by Debra Fiakas CFA

The last post on Chicago Bridge and Iron (CBI: NYSE) noted the entrance of CBI into the nuclear field with the acquisition of The Shaw Group, which has an exclusive relationship with Toshiba Corporation related to the Toshiba Advanced Boiling Water Reactor (ABWR).

More evolutionary than revolutionary the ABWR is supposed to be superior other designs in its light water reactor class. ABWR produces power by superheating water to the boiling point. The resulting steam is then used to drive a turbine attached to a generator. Other light water reactors also heat water, but not to the boiling point. Instead the heated water is held in a pressurized vessel and the energy generating heat is exchanged with a lower pressure vessel. It is the heat exchange process that creates steam and drives the turbine.

The first basic boiling water reactors were produced in the early 1960s. There has been considerable tweaking of the design over the years, resulting in the advanced version in the late 1990s. There are about a dozen or so deployments of the ABWR design by various power companies in the U.S., China and Japan, the only three jurisdictions where the ABWR design is licensed. Construction continues on several and some of the older unit built in the 1990s and early 2000s are still in operation. Indeed, several of the completed units have had to be taken off line for repairs of one kind or another.

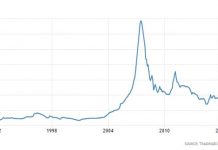

Principally the ABWR is supposed to be advantageous over other designs through reduced capital and operating costs. In the U.S. market cost advantages could not be more critical than at this particular time when swollen natural gas supplies have put other energy sources at a disadvantage. Some have even called the end of the nuclear energy industry as utilities have shuttered aging nuclear plants rather than incur the expenses of repair and refurbishing.

|

| Kashiwazaki-Kariwa Nuclear Power Plant |

By virtue of its investment in The Shaw Group with its Toshiba relationship, CBI now has both feet in the nuclear power plant business. CBI also has some new competition from General Electric (GE: NSYE). GE’s first ABWR installation began commercial operation at Kashiwazaki-Kariwa in Japan, in 1996. GE partnered with Hitachi in 2007 to produce ABWRs. The GE-Hitachi tie-up has and total of four ABWR plants completed in Japan and two in Taiwan. We count another ten units planned in Japan and the U.S. that have ordered from GE-Hitachi.

Toshiba is not be outdone by its competitor. Most recently Toshiba was been tapped as a contractor for the third and fourth operating units of the South Texas Project in Matagorda County, Texas. The South Texas Project is a nuclear power joint venture among Austin Energy, CPS Energy and NRG Energy. The consortium brags that the first two units of the South Texas generating station “produce 2,700 megawatts of carbon-free electricity – providing clean energy to two million Texas homes.”

Here is where The Shaw Group (now CBI) comes into the picture. Shaw is responsible for the engineering, procurement and construction portion of the South Texas contract. Shaw came up with $250 million for the strategic partnership with Toshiba when it was set up, of which $100 million was earmarked for a credit facility to finance the South Texas expansion.

The South Texas project is going forward natural gas prices be damned. It will be Toshiba and its Shaw Group/CBI partner which reap the initial benefits. The saying says ‘watched pots never boil’ but Toshiba and Shaw/CBI have figured out how to turn a coin with boiling water nonetheless.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. CBI is included in the Nuclear Group of The Atomics Index.