by Tom Konrad CFA

We cannot choose between transmission and renewable distributed electricity. Local renewable generation requires long distance transmission to even out variations of supply. Hence, both advocates of distributed renewables and large wind and solar farms should support transmission improvements. Here are a few stocks which should benefit from such investments.

Shortly after I launched Clean Energy Wonk, Blogger took the site down because I made the mistake of including both the words "Cheap" and "Free" in the title of an article about Energy Efficiency. Since it can apparently take up to 2 months for a human to actually check that a blog is not spam, I moved the Clean Energy Wonk domain to WordPress.

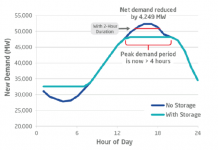

I’ve now posted an article on the new Clean Energy Wonk making the case that distributed wind and solar need transmission to export excess power when they are operating, and to supply power when the wind does not blow or the sun does not shine. Simply arguing that a state can produce enough renewable electricity locally to supply its needs does not mean that that electricity will show up at the right time, or even the right month. Buying storage to bridge the gap would be prohibitively expensive. I estimate that investments in transmission would cost 1/65th as much as the investments in electricity storage that they would make unnecessary. The long version on Clean Energy Wonk is called "Heretic Battles Strawman."

Because transmission is necessary for large scale renewable development, investors in transmission companies should be able to benefit from a large scale build-out of renewable generation without having to bet on a particular solar or wind company, or even a particular technology. Our Electric Grid stock list is full of such companies. These are my favorites:

WIRES:

- American Superconductor (AMSC). Although AMSC is mostly a wind company in terms of revenues and profits, recently the prospects for its eponymous superconducing cable have been heating up. Its superconductors will be crucial to the Tres Amigas Superstation linking the three major national grids, if that project is successful.

- General Cable (BGC) is a good bet for investors who expect the build-out to use tried-and-true technology. What could be more tried-and-true than traditional wires?

- Composite Technology Corp (CPTC.OB) falls in between AMSC and BGC, with its Aluminum Conductor Composite Core cables, which replace the traditional Aluminum Conductor Steel Reinforced cables. The composite core is smaller and stronger than steel reinforcement, allowing more electricity to flow in the same size wire, especially on hot days when power demand is typically highest.

CONSTRUCTION:

- Quanta Services (PWR) is the big daddy of the third party transmission construction business.

- Pike Electric Corporation (PIKE), MYR Group (MYRG), and MasTec, Inc. (MTZ) are smaller players, but could produce better returns for investors because their smaller size makes them likelier acquisition targets.

GRID OPERATOR:

- ITC Holdings (ITC) is probably the safest way to play this sector, since, as a utility gird operator, most of its assets are subject to utility regulation, and hence earn a regulated return on equity paid for by utility customers.

DISCLOSURE: Long AMSC, PWR, BGC.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Uh-oh. In the past ABB has been on this list, no?

Nothing wrong with ABB, I just forgot about it. SI is another I might have included.

Thank you! Will you also share your reaction to the new smart-grid ETF? (GRID,which includes these transmission stocks.)

I assume you’ll caution investors to wait for a better entry point. But is this ETF a good way to get exposure to transmission stocks plus smart grid stocks?

Look for an article on the new ETF, GRID in the next couple weeks.