John Petersen

Albert Einstein once said, “If you can’t explain it simply, you don’t understand it well enough.” So when the editor of Batteries International asked if I could present my analysis of plug-in vehicles in two pages and prove my numbers in a way that any open-minded adult could follow, understand and verify with an Internet search engine, I jumped at the challenge. The article was published yesterday in their Winter Edition. Since the numbers have profound implications for the energy storage sector and an expected flurry of ill-conceived electric vehicle projects like the planned Tesla Motors IPO, I’ve decided to reprint the article here and then offer some thoughts and observations on what the numbers mean for prudent investors.

The first great fraud of the new millennium

(Reprinted from Batteries International, Winter 2010)

PT Barnum would have been proud.

While hype-masters loudly proclaim that plug in cars will save the planet by slashing oil consumption and CO2 emissions, the numbers tell a different story; that plug-ins are all sizzle and no steak. The result is the industrial equivalent of a snipe hunt, a wild goose chase based on flawed assumptions.

Let me explain how I reached this conclusion. On December 31, 2009 Forbes published an opinion piece titled System Overload that questioned whether the battery industry was overbuilding global manufacturing capacity. The third paragraph noted:

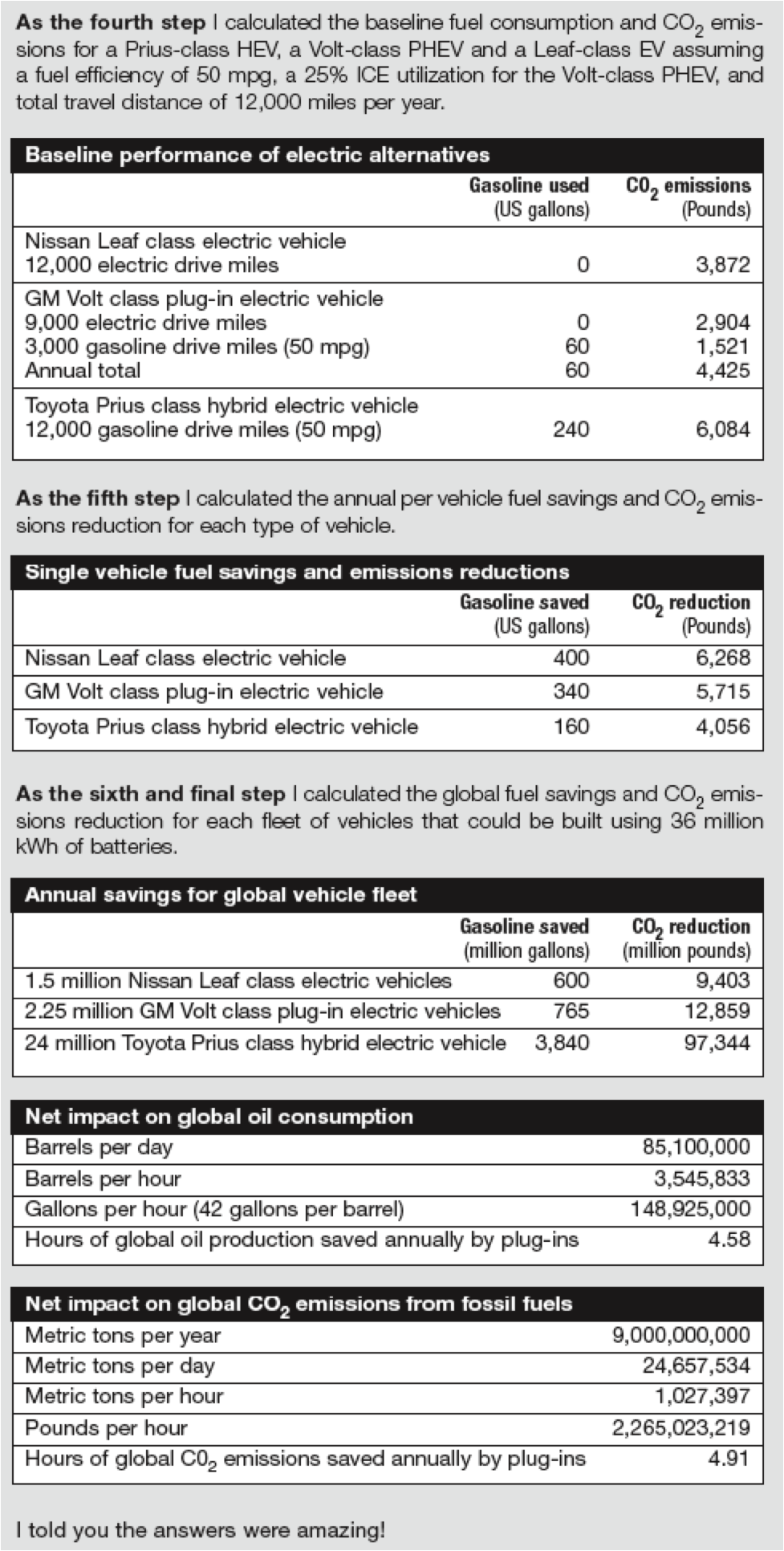

While the article went on to question whether there would be buyers for all those batteries, the capacity estimate got me thinking: “In a world that wants to save fuel and reduce CO2 emissions, but can only make 36 million kWh of batteries per year, what is the highest and best use for the batteries?”

I hate unanswered questions. So I fired up my computer and went to work. Within a few minutes, I found myself wondering whether anybody in Brussels or Washington DC owns a calculator and understands grade school math.

The calculations were simple but the answers were amazing at least to me. The sweet and simple summary is that the venerable Prius-class hybrid is five to six times more effective at reducing global gasoline consumption than its plug-in cousins and, in the US, it’s seven to 10 times more effective at reducing CO2 emissions.

In other words, plug-in vehicles are not the effective albeit expensive saviours of the planet that have been sold to credulous reporters and intellectually lazy regulators. They’re unconscionable waste masquerading as conservation.

I’m agnostic when it comes to the relationship between CO2 emissions and global warming. I simply don’t know enough to have a firm conviction.

I’m not the least bit agnostic when it comes to the fact that six billion people on this planet want a small piece of the lifestyle that 500 million of us have and take for granted.

For all of recorded history, the poor toiled in ignorance and didn’t know that there was more to life than subsistence.

Thanks to information and communications technology, the cat’s out of the bag and fully half of the world’s poor know that there is something better. The biggest challenge of this century will be making room at the table for six billion new consumers.

Accomplishing that without horrific environmental consequences and catastrophic conflict requires relevant scale solutions to persistent shortages of water, food, energy and every commodity known to man.

Using 100% of the forecast global battery production capacity to make plug-in vehicles will save less than five hours of oil production and CO2 emissions per year. I can’t see how any thinking man would consider that scale sufficiently relevant to justify the plunder of far scarcer mineral resources.

In my opinion, the plug-in vehicle industry is perpetrating the first great fraud of the new millennium by using one-on-one vehicle comparisons instead of fleet comparisons.

Yes, indeed PT Barnum would have been proud.

Implications for prudent investors

The most fascinating aspect of this analysis is that battery chemistries and costs are irrelevant. The numbers don’t work any better if you use NiMH or even lead acid batteries instead of lithium-ion. They also don’t work any better if you slash battery costs and make really cheap plug-in vehicles. Those factors might change the cost-benefit analysis for an individual driver or a particular vehicle, but they wouldn’t change the cost-benefit analysis for the only planet we have. It is arrogant insanity to believe we can conserve a relatively plentiful natural resource like petroleum by plundering scarcer mineral resources like aluminum, copper, lead, rare earth metals and even lithium to make batteries for plug-ins.

The gaping flaw in the logic of EV evangelists is their insistence that all analysis stop at the fifth step; a point where plug-ins can look reasonable to a casual observer. In the real world, rational energy, economic, and industrial policies compel the sixth step comparison of fleet-wide performance, which is where the house of cards comes tumbling down. Over the next few years, global investments in advanced battery, plug-in vehicle and charging infrastructure schemes will be north of $20 billion. The best possible outcome will be a one or two percent reduction in global oil consumption by 2020.

That dog won’t hunt. We can and must do better.

My core philosophy comes from Benjamin Graham, the patron saint of value investors, who observed, “In the short run, the market acts like a voting machine, but in the long run it acts like a weighing machine.” While the numbers have convinced me that business models based on the plug-in dream are doomed because the concept is fundamentally flawed; I understand the hype cycle, recognize that markets can be irrational for extended periods of time and know that irrational markets can be alluring to opportunistic traders who are smart enough to enjoy popping corks and go home before the music stops.

For those who can’t resist the hype and glitz, my favorite for “Best in Show” honors is France’s SAFT Groupe (SGPEF.PK). While I don’t write about SAFT regularly because it isn’t registered with the SEC, it’s a fine company that was the second largest beneficiary of the ARRA battery manufacturing grants President Obama announced last August. Unlike the other ARRA grant recipients, SAFT walked away with a double dip from a $299.2 million award to its U.S. joint ventu

re with Johnson Controls (JCI) and a separate $95.5 million award to Saft America.

SAFT has a diversified revenue base from battery sales to military and industrial customers. As a result, SAFT earned €28.9 million on 2009 sales of €559.3 million and had €306.8 million in stockholders equity at year-end. Despite its solid track record, SAFT carries a relatively modest market capitalization of €730.5 million, which works out to 1.3 times trailing sales, 25.3 times trailing earnings and 1.3 times equity plus anticipated DOE grant funding.

For “Domestic Best in Breed,” my favorite is A123 Systems (AONE), which edged out SAFT for the top spot on the ARRA battery grant list at $249.1 million. A123 also plans to borrow up to $233 million under the DOE’s Advanced Technology Vehicle Manufacturing (ATVM) loan program.

In the wake of a successful IPO last September, A123 finished 2009 with $528.2 million in stockholders equity and a clean balance sheet, but it lost $85.8 million on sales of $91 million. A123’s market capitalization of $1.7 billion works out to 18.2 times trailing sales and 2.3 times equity plus anticipated DOE grant funding. While A123 doesn’t offer SAFT class value, it stands head and shoulders above other domestic lithium-ion battery developers, particularly in light of its ongoing efforts to hedge its plug-in vehicle bets with forays into the utility and industrial markets.

Ener1 (HEV) has always struck me as a company that could go either way, but was likely to disappoint investors who bought at inflated prices. Ener1 took fifth place on the ARRA battery grant list with a $118.5 million award. It also applied for loans under the ATVM program, but hasn’t completed due diligence. Since the ARRA battery grant requires matching funds equal to 100% of the grant amount and any ATVM loans will require matching funds equal to 25% of the loan amount, management recently cautioned that the company will need $150 million in additional equity before the dust settles.

Ener1 finished 2009 with a $3.7 million working capital deficit and $116.2 million in stockholders equity, but its balance sheet includes $13.2 million of intangible assets and a whopping $51 million of goodwill. Since both values strike me as incredibly speculative in the context of a company that lost $51 million on 2009 sales of $34.8 million, I believe potential investors will probably focus on Ener1’s net tangible book value of $51.9 million for analytical purposes. Based on 30 years of experience with investors who were willing to invest in my clients but wore brass knuckles to pricing negotiations, my big concern is that Ener1 will have a tough time justifying a huge multiple of net tangible book value to large investors who know that its grants and loans can’t close without matching funds.

If it successfully completes it’s planned IPO, I’d put Tesla Motors a couple tiers below A123 because there isn’t a whole lot of diversification potential for an electric vehicle manufacturer. There may be a couple years of splash and spectacle before the inevitable becomes obvious, but Tesla is not a stock that I’d buy and put in a drawer for my grandkids.

I believe plug in vehicles combine immense risk with insignificant reward, a potentially catastrophic dynamic. SAFT strikes me as a decent investment because its fundamentals are sound without considering any speculative upside from plug-in vehicles. If A123 can diversify into commercial and industrial markets, it may also be a long-term survivor. Until Ener1 solves it’s chicken or egg dilemma of not having the cash it needs to absorb future losses and close on its ARRA grant and ATVM loan, I’d be extremely cautious.

Disclosure: I plan to sit this one out.

Great Write up.

In all this, what is your view on

(a) Crude Oil Price, over 1 year, 3 years, 5 years

(b) Battery companies , car manufacturers et all moving towards hybrids and hence the sector taking off ?

Thanks in advance

Best regards

Subu

From ’86 till the late ’90s, oil prices were relatively flat. In the late ’90s they hit an inflection point and have been trending up within a long-term price channel ever since. Since I’m not much of a forecaster, I tend to think the price channel will continue till we hit the next inflection point.

I’ve written several articles on the short term trends that mandate a huge shift to micro, mild and full hybrids in order to meet European CO2 requirements and US CAFE standards. Overall, I expect the storage sector to be a dominant long-term investment theme that’s just beginning to build.

Great article.

Some questions & remarks :

. depleted car batteries : the metals can be recycled for 100% => true ?

. cars are now for 85% recyclable in the E.U.

. what is the impact on global oil demand from 1 billion new 50mpg cars in the world by 2020 (China+India+Brazil etc) ?

. what is the global metal consumption impact of 1 billion new cars in the world by 2020, how does that compare with the metal production for those car batteries?

. Can Opec fullfill the new crude oil demand on time, given that Western Big Oil has only for 15 years proven recoverable crude oil reserves left on their accounting books, and are blocked from accessing ME or other Opec guarded turf territory ?

. I have 100% clean electricity supply to my home (wind turbine generated) since 4 years, therefore I reload that car battery at home, not using any FF’s.

. the country I live in produce 55% of it’s electricity using nuke plant power generating zero CO2, unless you add the CO2 emitted to delve, refine and process the uranium into fission fuel.

. the country I live in had zero renewable energy supply in 1998. Today it has 6%. Combined with the 55% nuke plant electricity, my country provides 61% of it’s electricity from no FF CO2 emitting resources.

. 5% of global electricity production is nuclear, thus is CO2 clean to reload the batteries.

. 20% of global electricity production is hydro power generated, in the USA it is 6%, but can be brought to 20% without any problem, given that there is over 170GW left to exploit (see wikipedia hydro power).

. The USA generates 75% of it’s electricity supply using fossil fuels.

. Current global installed wind turbine capacity = 151 000 MW, growing at a steady 28% per year. What will the share of wind power be by 2020, on a global scale ?

. The E.U. , a $15 Trillion economy, will produce 20% of it’s electricity using renewable energy supplies only, by 2020 (now 10%). The plan is to get to 50% by 2040. What if China and India do the same, and the US continue using it’s plentiful coal and natural gas resources ?

I know it is easy to comment on articles that you didn’t write yourselves. That is why I am glad You did the effort. Thank you for that.

Whether your input numbers are justifiable or not, I think your calculation that millions of Priuses are better than a few EVs are of course correct. Thats easily calculated without any controversial stats.

That is, the calcs are correct in a static market with static designs. In the real world carmakers put forth a toe-in-the-water of radical new designs to cover themselves when they sense a paradigm shift. And then they move the design along a little further, and repeat. Regulation, gas prices, and resource scarcity are certain to play hell with the car market, not to mention possible dire economic collapse. So there is an engineering and marketing and supply history to get from the 90’s SUVs to a future of small cars with unusual power plants. You can’t analyze the situation as if it were a single year under centralized planning. It’s a multi-decade chaotic process. Then too, we simply have to clean up coal-fired power, build a bigger and better grid, and supply much more wind, solar, and eventually other non-petroleum sources. Fuel cells are still in the mix, too, in spite of high technical hurdles. As are ultra-lightweight vehicles and public transport. So the Really Big Picture is, according to me, a chaotic mix of good and bad designs, good and bad business ideas, and a very uncertain playing field.

OK so you are really aimed at investing not designing the technocracy. Fine, I wish I could figure out what to invest in too. It seems to me that the other big investing problem is the shakeout thats bound to come as we lose the Hupmobiles and Model Ts of the market.

Although not directly based upon your present article, any comments on the recent collapse of Firefly which seems to have been the most direct potential competitor for Axion?

Alain, the recycling rate for lead-acid batteries is very high, approaching 99% in North America and Europe. The recycling rates for other types of batteries is very low. The reduction of C02 emissions from vehicle electrification starts from a base of 20 pounds per gallon of gasoline. If your grid has fossil fueled components you have to add back an adjustment for the power plant, but even with a pristine 100% green grid you can never exceed the 20 pounds per gallon. Ultimately the best solution for society is the solution that takes the biggest bite out of oil consumption. The addition of new demands in China, India and Brazil coupled with a global oil industry that can’t keep up merely add urgency to the need to cut oil consumption rapidly, which is not going to happen from the widespread use of plug-ins.

Jawfish, I agree wholeheartedly with your expectations of chaos and constant change. A simplistic either-or analysis is not useful at all in terms of policy planning, but it can be very useful for testing an investment thesis, which is exactly what this one does. If you do your either-or testing and find a big difference in outcomes, that’s valuable information, particularly if the outcome favors the less popular choice. I have every confidence that people will act in their own self interest over time. The either-or testing tells me that plug-ins will not be the preferred choice of buyers, nothing more.

Alegra, I’m saddened that Firefly was forced to close. While I’ve never viewed Firefly as a direct competitor for Axion, I firmly believe the world needs all the new storage solutions it can lay its hands on and that every company that brings a product to market will have more business than it can handle. With a little luck somebody else will take the technology out of the bankruptcy and succeed where Firefly failed.

I think your article is clever but also a good example of how to confuse the issue. Firstly, Einstein may have said that “If you can’t explain it simply, you don’t understand it well enough” but that is not the same as saying anything explained in simple terms is always correct.

You have simply restated the fact that the Prius uses batteries more efficiently than the Volt and nothing else.

Try the calculation again by taking all the ICE cars off the road and replacing them with either Priuses or Volts. The result with the Prius would be minimal reduction in the use of fossil fuels. The result with the Volt could be the elimination of fossil fuel use (assuming that biofuels were used for the occaisional longer trip outside the electric only range).

In fact using the current supply batteries in Priuses would only delay the perfection af the Volt technology and so cause more problems later when battery production inevitably increases.

I have called the two types of hybrid you are discussing the Volt (Range Extended Electric Car) and Prius (Conventional Hybrid) – just to keep it simple.

And finally your statement “I’m agnostic when it comes to the relationship between CO2 emissions and global warming. I simply don’t know enough to have a firm conviction.” would also make PT Barnum proud. If you don’t know enough about the subject why do you ignore the collective statements of scientists who do? I suspect that by being ‘agnostic’ you allow yourself to ignore the problem as efficiently as if you simply deny it exists.

Your request asks me to assume the impossible. The world can’t make any large format batteries for automobiles today. It will only be able to make 36 million kWh of large format batteries in 2015. That number will grow as manufacturing capacity is expanded but until you get up into the 700 million kWh of battery manufacturing capacity range, humanity will not be able to take ICE off the road and replace it with EV.

Like it or not we have to take baby steps. Remove as many ICE as possible and replace them with HEV. When every car that rolls off the line is an HEV, we can start looking into perhaps adding plugs.

EV technology today is both expensive and impractical. Presumably it will improve over the next decade while we’re picking the low hanging HEV fruit. Assuming facts that can’t happen isn’t problem solving. It’s issue avoidance.

Thanks for the quick answer.

But I am not asking you to make any new assumptions.

Prius style Hybrids simply recapture some of the energy that would have been lost during braking – Otherwise they are identical to conventional ICE cars. If you choose, using the logic that you have outlined, to use all available battery power for this technology, then you have made no progress towards eliminating the use of precious oil for personnal transport. Using the same batteries for the Volt would be investing in a technology that can eventually be powered by any power station of any type. This may be predominantly coal at the present but can change.

If every car that rolls off the line for the next five years is basically ICE (i.e. Prius style hybrid) then in five years time the situation will not have changed from today.

If we use the available battery capacity for Volt style range extended electric vehicles, then this technology could reach a level of maturity which a lot of people will require before they take it up.

Like you said ‘baby steps’ but at least heading in the right direction.

In short, Prius style hybrids build oil use for personnal transport into the system and change nothing.

The Prius class HEV is an efficiency technology that saves 40% on fuel consumption by using it more efficiently.

The Volt and Leaf class plug-ins are electric drive technologies that use batteries as substitutes for fuel tanks.

Batteries are very good efficiency technologies and dreadful fuel tank replacement technologies. Everybody talks about how much better things will be some day, but that does nothing to reduce the oil that is already built into the transportation system and draining the economic lifeblood of every advanced economy.

The first step in any trauma unit is to stop the hemorrhaging. Once the patient is stabilized you can start thinking about repairs, replacements and betterments.

EV technology is widely thought of as wonderful but it is also untested and its sterling reputation is based on conjecture rather than fact. I agree that the technology needs to be developed to a point where it will be useful. That being said it is a tragic waste of limited resources today.

The issue is not what might be possible in decades, it’s what is possible today.

No industrial revolution has ever sprung from a technology that cost more and did less. Moreover, no revolution as ever sprung from a technology that did not prove its merit first. Deciding in advance that electric drive will be the technology of the future and trying to force a revolution based on conjecture is contrary to all laws of history and economics. The EV evangelists need to prove their case first and then demand change.

My first reaction was to say that it is short term thinking that has put us into this mess in the first place but, when I thought about it for a bit longer, I realised that there is no conflict in our opinions.

If you are taking a short-term view (five years or about the lifespan of a gerbil) then you must conclude that the best thing to do is rush out to buy a Prius (or equivalent) before all the batteries vanish.

If you want to think medium term (decades) or long term (human lifespans) then buy a Volt when they come out and use renewable energy to charge it.

I’m only concerned about this sector from the perspective of an investor who wants to make money by investing in companies that plan to manufacture mass market products for sale to the general public.

I don’t buy experimental products that have the potential to put me or my family at risk and until tens of thousands of vehicles have been in the hands of individuals for three to five years I will absolutely look at them as xEVs. Anything else is signing up to be a lab rat and I’m not interested.

All of the EV advocates out there assure me regularly that battery prices are going to collapse in the immediate future and that battery performance will soar. With that dynamic, the prices of EVs are going to be like the prices of iPhones. Since I don’t have piles of spare cash lying around and my current car is both paid for and serviceable for at least a couple more years, I’d certainly want to wait a couple years and save $10,000 to $15,000 on a $40,000 vehicle. Anything else is fiscal insanity.

Your comment evinces a childlike confidence in corporate America and I have to admit that’s something you don’t see much of nowadays. Keep spreading the good word.