On November 27, I attended the National Renewable Energy Laboratory’s (NREL) Fifth Energy Analysis Forum, hosted by NREL’s Strategic Energy Analysis & Applications Center. The forum focused on carbon policy design, the implications for Renewable Energy and Energy Efficiency. As a stock analyst focused on that sector, I am extremely lucky to have NREL as a local resource: the quality and the level of the experts at NREL and the ones they bring in is probably not matched anywhere in the country, and conferences like these provide priceless insights into what these Energy Analysts are thinking.

Why should investors care what analyst think about the best form of carbon regulation, when it will be the politicians who eventually implement it? Because these are the very experts politicians will call on when designing their legislation. While interest groups will also undoubtedly have a large say in regulation, they are unlikely to come up with new ideas which help shape future regulation. The new ideas will come from the 50 or so analysts that gathered in Lakewood last Tuesday, and the regulations based on these ideas will be critical to the business plans of the companies we invest in.

This is a link to my notes. I will likely find many investment ideas there, only some of which will make it into articles. For those with the time and interest, I expect they will be a valuable resource. For the other 99% of readers, here are ten interesting, intriguing, or just plain surprising ideas that pop out for me.

From Howard Gruenspecht, Deputy Administrator: Energy Information Administration

INSIGHT #1: "Clean Coal" is a Solution to a Political Problem

Integrated Gasification Combined Cycle with Carbon Capture and Sequestration (IGCC w/ CCS or "Clean Coal") is popular with legislators because it is a solution to a political problem, not because the technology is ready or because analysts expect it to be the most economical solution. Nuclear power is likely to be cheaper, and it is an existing technology.

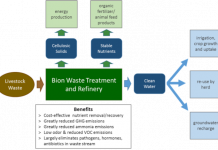

INSIGHT #2: Electricity Generation may be a Better Use of Biomass than Liquid Fuels

If the goal is to reduce net carbon emissions, burning biomass for electricity (either by cofiring in coal power plants, or in dedicated biomass generation stations) is more effective than using the same biomass to produce liquid fuels, such as cellulosic ethanol. TK note: I believe that many investors in companies developing methods to produce cellulosic ethanol are underestimating the competition for available feedstock from biomass based electricity generation.

From Joe Kruger, Policy Director National Commission on Energy Policy

INSIGHT #3: Electricity Generators May Get Windfall Profits

Allocation of Emission Credits is likely to create windfall profits for existing generators except in carefully designed auctions.

From Eric Smith, EPA Climate Economics Branch.

INSIGHT #4: EPA May Have to Regulate More than Tailpipes

Because of the Massachusetts vs. EPA lawsuit, the EPA must now regulate Greenhouse Gas (GHG) emissions from automobile tailpipes. The EPA is now studying GHG, and if the EPA concludes that GHG represent an endangerment to the public, the EPA will be forced to regulate GHG emissions from many more sources than just vehicles.

From Rich Cowart, Regulatory Assistance Project

INSIGHT #5: It’s Better to Allocate Credits to Electricity Distributors than Producers

Greenhouse Gasses need not be regulated at power generators, and other approaches may lead to more efficient reductions. Mr. Cowart was introduced as "Father of the Load-based Cap," in which GHG emissions are distributed to power distributors on behalf of their customers. Carbon regulation can occur anywhere from the mine/wellhead when a fossil fuel is first taken from the ground, to the final consumer. Where this regulation takes place matters because different actors have different abilities to change the way power is consumed. Mr. Cowart argues effectively that for the electricity and natural gas sectors, energy distribution companies are best placed to work with consumers to reduce overall energy use.

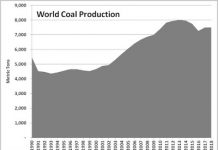

BONUS INSIGHT (my own): China Can Build Coal Plants, But We Can Cap Their Emissions

Worries about the number of coal plants built in China and other developing countries might be best dealt with by applying carbon regulation at the mine mouth. China is now a net coal importer. Given that, the rest of the world does not need China’s acquiescence to regulate carbon emissions: the coal exporters of the world could form an Organization of Coal Exporting Countries (OCEC), which would effectively be able to limit the total amount of coal burned around the globe. The United States, which I have previously called the "Saudi Arabia of Coal," could play the role of the swing producer, much as Saudi Arabia has traditionally played in OPEC.

From Karl S. Michael, NYSERDA

From Karl S. Michael, NYSERDA

INSIGHT #6: Reggie Never Asked, "Where are GHGs best Regulated?"

The Northeast Regional Greenhouse Gas Initiative (RGGI, or "Reggie") will be an emissions cap on power plants because the question was never asked: are power plants the right place to regulate Greenhouse Gasses? Future climate regulations should ask this question up front.

Todd Litman, Victoria Transport Policy Institute. I’ve long been a fan of Todd Litman. Among other things, his comprehensive economic analysis was very influential in providing the ideas for my recent articles Investing in Mode-shifting, and my current love affair with commuter rail stocks.

INSIGHT #7: A Carectomy is Better than a Better Car

Regulations designed to solve a single problem often end up making others much worse. For instance, an increase in CAFE standards will make vehicles more efficient, lowering fuel costs. Driving will rise somewhat because it is less expensive, but this will only reduce the fuel savings by a small amount. However, the inc

reased distances driven will increase accidents, congestion, parking costs, road costs, and other indirect costs to society, and these costs are likely to swamp the savings from better fuel economy. Society would be better served by policies which reduce driving, rather than increase it.

INSIGHT #8: Put the Car back into "A La Carte."

The current pricing system for driving is like the "all you can eat buffet." It encourages people to over-consume (drive too much) because the marginal cost of driving (fuel and maintenance) is only a small fraction of the average cost of driving, which consists mainly of fixed costs such as vehicle ownership and parking costs. Since most of the costs to society of driving are correlated to the number of miles driven (road safety, road maintenance, pollution), this leads to much higher costs to society for increased driving than to the individual. The all-you-can-eat pricing model is also unfair to the poor, because it makes it impossible for many to drive at all, when an a-la-carte pricing model would allow them to drive small amounts for essential trips.

Mark Meliana, NREL Hydrogen Technologies Program, speaking of California’s Low Carbon Fuel Standard (LCFS), on which he worked until recently being hired by NREL.

INSIGHT #9: Some Fuels are Better than Others

The California LCFS incorporates "Drive Train Efficiency" for different fuels, which reflects the quality of the energy in various transportation fuels. A Btu of electricity is worth a lot more than a Btu of gasoline, because electric motors are inherently more efficient (by a factor of 5) than gasoline engines. This is completely independent of vehicle aerodynamics, and drive train design, factors which will also effect efficiency. Diesel engines are inherently 1.28 times as efficient (on a Btu basis) than gasoline engines, while hydrogen is 2.13x as efficient, and electric motors are 5 times as efficient as gasoline engines. This is why an electric vehicle powered by electricity from a coal plant is still much less carbon intensive than a gasoline powered vehicle. These numbers are the inverse of the factor "eta" in the LCFS.

John Sheehan, Live Fuels (formerly of NRELs Biofuels division.) Incidentally, I had the opportunity to hear John speak (PDF 100 KB, (Powerpoint 4.5 MB) over a year ago while he was still at NREL. At that time, he was constrained in expressing his opinion about conventional biofuels… this time he didn’t pull any punches.

INSIGHT #10: Water is the 800 Pound Gorilla

Narrowly defined incentives in biofuel policy are likely to lead to more boondoggles as we have seen in the domestic corn ethanol and biodiesel industries (see notes for specifics.) Water use is "the 800 pound gorilla" we need to be talking about when considering which biofuels we can sustainably produce.

Final Thoughts: For analysts, it’s clear that a narrow focus, be it in biofuels, transportation policy, or allocation of GHG allowances, will lead to more perverse effects. For investors, we need to be aware that the perverse effects of bad policy will eventually fail to sustain an unsustainable model, as investors have recently learned about corn ethanol. On the other hand, shorter term investors may be able to profit handsomely from regulatory windfalls, a trend we have also seen in corn ethanol.

Will likely policies which will be designed to encourage IGCC and a focus on cheaper driving rather than more efficient transport in the future follow this same pattern? They may, and it is likely to lead to substantial costs to society and investors who jump on the trends at the wrong time.

In contrast, good policies will allow investors to do well by doing good, and profit as companies solve societal problems, rather than reaping transient rewards at the taxpayer’s expense. These good policies include load-based rather than generation based carbon caps, which will allow energy efficiency companies to more easily reduce consumers’ electric bills and make profits for their shareholders. Likewise, transport policies which provide viable alternatives to driving and incentives to use those alternatives will allow investors in alternative transit to profit while reducing commuting costs, traffic fatalities, congestion, pollution, and greenhouse gas emissions.

We all like making money in the market. Good energy analysts, like the ones at this forum, are working to provide us the opportunity not only to make money, but to solve societal and environmental problems at the same time. For that, we’re all lucky to have them.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

I think thats a great point you made about the cost of raising CAFE standards. I’ve done some work with the AAM and I think its a major oversight not to take those problems into account right now. Looks like they did decide to raise them though, but I’m glad they were at least able to make a compromise.

Thanks, Kevin, but I can’t take credit for the point about CAFE standards… I got it from Todd Litman at The Victoria Transit Policy Institute (an excellent site to research transit policy.) He’d probably tell you that none of the ideas are his, either, but he’s done an excellent job of bringing all the best practices together in one place.

i have an idea to do my final project in biofuel production,so pleas give me some materials and ideas .thank you

Hey – whatever helps these ideas get read. One thing is though is that a raise in those standards is pretty much unavoidable. I think we got the best that we could ask for in the package. But like I said before – its important that the auto industry was involved and behind the new ones.