Tag: GPP

10 Clean Energy Stocks for 2021: Wrap Up

By Tom Konrad, Ph.D., CFA

The Ten Clean Energy Stocks for 2021 model portfolio had a decent year. With a 13.2% total return, it handily beat its clean energy income stock benchmark, the Global X Renewable Energy Producers ETF (RNRG, formerly YLCO), which fell 12.1%. It did not, however, compare as well to the wider universe of income stocks, which had an excellent year, with its benchmark SDY up 27.2%.

The poor performance of clean energy stocks in 2021 was largely due to the bursting of a clean energy bubble which formed in the second half of 2020 fueled by speculation...

10 Clean Energy Stocks for 2021: November. Notes on MIXT, GPP, EVA

By Tom Konrad, Ph.D., CFA

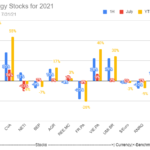

Monthly Performance

Returns for the Ten Clean Energy Stocks for 2021 model portfolio are shown below. It was a good month for clean energy stocks as well as the broader stock market, with the portfolio up 4% for a 20% total return through the end of October. Its clean energy benchmark (RNRG) was up more (8%) but is still down 6% for the year. Its broad market benchmark (SDY) rose 5% and has caught up with the model portfolio at a 20% return year to date.

Earnings

Third quarter earnings season has started. Below are some notes I’ve...

10 Clean Energy Stocks Updates: Green Plains Partners Refi; Covanta Buyout

By Tom Konrad, Ph.D., CFA

Second quarter earnings season is in full swing. Below are a couple updates and the monthly performance chart that I recently shared with my Patreon supporters.

Green Plains Partners Earnings and Future Dividend

(published August 2nd)

Ethanol Master Limited Partnership Green Plains Partners (GPP) declared second quarter earnings today. The main news remains the long anticipated debt refinancing and new dividend guidance going forward.

At the end of the first quarter, I predicted that, after debt refinancing, GPP would increase its quarterly dividend to something in the $0.25 to $0.30 range.

The new guidance is for the partnership to target...

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

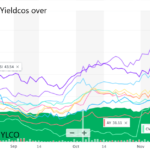

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

Clean Energy Stock Deflation and Biden’s Infrastructure Plan

By Tom Konrad, Ph.D., CFA

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of a general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks...

The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

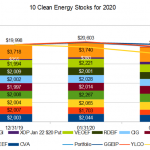

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

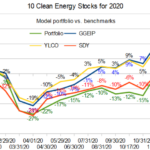

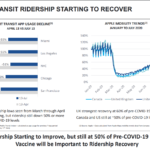

10 Clean Energy Stocks for 2020: Rose Colored Covid

by Tom Konrad, Ph.D., CFA

The stock market took off in November, fueled by very positive covid-19 vaccine news, and possibly also the prospect of a little competence and sanity in the White House. While both of these are unambiguously positive for the economy, I think investors are seeing the future through rose colored glasses.

Rose colored covid-19.

What a Biden Victory Means for the Economy

A Biden victory is good news in that we will finally have someone in the White House who will work to reduce the infection rate in the pandemic, rather than vacillating between wishful thinking and actively spurring...

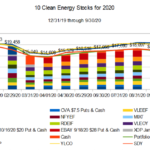

10 Clean Energy Stocks for 2020: Updated Model Portfolio

by Tom Konrad, Ph.D., CFA

After a couple down market days, all the limit orders I listed on Monday have executed.

Here is the current portfolio:

Position

Shares

Position

Shares

CVA

135

CIG

587

CVA Mar21 $7.50 Put

-2

RDEIF

100

VLEEF

57

VEOEF

75

GPP

276

EBAY Jan ‘21 $8 Put

-1

NFYEF

98

Cash

$4415

MIXT

274

Coming Up:

Third quarter earnings season is starting… I plan to write short notes on earnings as they come out for my Patreon supporters, which will be compiled into longer articles on AltEnergyStocks.com a few days later.

Also, I’m doing a talk on how to divest from fossil fuels with the founder of divestor.org this coming Monday at 8:30 pm ET for the Climate and Health subgroup of Citizens Climate Lobby ...

10 Clean Energy Stocks for 2020: Spooked in October, but Trading Anyway

by Tom Konrad, Ph.D., CFA

Two of the cash covered puts in the 10 Clean Energy Stocks for 2020 model portfolio have now expired, and I am left with a difficult decision as to what to replace them with.

As I discussed last month, I feel the market is overvalued given the economic impact of the pandemic and little prospect of fiscal stimulus before January. Yes, the market is not the whole economy, and large tech firms and high income workers and the wealthy are doing great while people on the bottom half of the income ladder are being crushed. With...

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

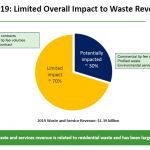

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

You can see overall performance for January and February in the following chart. Not that...

Correction, or Bear Market?

by Tom Konrad, Ph.D., CFA

On February 21st, I was helping an investment advisor I consult with pick stocks for a new client's portfolio. He lamented that there were not enough stocks at good valuations. This is one of the hardest parts of being an investment advisor: a client expects the advisor to build a portfolio of stocks which should do well, but sometimes, especially in late stage bull markets, most stocks are overvalued. I reminded him, "The Constitution does not guarantee anyone the right to good stock picks." He agreed, but he still had to tell his client that...