Tom Konrad CFA

Disclosure: I am long MIXT.

“The MRM market has been growing quickly, and does not look like it will slow down.”

So says Clem Driscoll, President of C.J. Driscoll & Associates, a leading consultant for the Mobile Resource Management (MRM) industry.

One beneficiary of this growth has been Fleetmatics Group PLC (NYSE:FLTX.) The company’s revenues have been growing 35% per year for the last four years. On Friday, the company was knocked down a peg after reporting fourth quarter earnings. The company reported greater than expected revenues, but lowered earnings guidance for 2014.

According to Driscoll, Fleetmatics’ valuation has been pulling up valuations across the industry, including a large number of private firms (which have been the subject of significant private equity activity) and divisions of other companies with businesses based around Global Positioning Systems (GPS) like Garmin, Ltd. (NASD:GRMN), Trimble Navigation Limited (NASD:TRMB) and TomTom (Amsterdam:TOM2).

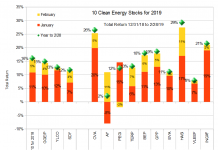

As you’ll note from the chart above, MiX Telematics (NASD:MIXT, JSE:MIX) stands out for its modest comparative valuation, especially with respect to Fleetmatics. Unlike Trimble and Garmin, Mix and Fleetmatics are fully focused on the MRM space. Both provide Fleet Management Solutions using a Software-as-a-Service (SaaS) model, but Fleetmatics is roughly three times more expensive per share based on sales (P/S), book value (P/B), and trailing earnings (P/E). Based on the price-earnings-growth (PEG) ratio, FLTX shares are more than twice as expensive as MIXT, even after Friday’s decline. (Note that the ratios are shown in log scale in order to display them on one chart.)

MiX vs. Fleetmatics

While Fleetmatics and MiX have similar business models, they serve different groups of MRM customers. Fleetmatics is based in the US, where the industry started, and where fleet management solutions have the highest market penetration. MiX started in South Africa, but now serves clients in 112 countries worldwide. The company’s founder and CEO, Stefan “Joss” Joselowitz told me in a phone interview that the move to become a global company started eight to nine years ago. As part of the transition, he relocated to the US with his family six years ago. MiX has offices in East Africa, Dubai, the United Kingdom, the US, Brazil, and Australia. Joselwitz says the move has helped the company in its relationships with international clients. The company listed its American Depository Shares (ADS) on the Nasdaq stock market with the symbol MIXT in August 2013. Each NASD:MIXT ADS is equivalent to 25 JSE:MIX South African shares.

According to Driscoll, the whole industry is becoming more international. Companies based in the US are expanding into overseas markets, or at least looking at overseas markets. Joselwitz thinks it will be difficult to replicate his company’s international presence and relationships on the ground. This infrastructure gives MiX an advantage in serving large international companies, where MiX is the market leader, especially in the Oil and Gas industry.

Different industries require different types of MRM solutions. Oil and Gas and Utility clients require strong integration with mapping and geographical data, while the trucking industry requires hours monitoring, and miles driven on a per state basis, for the purpose of state tax reporting. A new rule from the Federal Motor Carrier Safety Administration is expected to require electronic driver logs in trucking soon. Driscoll expects the new requirement is likely to drive adoption of fleet management solutions in the industry, but also lead to some price erosion from increased competition.

Fleetmatics’ main market is small and medium businesses (SMBs), which require simpler solutions than sophisticated multinationals. According to Driscoll, its offering is fairly basic, but regarded as a good solution for its target market.

Despite it’s simpler offering, SMBs have less pricing power than MiX’s multinational clientele. At the end of 2013, the companies had active subscriptions for similar numbers of vehicles (445,000 for Fleetmatics compared to 428,500 for MiX), but Fleetmatics’ quarterly revenue was $50.1 million compared to $29.6 million for MiX, despite the former’s relatively simple offering. Although not all revenue from each company comes from subscriptions, this equates to approximately $450 per vehicle for FLTX compared to $275 for MiX. This greater revenue is reflected in each company’s gross margins, which are 77% for FLTX, and 66% for MiX. MiX’s gross margin on subscriptions is slightly higher, “approaching 70%” on subscription revenue, but still low compared to Fleetmatics.

The reason MiX is able to serve its more demanding customers at a lower cost per vehicle than Fleetmatics is its South African base. The company keeps as many of its operations as it can in relatively inexpensive South Africa, where Joselowitz says the cost of a software engineer is half that of a software engineer in the US. With the majority of its expenses in South African rands, and much of its revenues in the dollar, Euro, and other international currencies, a falling rand leads to an earnings boost for MiX.

Growth Drivers

New regulatory requirements such as those mentioned above for trucking may drive some growth, but they are far from the only or primary growth drivers. Much more important is the extremely attractive financial proposition. C.J. Driscoll & Associates recently completed a survey of fleet operators regarding their interest in MRM systems. 36% of the respondents use such a system, with higher penetration in larger fleets.

They found:

- Most operators see a return on investment in less than a year.

- Fuel savings were the easiest to quantify, although highly variable. Three different managers reported $550, $850, and $1,400 per year in savings from reduced fuel costs. One manager reported 5% to 8% fuel savings from day one because of reduced idling.

- 31% of managers reported receiving an insurance discount as a result of using an MRM system.

- Many managers also reported significant savings from reduced maintenance, more efficient use of driver time, and fewer accidents.

With all these benefits, it is unsurprising that customers are on the whole very satisfied with their MRM solutions. 79% reported being either very satisfied or somewhat satisfied, and only 6% reporting any level of dissatisfaction.

Driving Safely, Driving Green

While the above results make fleet management easily cost effective for most clients, the greatest safety and fuel efficiency improvements can be achieved with some sort of driver behavior modification (DBM). These systems give drivers real-time feedback, allowing them to increase safety and reduce fuel use much more quickly and effectively than without the system.

While Driscoll says that all major MRM providers offer driver behavior monitoring as an option, its use is much more suitable for t

he large, sophisticated fleets which are MiX’s core customers than they are for the SMBs which are Fleetmatics’ customers. The adoption of DBM is still in its infancy in the US. Only 6% of the MRM customers in C. J. Driscoll’s study reported using some sort of driver behavior management system.

In contrast, MiX includes a driver behavior management system standard in its fleet management solutions. According to Joselowitz, “A standard feature of our MiX FM range of products is in-cab driver notification which is effected through audible feedback to the driver in the event of a violation. We then offer increasing levels of sophistication where we add visual feedback as well such as with the Ribas and all the way up to color displays.” Even though most of MiX’s clients opt for the standard offering, their results show it to be highly effective.

Although I do not have comprehensive data, the results of several studies provided to me by MiX seem to confirm that the ability to monitor real time driver performance often produces amazing safety improvements. The results are impressive even in comparison to the results reported in the C.J. Driscoll study. MiX shared results from several Middle Eastern clients that had reduced accidents between 50% and 95%. Such reductions would almost certainly not be possible on the much safer roads of the US and Europe, but they are impressive anywhere.

Reductions in Road Traffic Accidents and Rollovers by a Middle Eastern Oil and Gas company after implementing a MiX fleet management solution in 2009. Reductions in Road Traffic Accidents and Rollovers by a Middle Eastern Oil and Gas company after implementing a MiX fleet management solution in 2009. |

The graph above showing a client reducing road traffic accidents from 215 to 6 in three years is not an isolated example. Several other studies showed clients reducing accidents and accident related costs between 50% and 95% after the adoption of MiX’s solution.

In terms of efficiency, MiX’s anecdotal evidence points to customers saving from a low of 5% to as much as 27% in fuel costs after the adoption of MiX’s solution. Most of the clients who quantified their fuel savings had efficiency gains in the low teens.

Will Insurers Drive MRM Adoption?

Overall, I find the evidence that driver behavior management significantly reduces accidents quite compelling. It may also improve fuel efficiency more than a basic fleet management solution, but it is the increased savings which should prove compelling to insurers. Yet insurers are only beginning to pay attention.

According to Driscoll, insurance has not yet become a selling point for MRM providers despite the 31% of managers reporting receiving a discount. Insurers who do give a discount are more interested in the fact that the fleet manager is using an MRM system than if that system includes driver behavior management.

In an article on Telematics Update, Christopher Carver, a former program manager for commercial insurance telematics at Liberty Mutual, was quoted as saying, “Commercial insurance is waking up to telematics. Fuel efficiency is definitively linked to lower claims costs. Improved efficiency – driving fewer miles at less busy times – means [fleet operators] are a better bet for an insurance company.”

When insurers do wake up to telematics, I expect they will push for higher adoption of driver behavior management. That in turn should benefit MiX, which has extensive experience with driver behavior management, and the data to prove its effectiveness.

Conclusion

Mix Telematics is a leader in the rapidly growing fleet management industry. More importantly, it is already a leader in a number of trends which are likely to reshape the industry in the coming years: increasing globalization, growing focus on reducing fuel costs, and an insurance-driven focus on improving driver safety. Its South African home base and experience with demanding multinational customers gives MiX a low cost base which is likely to serve it well in a highly competitive industry.

Because of its recent listing in the US, MIXT is much less familiar to Wall Street than US-based competitors such as FLTX. This lack of familiarity is unlikely to last. Neither is MIXT’s low relative valuation.

This article was first published on the author’s Forbes.com blog, Green Stocks on February 26th.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.