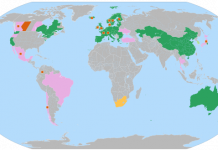

I just came across this article on potential problems with the emerging trade in carbon credits. The piece is not technical and I wouldn’t say that it is particularly well-researched, but it does raise a key point – as the market for carbon emissions grows, the need for standardization and collaboration between governments and regulators will become ever more pressing. This could create problems. The carbon market is unique in that the commodity traded derives its value primarily from its ability to meet the requirements set by an environmental regulator. There is also a market for voluntary offsets to emissions, but this market is small and unlikely to ever represent a significant piece of the total carbon trading pie (the World Bank estimates (PDF document) that the EU ETS, the only regulations-based emissions trading market in the world, accounted for 99% of total market value in 2006). The problem with this is that governments have a long history of messing things up when they get involved in any industry. For instance, in Europe, the market for phase one emission allowances took a massive hit after it became clear that EU governments had over-allocated emissions to shield their national industries from the full effects of strict emissions caps. Besides effectively neutralizing the economic incentive to innovate and reduce emissions, this seriously shook the market’s confidence in the ability of governments to uphold the necessary conditions for an effective and efficient carbon market to develop. As the hype around emissions trading and global carbon markets engulfs you, be sure to always keep in the back of your mind the fact that one of the largest risks this market faces is governments and their regulatory agencies. Like any market, it won’t take much of a faux pas for investor confidence to be severely shook and for millions or even billions of dollars in market value to be wiped out overnight. This would be bad for the market and the environment.