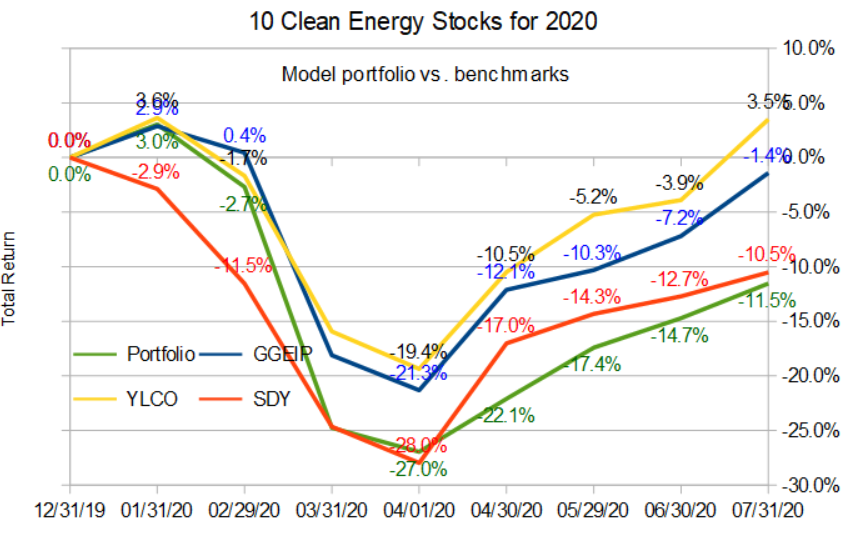

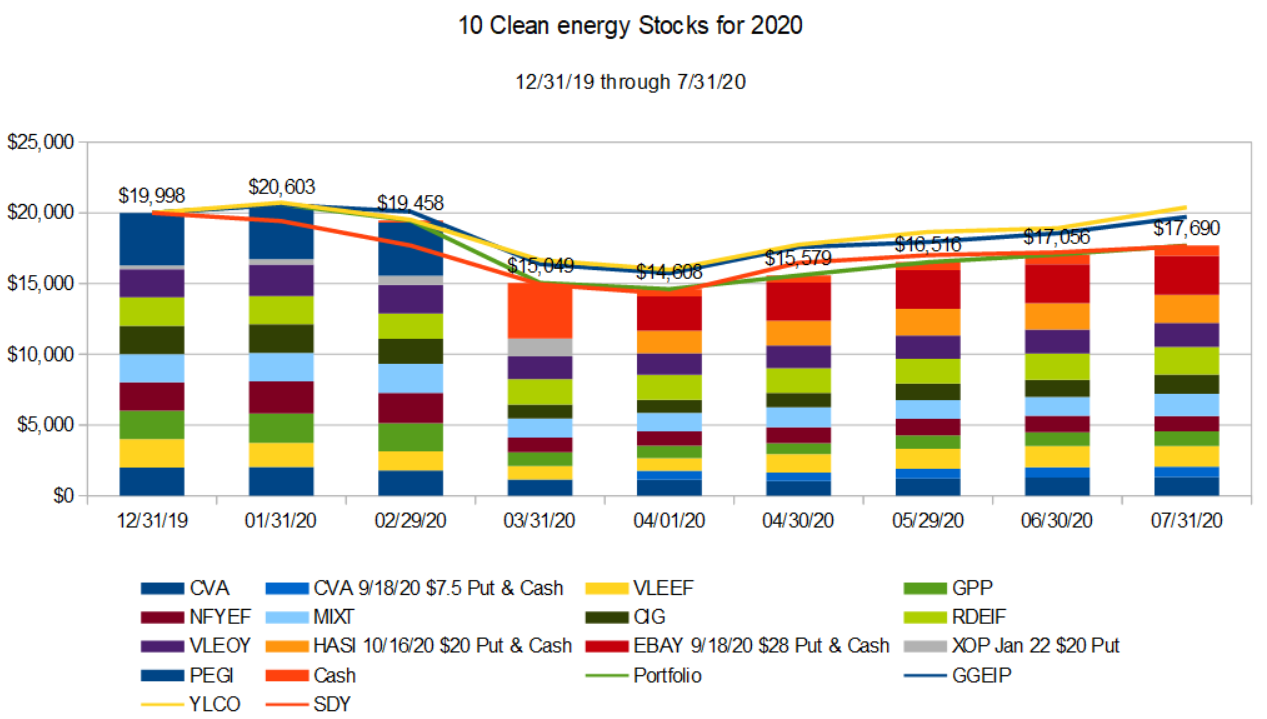

For the 10 Clean Energy Stocks model portfolio, no change. This is simply because I try to minimize trading in the model portfolio; I want it to be a strategy that a small investor who only looks at her portfolio a couple times a year can emulate. In the past, that has sometimes helped and sometimes hurt. This year, it has hurt. 2020 has been a great year to be a trader, with the wild market gyrations. I expect those gyrations to continue, and the model portfolio will stand pat.

If we do see a sharp market decline in the next couple of months, I will probably change that. In that case, I will cash out the gains on the cash covered put positions, and use the money freed up to invest in whatever bargains a renewed market decline creates.

Earnings Season Begins

Over the last couple weeks, I have been sharing my thoughts on various company’s second quarter earnings with my Patreon supporters. If you’d like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I’m reprinting those thoughts below.

Valeo First Half Earnings (published July 22nd)

French autoparts maker Valeo (VLEEF, VLEEY, FR.PA) reported first half 2020 earnings this morning. Sales were down 28% compared to the comparable period for 2019, combined with large losses and asset write-downs, which were 90% due to the reduced short and medium term prospects for the auto sector due to covid.

The good news was that sales in the automotive sector as a whole were down 6% more than Valeo’s, meaning that the company continues to increase its market share. Also, the 10% of the asset write-downs which were not due to covid were likely opportunistic. As long as the company had to write down the value of its assets due to covid, management seems to have taken the opportunity to re-value other assets that were overvalued on its balance sheet as well. This makes it more likely that future accounting revisions, if they come, will be upward.

Over the medium term, I believe that covid is likely to increase the demand for personal automobiles, especially small city cars, as people shift from mass transit to private cars in order to maintain better social distancing. So while Valeo’s first half results look horrifying, there are reasons to believe the medium term story will not be nearly so grim.

Selling NFI Group (published July 28th)

In June, I said “I am looking for an inviting… stop [to] disembark” regarding bus manufacturer NFI Group’s (NFYEF, NFI.TO) stock.

The reason was because I predict a bumpy road for NFI’s customers as transit and intercity coach ridership plummets in response to Covid. I’ve become increasingly pessimistic, especially about US municipal transit system operators as the Senate looks unlikely to pass a meaningful Covid relief bill and then work out a compromise with the House before they go on recess. Even if they do, there has been little talk about including help for transit agencies.

Today, NFI announced a new cost cutting program, causing the stock to rally in the morning. I think I found my stop.

MiX Telematics: Could Have Been Much Worse (published July 31st)

MiX Telematics (MIXT) released earnings for the quarter ending June 30 on July 29th. Subscription revenue was down 18.2% from the previous quarter, but only 6.1% year over year. This is an impressive showing given the general drop in economic activity.

Even better, most of the loss of revenue was not loss of customers, but rather its large oil and gas and transportation customers taking vehicles out of service. Its customer losses were mostly limited to small operators with smaller fleets. The larger multinational corporations which form the core of MiX’s business remain, just with temporarily smaller fleet sizes.

MiX also increased its margins by cutting costs, including reducing staff count by 80 workers.

Longer term, the trends are mostly in MiX’s favor. Two of the largest groups of MiX’s customers, the oil and gas sector and mass transit are likely to experience difficult times for years to come, but the pandemic is also accelerating the trend towards remote asset management.

MiX’s solutions allow most fleet management tasks to be done remotely, and so enable fleet managers to do more of their work from home. During the question and answer session of the conference call, CEO Stefan Joselowitz said, “I think there’s a growing recognition among larger fleets that centralized data and the value that it unlocks in a mobile from a mobile asset perspective is significant and accretive to their businesses. And I think that recognition and realization is driving these conversations. And I think it’s exciting from an industry perspective, and particularly exciting from our perspective, as it applies to global fleets, that we are almost uniquely positioned to be able to, I guess, solve some pieces of this puzzle for them.”

I think so, too. As I wrote in my March and June updates, I consider MIXT to be a good value and continue to do so.

If the broad market falls due to the resurging pandemic in the US, MIXT is one stock I will be buying.

Conclusion

Taken together, these three stock updates flesh out a theme I see emerging from the coronavirus pandemic: I expect social distancing to be with us, at least in part, permanently.

Few people are talking about the long term effects of the pandemic… the usual conversation I hear is along the lines of “when this is over and things go back to normal.” That is a nice thought, and we all hope for it, but hope is not generally a wise investment strategy.

Even if/when we have a vaccine, it could easily be like the flu vaccine: able to slow the spread, but not completely effective. Successful investors anticipate the likely future, not the future they want to see.

If some level of social distancing becomes a permanent feature of our society, this will permanently harm collective transportation, like New Flyer’s buses and airlines. It will help companies which allow us to do our jobs remotely (like MiX’s telematics software) or through sensors and automation (Valeo.)

Disclosure: Long positions all the stocks in the model portfolio, although NFYEF is now a very small position.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Should we buy puts, then, as we did early in the year?

Should we buy Puts, then, as earlier in the year?

I suggest reducing your overall exposure to a market decline in some way. That could be buying puts, selling covered calls, or just selling stocks and holding more cash. Or all three. I generally do the covered calls and cash options; I used puts in the 10 Clean Energy Stocks portfolio because it’s a simpler strategy than covered calls, and cash is a strange option in a 10 “stocks” portfolio.