Charles Morand

The relationship – or lack thereof – between oil prices and the performance of alt energy stocks has been a long-time interest of mine. I discussed it last in late March when I looked at correlations between the daily returns of alt energy and fossil energy ETFs. At the time, I found that only a weak relationship existed between the two and that if someone wanted to make a thematic investment play on Peak Oil, alt energy ETFs were not an ideal way to do so.

Seeing as the popular press and countless “experts” continue to claim, whenever they get a chance, that the fortunes of alternative energy stocks are closely tied to the price of oil, I figured I would revisit the topic.

Fossil & Alternative Energy: The Relationship That Isn’t There

This time around, I took a slightly different approach for my analysis: I correlated the weekly returns for US oil and US natural gas directly (as opposed to through an ETF) with returns for the S&P 500 and four alt energy ETFs. For US Oil and Nat Gas, I used price data provided by the Energy Information Administration here (Spot Price FOB Weighted by Estimated Export Volume) and here (Contract 1), respectively. I got ETF and S&P 500 price and index value data from Google Finance.

For the ETFs, I picked the Claymore/Mac Global Solar Index ETF (TAN) as the solar sector representative, because I took a position in it in March (which I liquidated last week even though I initially claimed I would hang on to it for 18 to 24 months. I have now grown more worried about downside risk than I am optimistic about upside prospects over that time horizon, so I took my money out).

The other ETFs were: the First Trust Global Wind Energy Index (FAN) for wind, because it represents a more direct play on the sector than the alternative; the PowerShares Clean Energy (PBW) ETF for alt energy other than solar and wind, as an analysis I conducted earlier this year indicated it is the best way to access other sectors; and the Powershares Global Progressive Transport (PTRP) ETF, as it provides the only proxy I know of for returns on a basket of stocks with exposure to alternative modes of transportation.

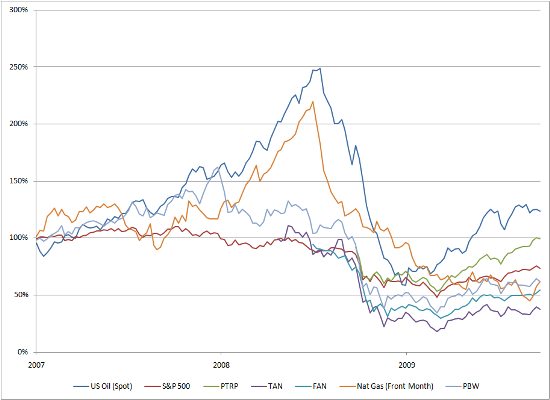

The graph below displays returns for all four ETFs, Oil, Nat Gas and the S&P 500 between Jan. 1, 2007 and Sep. 25, 2009 (click on the image for a large view).

The table below shows returns and volatility for all seven assets over the same time interval but broken down into sub-periods. Seeing as 2009 and the post-Lehman collapse period have been eventful times to say the least, I thought it would make sense to create a few distinct sub-periods for analytical purposes.

What jumped out at me from this table is the relatively strong performance of the Powershares Global Progressive Transport (PTRP) ETF, even after adjusting for volatility. As the correlation analysis below demonstrates, this performance is not due to a rise in oil prices.

My going theory is that there is a Green Stimulus Effect at work given how much of global stimulus dollars have gone to transportation programs. This would be something worth exploring further but it certainly seems in line, at least on the surface, with a prediction I made nearly one year ago.

The following three tables contain the real meat of my analysis. They are fairly self-explanatory: they show correlation coefficients between US Oil, US Nat Gas and the S&P 500 with all other assets. The correlations are for the periods outlined in the tables or since inception in the case of PTRP (Sep. 19, 2008), TAN (Apr. 18, 2008) and FAN (Jun. 20, 2008). The correlation coefficients above 0.5 are highlighted.

These results are, once again, in line with my expectations: there is little reason to believe that there is a strong relationship between changes in the price of oil and the performance of alt energy stocks. Even for natural gas, where one could expect a correlation with wind and solar given that all three fuels are used in power generation (or load abatement), there does not seem to be a strong relationship.

TAN and FAN have not yet been around for long enough to analyze returns going very far back into the past, but PBW has. Although the correlation between PBW‘s returns and oil’s returns seems to have strengthened somewhat in the past year, it certainly does not qualify as strong.

I must admit that I was fairly surprised to find such a low correlation between the returns on oil and those on the PTRP ETF. My guess is that this ETF hasn’t been around long enough, and that a relationship might emerge under an extreme Peak Oil scenario. That said, spending on public transportation is heavily dependent on the fiscal health of various levels of government, and we’ve just been moved from the emergency room to the critical care unit.

On the other hand, I was not particularly surprised to see that returns for all four alt energy ETFs are strongly correlated with returns for the S&

;P 500 – that seems intuitive enough given that they all belong to the same asset class.

Conclusion

It doesn’t really matter how one slices and dices the data: there just does not appear to be a strong relationship between returns on oil and returns on alt energy stocks, including alternative modes of transportation.

That’s not going to matter to a great many commentators who will continue to claim in newspaper and magazine articles, on blogs and on TV that the success of alt energy stocks is closely tied to the price of crude, even though that’s mostly untrue.

Those who invest in alt energy should, however, pay close attention. These results suggest that there are far more important factors than oil prices, most notably returns in equity markets in general and regulatory incentives by governments.

There is a good chance that equity returns and returns on oil will diverge in the next couple of years as oil prices climb and equities stagnate or decline. If such a scenario materializes, those who have the relationship backwards could be in for unpleasant surprises.

DISCLOSURE: None

Thank you for these insights, Charles … and esp. for mentioning Peak Oil more than once.

For those who’ll be in the Denver area over the next week and want to know more about Peak Oil, I invite you to join ASPO-USA for the 2009 Peak Oil Conference, Saturday-Tuesday, October 10-13, at the Downtown Denver Sheraton Hotel (1550 Court Place). AltEnergyStocks.com’s own Tom Konrad will be one of over 50 experts from the USA, Europe, Russia, Brazil China, OPEC nations, and other parts of the world who will come together in Denver to discuss where we are now (re: oil supplies), where we may be headed, and how best to prepare for a very different future. Click here for complete information about the 2009 International Peak Oil Conference – including discounted online registration.

Phil,

Since I am a speaker at the conference, I decided to publish this… normally we don’t publish this sort of PR comment, but I’ll make an exception in this case. On the other hand, you might think if AltEnergyStocks.com as a place to advertise the next time you’re promoting a conference.

Charles,

I still expect a strong lagged correlation between oil prices and mass transit companies (many of which are part of PTRP.) The reason I think this correlation does not show up in your study, is that it is likely to be lagged by 1-2 years.

Here’s what I anticipate:

1- oil prices rise

2- voters ask for more mass transit

3- politicians decide to do something

4- red tape

5- something is finally done.

6- mass transit companies benefit

I go into more detail on this in my recent article on bus company New Flyer.

PTRP is for me. Even without stimulus monies or voter activism, these companies are in a winning sector.

Tom:

That would be my expectation as well, although as mentioned in the article I wonder to what extent the fiscal mess most levels of government in the West currently find themselves in will dampen social expenditures.

The good thing with the PTRP ETF is that it allows investors to access global markets where such budgetary constraints may not be as important going forward (e.g. China. India, Brazil)

isaac the terrible:

I think PTRP is indeed a great ETF to own. I was surprised with how well it’s performed this year.

That said, I’m not sure right now is a good time to get in. It has had a great run YTD and I question – although I have not done any analysis on this – whether it still offers good value at this level.

Personally, I would wait for a pullback before initiating a position.