The Green Global Equity Income Portfolio (GGEIP) is a private strategy managed by Tom Konrad, Ph.D., CFA. GGEIP’s primary objective is a high level of current income with a secondary objective of long term capital appreciation. GGEIP only invests in the stocks and preferred securities of companies that have a net positive effect on the environment compared to the competitors they displace. Most stocks in the Portfolio are small or microcap, and an options strategy is used to enhance current income and reduce risk.

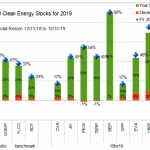

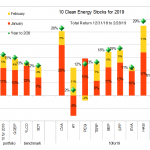

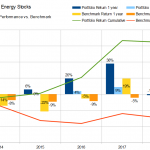

Dr. Konrad has managed GGEIP since December 2013. Total return after fees was 1.5% in 2014, 11.6% in 2015, 30.5% in 2016, and 25.6% in 2017.

The Portfolio is not currently open to outside investors. However, much of the research used in the strategy is also used to inform the Green Economy Strategy offered by JPS Global Investments.

by Tom Konrad Ph.D., CFA

July 2019 was “marginally” the warmest month on record. Meanwhile, the stock market was also inching to new highs, and the real, sweltering evidence of climate change continues to let clean energy income stocks turn in a blistering performance.

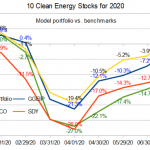

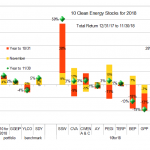

While my broad income stock benchmark SDY was up 16.0% through the end of July (0.9% for the month), my clean energy income stock benchmark YLCO is up 23.4% through July (0.4% for the month,) My 10 Clean Energy Stocks model portfolio is up 28.3% (1.3%) and my real-money managed strategy, GGEIP, is up 26.4% (1.2%) for...

by Tom Konrad Ph.D., CFA

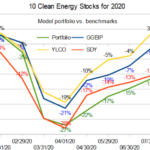

At the start of November, I abandoned my short-term bearish stance on the market, writing "I’m not confident that the correction is over, but we seem to be heading into a temporary lull, and so I’m going to abandon cash as my top pick for November." This turned out to be a good call, with my Ten Clean Energy Stocks model portfolio up 4.3% for the month, slightly behind its broad dividend income benchmark, SDY, which was up 4.9%. Its clean energy income benchmark YLCO gained 1.6%, as did the private portfolio I manage, the...