…and Why Not Invest in Oil Companies?

Tom Konrad CFA

The purpose of this series on peak oil investments has been to highlight companies outside the oil sector that are likely to benefit from increasing oil prices. This article explains why we should expect oil prices to rise.

What is Peak Oil?

There are many definitions for peak oil. In its most basic form, Peak Oil is the moment of highest production. World oil supplies are finite, and so we cannot continue to produce oil in increasing quantities forever. It’s a mathematical certainty that at some point the supply (the annual total production) of oil will stop increasing and begin declining. Theoretically, peak production could be the result of declining oil demand, or it could arise from declining oil supply. With rising economic activity and car ownership in much of the third world, there is little prospect of declining demand, so nearly all observers focus on supply.

If demand continues to follow its current rising trend, even stable oil supplies will lead to rising oil prices. How quickly oil prices rise in response to increasing demand will depend on how responsive oil supply is to changes in the oil price.

Oil Price Volatility

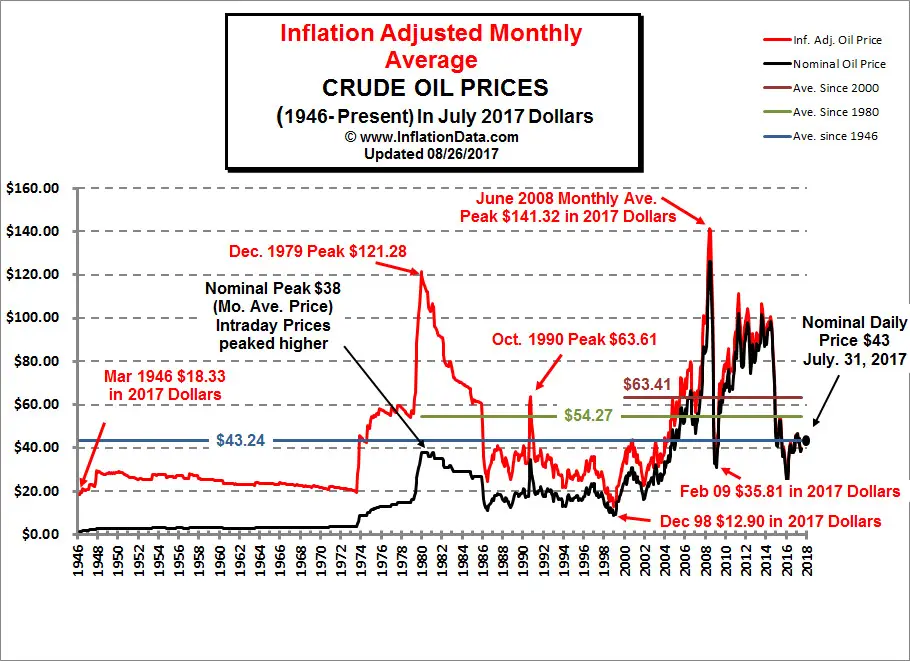

Historically, increases in volatility in the price of oil has been associated with disruption of supply. Consider this price chart from InflationData.com (click for full size image.) Before 1973, the oil price was remarkably stable. In 1973, 1979, and 1990, we see sharp jumps in the price of oil caused by the Arab oil embargoes and the first Gulf War. But in addition to the immediate increase in the price of oil, we also see that each of these price spikes is also associated with more volatility in the price of oil (the graph becomes more jagged.

After 2002, the recent rising trend in the oil price has been accompanied by a further increase in oil price volatility. Economics says that the price adjusts to bring supply and demand into balance. We know that demand for oil has been increasing for most of this period, and supply has been increasing to keep up. This can account for the observed increases in the oil price. But what accounts for the increasing oil price volatility?

Is it Speculation?

Many have been quick to point the finger at speculation as the cause of increasing volatility in the oil price. Multiple studies have looked for but have not found any link between oil speculation and oil price volatility [pdf].

In addition to the lack of evidence that speculation increases price volatility, blaming speculation for increased volatility demonstrates a naivete about how speculators make money. As anyone who has ever traded anything from baseball cards to exotic derivatives knows that, in order to make money, a speculator needs to buy low and sell high. When speculators buy oil, they are acting to increase demand (the aggregate desire to buy), and so are increasing the oil price. When speculators sell oil, they are acting to increase supply (the aggregate desire to sell), and so are decreasing the oil price.

In order to increase price volatility, a trader would need to buy when prices are high (raising prices further) and sell when prices are low (causing them to drop further.) Any speculator who consistently buys high and sells low will also consistently lose money, and will soon stop speculating because of lack of funds. In contrast, a speculator who buys low and sells high will not only make money, but will reduce overall volatility. Selling when prices are high will moderate price spikes, while buying when prices are low will moderate price falls: both have the effect of reducing price volatility.

In other words, speculators who increase volatility will soon run out of money and stop speculating, while speculators who reduce volatility will make money and likely continue speculating unless laws are changed to prevent them from doing so. Attempts to ban or limit oil speculation are likely to have the perverse effect of increasing, rather than reducing future oil price volatility.

The End of Easy Oil

If increased volatility is not the result of speculation, it probably has to do with other changes in the structure of the oil market.

Except for geopolitical events such as the wars and oil embargoes mentioned above, the supply of oil tends not to be volatile. Demand fluctuates with changes in economic activity, and so the demand for oil will be more volatile when economic activity is more volatile. Hence, the price volatility associated with the large spike in oil prices leading up to 2008, along with the subsequent rapid decline and recovery may be attributable to changes in oil demand. However, the years from 2002 to 2007 were characterized by remarkably steady economic growth. Hernce the high oil price volatility during 2002-07 must indicate that the ability of the oil supply to respond to changing demand had decreased compared to earlier periods.

I conclude that the most likely source for increased oil price volatility is a reduction in the ability of oil supply to adjust to changes in price. This agrees with another formulation of the Peak Oil thesis: Peak Oil is not the end of oil, but the end of “easy” oil. We still have an oil supply, and it may or may not be declining, but extracting enough oil to meet demand is becoming increasingly difficult and expensive. We pay the increased cost of extracting the more difficult oil reserves in higher and more volatile prices at the pump, and in environmental disasters such as the blow-out of BP’s Macando well.

Implications of the End of Easy Oil

As world oil demand continues to rise, and extracting oil becomes increasingly expensive and more dangerous, several trends are likely to continue.

- Oil prices will rise in order to compensate oil companies for the increased costs and risks of finding oil.

- Oil companies will become less able to quickly adjust supplies to changes in the oil price, further increasing price volatility.

- Increased drilling risks will cause more frequent oil spills. Increased political risks as oil firms increasingly search for oil in places controlled by less stable political regimes will lead to more frequent expropriation of oil firms’ assets by those same unsavory regimes, as we have seen in Venezuela.

- Increased oil prices will lead to adjustments in our oil use that decrease demand.

Why not Just Invest in Oil Companies?

The increased geological and political risks of oil exploration and production are why investing in oil companies is probably not the best way to benefit from increase

s in the oil price. BP’s price decline in the wake of the Deepwater Horizon disaster is a graphic reminder of the risks of investing in oil companies in the hope of profiting from rising oil prices.

Investing In Reducing Oil Demand

Not wanting to take on the increased risks inherent in oil companies, I have focused this series on the companies and technologies that help reduce demand for oil. These include substitutes for oil, such as Biofuels, Hydrogen, Electricity, Natural Gas, Synthetic Fuels, and Algae. I also probed the barriers that limit adoption of alternative fuels, and the constraints that limit alternative fuel deployment and profitability, which I brought together in a comparison of the short and long-term viability of all these alternative fuels.

Shifting gears a little, I took a look at what reducing oil demand will mean for the economy going forward, and concluded that technologies and strategies for reducing oil use in transportation have better prospects than most options for replacing oil. I looked at increasing vehicle efficiency, and ways to use IT to reduce congestion and driving, including GPS navigation, and Mass Transit stocks. Delving into AltEnergyStocks’ Peak Oil Stock lists, I brought you Ten EV and HEV stocks, and then Six More HEV and EV stocks from reader suggestions. I also looked at four bicycle and moped stocks, as well as four individual stocks that caught my attention along the way: CVTech Goup, Telvent GIT SA, Shimano, and Great Lakes Dredge and Dock.

Coming Up

This is the twenty-second article in a series that has expanded to a breadth and depth that I never anticipated when I began it in March. (You can find a complete index here.) I have a few more individual stocks to write about, after which I plan to cap the series with a short list of companies best positioned to profit from a long-term rise in the price of oil. I’ve learned a lot in the writing of this series, and my picks today are not the same as they would have been when I started, and that is in large part due to your comments and suggestions along the way. I hope you all have learned at least as much as I have.

DISCLOSURE: None.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.