by Debra Fiakas CFA

Glyeco recycles waste glycol into reusable antifreeze, windshield wiper fluid and air conditioning coolants for the automotive and industrial markets. The used coolant and antifreeze liquids are frequently contaminated with water, dirt, metals and oils. The company uses a proprietary technology at the foundation of its recycling system to eliminate contaminants. The company focuses mainly on ethylene glycol in its six processing plants.

Last month chemical recycler GlyEco, Inc. (GLYE: OTC/QB) acquired Brian’s On-Site Recycling, a provider of antifreeze and air conditioning coolant disposal services in the Tampa, Florida area. The deal extends Glyeco’s market share and geographic footprint. The company also gains expertise through the members of Brian’s management team who have agreed to join Glyeco to advance the Glyeco brand in Florida. Terms of the transaction were not disclosed and Glyeco is keeping mum on the revenue and earnings contribution expected from Brian’s

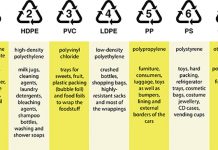

Image result for glycol imageStill the idea of recycling a hazardous chemical is beguiling. Ethylene glycol and propylene glycol are the preferred raw materials used for water-based antifreeze due to a mix of favorable properties: high boiling point, low freezing point and thermal conductivity. Glycol is typically made from natural gas or crude oil – non-renewable and polluting sources. Glycol does breakdown in water, but it can deplete oxygen levels and kill fish and other aquatic life. While propylene glycol is more or less non-toxic, it can be extremely corrosive when exposed to air. On the other hand, ethylene glycol is decidedly poisonous.

The company is still struggling to get the business going. In the twelve months ending March 2016, Glyeco reported $7.5 million in total sales. Unfortunately, the antifreeze recycling business is not profitable. The net loss in that period was $12.3 million or $0.16 per share. The company had to use $1.3 million in cash to support operations. With a cash kitty of $3.8 million at the end of March 2016, there is something of a cushion for the company until the business gains sufficient scale to generate profits. The acquisition of Brian’s should contribute to that end.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.