Denny Schlesinger

Machiavelli’s The Prince and Sun Tzu’s The Art of War are the two best known classic treatises on strategies to conquer and to govern. As Kandi Technology Group’s [NASD:KNDI] electric vehicle strategy unfolds, I’m reminded of these masterpieces.

The Challenges

There are many of them. To start with, the current personal land transportation paradigm, the internal combustion engine, is not just well entrenched, it is becoming more efficient as time goes by. The fears of peak oil are vastly exaggerated specially now that fracking technology has added billions of barrels of recoverable reserves to the inventory. Fuel efficiency continues to increase with not just better engines and lighter and better designed cars but also with developments like hybrids, micro-hybrid start-stop technology and alternative fuels like natural gas for light vehicles and LNG for heavier ones. Cheap and abundant natural gas is a strong incentive to develop the required fuel distribution infrastructure.

The batteries themselves are a huge challenge. Batteries cannot compete with hydrocarbons in fuel density. The weight and bulk of the batteries cuts down on the range and payload of the electric vehicle requiring frequent recharging and recharging a battery takes a lot more time than filling a tank with gas. This makes recreating the driving experience of an internal combustion engine vehicle with an electric car very difficult. As if this were not enough, the lifetime expectancy of batteries is low when compared with the life of a gas tank which lasts as long as the car itself. Add to that the high cost of the battery and electric cars become mission impossible except for specific and limited uses like certain fleets (post office, etc.).

With high expectations for wind and solar power it seemed logical to people who did not think the problem through, that electric vehicles were a given. Traditional auto makers expected to replace the gas guzzler with a similar car but with an electric motor. This does not work for, among others, the reasons given above. The challenge, then, is to think outside the box.

Disruptive vs. Sustaining Technology

Clayton Christensen labels new technology as being either sustaining or disruptive. A sustaining technology is one that fits easily into a company’s exiting frame of reference. Hybrids such as the Toyota Prius and micro-hybrid (start-stop) electric cars are example of sustaining technology. An upstart like Kandi has practically no chance against the incumbent industry giants with such a technology.

Disruptive technology, to the contrary, is one that incumbents find hard to incorporate into their exiting frame of reference. The challenge, then, is to think outside the box to find or to create a disruptive technology. A paradigm shift, if you will.

Kandi’s Paradigm Shift(s)

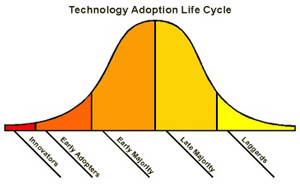

Technology Adoption Life Cycle In his marketing books, Crossing the Chasm and Inside the Tornado, Geoffrey Moore uses the Technology Adoption Life Cycle (TALC) to describe how high technology products move from garage to market. He calls TALC “a model for understanding the acceptance of new products.” In The Gorilla Game, he tells investors how to use TALC to help identify the winners the gorillas and how to use TALC to time the investments. The Whole ProductIf you have a car but there are no roads in your vicinity and no gas pumps and no mechanics, then the car is not useful to you except as a conversation piece. The whole product includes the car, the roads and all the services like gas pumps, oil companies, mechanics, spare parts, driving schools and traffic lights.From Telecosm Crosses the Chasm |

Of course, I cannot get inside the head of Kandi CEO Xiaoming Hu. I can only report what has happened. Kandi started out making all terrain vehicles (ATV) for export. It was suggested to Kandi that a US listing of its stock would create a more solid image that would help sales in the USA. The listing was done via a reverse merger which turned out to be unfortunate because several other Chinese reverse mergers turned out to be frauds, tarring the legitimate ones in the process. Business was doing well until the financial crisis of 2008 hit. Whether for that reason or for some other, Mr. Hu redirected Kandi into the pure electric vehicle business of which I became aware through the Seeking Alpha articles of Arthur Porcari in mid 2010. [Editor note: These articles were first published on AltEnergyStocks.com, and syndicated on Seeking Alpha.] I liked what I saw and I wrote my first Kandi article on October 31, 2010.

Can electric vehicles (EVs) be disruptive technology? Not the way the major auto makers are approaching the market. To be disruptive a technology has to be cheaper and the Volt sure isn’t, and it has to serve an under-served market and the Volt sure doesn’t. To have a chance of success, EVs need a really new paradigm. It seems that Kandi Technologies has found such a new way.

The first big shift was in battery ownership which in hindsight makes perfect sense since the battery is the main stumbling block. The car would be sold (with the help of subsidies) and a swappable battery would be leased. The program was announced with great fanfare, an initial lot of cars was sold and then sales dried up. What happened? According to the Technol

ogy Adoption Life Cycle (TALC), some “innovators” bought the cars but there was no follow up. The Whole Product was missing. A viable infrastructure, which was quite beyond Kandi to establish, was missing. For that Kandi needed help.

Again, I don’t know what happened behind closed doors but the powers that be in the PRC wanted electric cars and Kandi had them. In addition to provincial governments providing subsidies, the two principal state electric utilities got involved. They would own the batteries which would serve double duty powering the cars as well as serving as grid storage in what is being called Vehicle to Grid (V2G) for plug-in rechargeable batteries and Battery to Grid (B2G) for swappable and otherwise stand alone batteries. This makes for a very powerful combination. Batteries that are no longer good enough to power cars can be used for grid storage extending their useful life. As grid storage the electricity subscribers help defer the batteries’ cost. Selling electricity is the utilities’ business which is a good reason for them to build the battery swap service stations.

The next important paradigm shift was to stop looking at it as private transportation. The EVs would become public transportation with the various city or provincial governments creating lease and rental programs. The lease vehicles would have swappable batteries while the rental cars would have rechargeable batteries which would be charged in the program’s vertical garages while waiting for the next customer.

Not only would these programs lower the cost of entry for users, it guaranteed a much larger initial sales volume for Kandi, removing some of the obstacles created by the more usual TALC style adoption. The first lease program would be for 20,000 vehicle to be delivered over a period of 12 months. Although some orders for batteries and cars were placed, the 20K vehicle lease program was also delayed on account of the missing Whole Product. Now we are expecting it to go forward after the Lunar New Year (February 9 to 15, 2013).

Alliances Mr. Hu Has Made

Clearly Kandi could not expect to go it alone. Each province wants to have its own industries which means Kandi needs provincial partners. Kandi needs the cooperation of the electric utilities and also reliable battery suppliers. These are some of the strategic alliances Kandi has made:

- State Grid Power Corporation

- Jinhua City, Zhejiang province, 3,000 EV subsidy program

- Tianneng Power International, Ltd., batteries for Jinhua City project

- Wanning City, Hainan Province, parts factory 100,000 cars

- Wei Fang City, Shandong Province, parts factory 100,000 cars

- Hangzhou, Zhejiang Province, 20,000 car lease program

- Zhejiang Guoxin Car Rental Co., Ltd., Hangzhou EV leasing program

- Hangzhou Green EV Rental Co., Hangzhou EV leasing program

- Hangzhou Yulong EV Technology Co., Ltd., Hangzhou EV leasing program

- Zhongju (Tianjin) New Energy Investment Co., Ltd., Hangzhou EV leasing program

- China Aviation Lithium Battery Co., Ltd. (“CALB”), a subsidiary of Aviation Industry Corporation of China (“AVIC”), Batteries for Hangzhou 20,000 EV leasing program

- Hangzhou 100,000 EV rental project with vertical parking garage

- Zhejiang Zotye Holding Group Co., joint venture

- Geely Automobile Holdings Ltd., joint venture

- TongXu AoXing Vehicle Co., Ltd., marketing agreement in TongXu County, KaiFeng City, HeNan Province

Mr. Hu is systematically covering all his bases getting partners to do all the things that are outside Kandi’s core competence. I found it significant that Mr. Hu visited Mr. Li at Geely last November, not the other way around. It shows that Mr. Hu is the driving force.

Name Change

It might be entirely symbolic but last December Kandi changed its name from Kandi Technologies Corp. to Kandi Technologies Group, Inc. to better reflect the new reality: Kandi is no longer just a go-kart and ATV maker but the leading developer of pure electric vehicles in China, a position it has achieved in barely three years.

Kandi claims to have an annual capacity to make 300,000 cars. There is no reason why the two manufacturing joint ventures can’t make a similar number. When this venture finally takes off, and it could well be this Year of the Snake, the results should be impressive.

Disclosure: Long KNDI.

Denny Schlesinger is a retired management consultant, individual investor and editor of Software Times where this article was originally published.

References

The Prince Niccolo Machiavelli (Author), Daniel Donno (Translator, Introduction)

The Art of War Sun Tzu (Author), Samuel B. Griffith (Translator), B. H. Liddell Hart (Foreword)

The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton M. Christensen

Telecosm Crosses the Chasm Software Times

FORM 8-K Name change, 2012 Annual Meeting of Stockholders

Arthur Porcari’s four part series on KNDI at Alt Energy Stocks

- Examining Kandi Technologies: A China-Based EV and Quick Change Battery Company (Part I)

- Company’s Business and History (Part II)

- Financial Condition (Part III)

- What’s With The Stock Price? (Part IV)