https://renewableops.brookfield.com/

Tag: Brookfield Renewable Energy Partners (BEP)

The Brookfield Renewable Energy Corporation Premium

By Tom Konrad, Ph.D., CFA

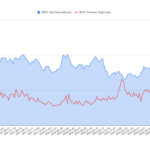

On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. Quarterly earnings actually beat expectations, but for Yieldcos like Brookfield, cash flow numbers and revenue (which can be more indicative of the company’s ability to pay and raise dividends) can be more important. These fell short.

The company attributes the cash flow shortfall to its own clients delaying payments at the end of December, in order to make their own financial statements look better, and it expects the shortfall to reverse...

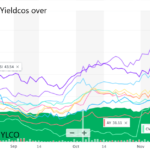

Yieldco Valuations Look Attractive

By Tom Konrad Ph.D., CFA

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high...

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

Clean Energy Stock Deflation and Biden’s Infrastructure Plan

By Tom Konrad, Ph.D., CFA

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of a general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks...

Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...

The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

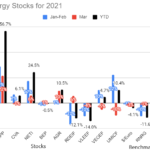

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

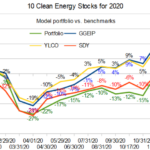

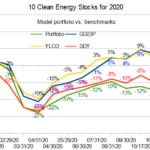

10 Clean Energy Stocks for 2020: Rose Colored Covid

by Tom Konrad, Ph.D., CFA

The stock market took off in November, fueled by very positive covid-19 vaccine news, and possibly also the prospect of a little competence and sanity in the White House. While both of these are unambiguously positive for the economy, I think investors are seeing the future through rose colored glasses.

Rose colored covid-19.

What a Biden Victory Means for the Economy

A Biden victory is good news in that we will finally have someone in the White House who will work to reduce the infection rate in the pandemic, rather than vacillating between wishful thinking and actively spurring...

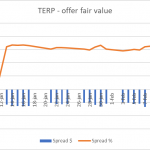

Why is Terraform Power Trading at a Premium to the Brookfield Renewable Merger Value?

Tom Konrad, Ph.D., CFA

A reader asked:

Read your recent article on Pattern Energy (PEGI). Great summary and thoughts.

Would like to ask your view on TERP potential takeover by BEP (via shares swap) and whether you reckon the recent run-up on TERP is too excessive?

It's a good question, and one that Robbert Manders on Seeking Alpha did a thorough analysis of here. For the details of the merger, I refer you to his work.

While his analysis is careful and complete, I disagree with his conclusion. TERP shares are not trading at a significant premium to the merger value. The reason is...

Should Pattern Energy Shareholders Vote Against the Merger?

by Tom Konrad Ph.D., CFA

This morning, hedge fund Water Island Capital called on Pattern Energy (PEGI) Shareholders to vote against the merger with the Canada Pension Plan Investment Board (CPPIB).

Water Island claims the merger is undervalued compared to the recently surging prices of other Yieldcos, and that PEGI would be trading at over $30 given current valuations. There are not a lot of other Yieldcos left, especially if we eliminate those with their own special circumstances. These are Terraform Power (TERP) which is subject to its own buyout agreement with Brookfield Renewable Energy (BEP), and Clearway (CWEN and CWEN/A) where...

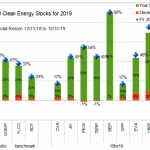

2020 Hindsight: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Sometimes it's good to be wrong.

When I published the Ten Clean Energy Stocks For 2019 model portfolio on New Year's Day 2019, I thought we were likely in the beginning of a bear market. With 20/20 hindsight, that was obviously wrong.

I made the following predictions and observations:

"he clean energy income stocks which are my focus should outperform riskier growth stocks."

"eep value investors will put a floor under the stock prices of these ten stocks."

"I could also be wrong about the future course of this market."

"I have a history...

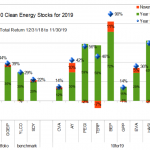

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...

Ten Clean Energy Stocks For 2019: Pattern Buyout, Analyst Downgrades

by Tom Konrad Ph.D., CFA

Although valuations and political uncertainty have me spooked, October was another strong month for the stock market in general and clean energy income stocks in particular.

While my broad income stock benchmark SDY added 1.6% for a year to date total gain of 19.6%. My clean energy income stock benchmark YLCO did even better, 2.7% for October and 29.7% year to date. The 10 Clean Energy Stocks model portfolio fell somewhere in between for the month (up 1.8%) but remains unchallenged for the year to date (40.7%). My real-money managed strategy, GGEIP, lagged as I reduce...

Ten Clean Energy Stocks For 2019: What Caution Looks Like

by Tom Konrad Ph.D., CFA

So far, my worries about stock market valuation and political turmoil have not turned into the stock market downturn I've been warning readers to prepare for. In fact, September has been a particularly sunny month for both clean energy stocks and the stock market in general.My broad income stock benchmark SDY was up 3.9% and the energy income stock benchmark YLCO rose 2.7% for the month, more than reversing August's declines. My 10 Clean Energy Stocks model portfolio accelerated upward by 5.3%, as did my real-money managed strategy, the Green Global Equity Income Portfolio(GGEIP), which...

Ten Clean Energy Stocks For 2019: Will Pattern Merge With Terraform?

by Tom Konrad Ph.D., CFA

August 2019 saw economic warning signs flashing and a worsening trade war with China. Unsurprisingly, this led to weakness in most stock market indexes.

My broad income stock benchmark SDY was down 2.4% and the energy income stock benchmark YLCO fell 0.3% for the month. Most of the stocks in my 10 Clean Energy Stocks model portfolio continued to buck the trend, with the portfolio as a whole gaining 2.2% for the month. My real-money managed strategy, GGEIP, also turned in a solid 1.9% gain.

The strong performance of my portfolios probably rises from the falling interest...

Ten Clean Energy Stocks For 2019: Sell The Peaks

I missed my regular monthly update in early June because of vacation.

In hindsight, early June looks like it was a good buying opportunity. The broad market of dividend stocks (represented by my benchmark SDY) falling six percent in May, only to rebound a similar amount in June. At the time, I would have continued to advise caution: “Sell the peaks” rather than “Buy the dips.”

Particularly volatile stocks like European autoparts supplier Valeo (FR.PA) from this list would have generated even greater short term gains. But it would take more than a six percent market decline to transform this bear...