by Debra Fiakas CFA

The business interests of Chicago Bridge and Iron (CBI: NYSE) have varied far and wide from its bridge building start in the late 1800s. These days the company is no longer headquartered in Chicago, builds a lot more than bridges and works with so many more materials than iron. It may seem even more questionable to include Chicago Bridge and Iron among alternative energy companies. However, since February 2013 when CB&I bought out The Shaw Group with its nuclear power plant construction services, CB&I has jumped directly into the alternative energy sector.

While alternative energy might not be the highest priority, CBI certainly wants a better position in the energy sector. CBI needs to go beyond its usual engineering, procurement and construction (EPC) functions to extend help to an evolving power generation industry that increasing is involved in innovating new technologies. The Shaw Group brings a broader range of power generation skills and experience to the combination. The Shaw Group lays claim to induction pipe bending technology and environmental decontamination technologies. More importantly, Shaw Group has an exclusive relationship with Toshiba Corporation related to the Toshiba Advanced Boiling Water Reactor.

The June 2013 quarter will be the first full quarter for the CBI-Shaw combination. It will be the first look at a transformed operation. The Shaw Group earned $198.9 million in net income on $6.0 billion in total sales in the year 2012. While the company has reported net losses in the recent past, cash flow from operations has been consistently positive. CBI is a bit smaller company, only coming close to the $6.0 billion sales hurdle back in 2008. In 2012, CBI reported $5.5 billion in total sales on which it earned $301.7 million in net income. CBI is consistently profitable and consistently turns out ample cash flows from operations.

The seventeen or eighteen analysts following CBI think the combination will result in $2.8 billion in total sales and $110.3 million in net income. In 2014, which will be the first full year the two will be tied together, the consensus estimate is for $551.0 million in net income on $13.0 billion in total sales.

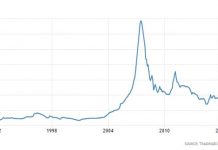

Shares of CBI have been on a nice upward trajectory with periodic pullbacks that give long-term investors a chance to jump into a promising story. The momentum that has built up in the stock suggests a $76 target price, which represents potential price appreciation of 25% from the current price level. The mean target among those analysts with the estimates is $70.00. At the price the implied multiple is 14 times the 2014 earnings estimate of $5.13 per share. That appears reasonable for a company targeting markets with growth rates in the middle teens.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. CBI is included in the Nuclear Group of The Atomics Index.