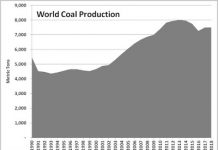

To be sure, the near-term prospects for carbon emissions trading are bleak. Continued decline in industrial production across the world’s major manufacturing economies will inevitably lower carbon emissions. The clearest indicator of this, short of directly measuring emissions, is a sharp decline in the price of various fossil energy commodities (i.e. oil, natural gas and coal) on the back of falling demand.

Another important factor for carbon emissions trading is that the commodity in play – the regulatory right to emit a unit of carbon dioxide equivalent (CO2e) – derives its legitimacy entirely from a regulatory scheme rather than from an economic need. Placing faith in carbon markets therefore means placing faith in politicians. The next 12 to 18 months are unlikely to produce much in the way of vigorous environmental action on the part of government (barring subsidies for alternative energy related to the stimulus package), especially if it means additional costs on industry.

These headwinds didn’t prevent XShares Advisors from launching a new carbon emissions ETF, the AirShares EU Carbon Allowances Fund (ASO). ASO is an interesting product – it’s a commodity pool that holds long positions in emission allowances under the European Emissions Trading Scheme.

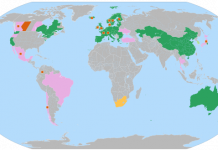

ASO is the second product of its kind (sort of…). Last June, Barclays launched the iPath Global Carbon ETN (GRN), an exchange traded note that tracks what it calls "carbon-related credit plans". For now, GRN tracks the EU ETS as well as the Clean Development Mechanism (CDM), conferring it an emerging market angle that ASO lacks.

These two securities now allow individual investors to play carbon trading more directly, but beware; the world of carbon markets is highly complex and unless you’re crystal clear on the rules on how these permits are allocated by regulators and traded by market participants, you could be in for some nasty surprises. For instance, for the first phase of the EU ETS (2005 to 2007), European governments over-allocated permits, leading a price collapse when people figured out the market was net long.

Besides these securities, investors can also play carbon trading indirectly by taking equity positions in firms running carbon exchanges, including Climate Exchange plc (CXCHY.PK) or World Energy (XWE.TO). We will continue to seek out and list securities that allow investors to play various environmental markets, so be sure to check our Environmental Markets section regularly.

In closing, although I do believe that in the long run emissions trading will likely become the preferred regulatory route to curtail carbon emissions in many jurisdictions, the next 12 to 24 months could spell more downside for the sector as the perfect storm continues to hit. I will provide an update on these and other securities when I see the outlook brightening.

DISCLOSURE: Charles Morand does not have a position in any of the securities discussed above.

DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.