Tom Konrad CFA

There are many proposed solutions to the liquid fuels scarcity caused be stagnating (and eventually falling) oil supplies combined with growing demand in emerging economies. Some will be good investments, others won’t. Here is where I’m putting my money, and why. This third part looks at the possibility of displacing gasoline with natural gas, by converting vehicles to natural gas.

In Part II of this series, I listed five potential substitutes that have been proposed to replace oil as limited supply and growth in developing markets draw oil away from traditional users. These were:

- Biofuels and Biochemicals

- Vehicle Electrification

- Hydrogen

- Natural Gas

- Coal and Natural Gas to Liquids

Part I looked deeper into the potential for biofuels to displace oil, and made some recommendations as to which stock might benefit most from this trend. Part II looked at vehicle electrification and hydrogen fuel cell vehicles. This part looks at natural gas vehicles (NGVs), their potential to displace oil, and associated potential investments.

Why Pickens’ Plan Won’t Work

To understand why we should not expect too much from NGVs, I find it useful to start with the reasons proponents expect that NGVs should be able to displace oil. T Boone Pickens is the leading proponent of this strategy, so let’s take the main points from his PickensPlan:

- It’s off-the shelf technology

- Initial costs will fall as manufacturing ramps up

- Fuel costs are lower than diesel

- We have abundant domestic natural gas supplies.

- Electric Vehicles and Hydrogen are not viable for long distance trucking

- NGVs are a natural fit for fleet vehicles.

- Natural Gas is the cleanest fossil fuel

- There is an existing natural gas infrastructure throughout the country.

I recently came across a series of well-argued articles by Eamon Keane, a British Energy Systems Engineering Master’s student on why NGVs won’t decrease oil dependence. I’m going to let him do most of the arguing here, since he goes into much more detail than I would, and simply point readers to the articles where he takes on each of these points.

Off-the shelf technology That means that we already know how to use natural gas for transport. This puts it ahead of fuel cells, but not ethanol, biodiesel, or vehicle electrification. The other side of that coin is, if this is off-the-shelf technology and it’s such a wonderful thing, why aren’t we already using it?

Initial Costs Will Fall. It seems like every form of alternative energy that currently has price problems tries to counter them using this shibboleth. Sure, anything that is widely adopted will be able to be built more cheaply due to economies of scale. Vehicle electrification proponents say this about batteries, too. The question is, how far and how fast can the price fall? Because we’ve known how to build NGVs for years, NGV technology is unlikely to make giant advances quickly; that’s more to be expected from emerging technologies. Eamon looks at the economics of NGVs here, and finds them wanting.

Fuel costs are lower. Fuel costs for NGVs are only marginally lower than for diesel vehicles. This is the argument for electric vehicles as well, only the fuel costs for electric vehicles are much lower than for NGVs. See Eamon’s economics of NGVs post again. Most NGV conversions have been spurred by government incentives and mandates, not economics. Economic demand is practically non-existent.

Abundant Domestic Natural Gas. Again, we have even more abundant domestic electricity (since natural gas is just one potential source of electricity.) And natural gas is not as limitless as many of its boosters claim. We’re already using natural gas for industry, residential and commercial uses, and electricity generation. Only about 3% of natural gas is currently used for transportation. The demand for natural gas for electricity generation is likely to increase significantly, as electric utilities increasingly cancel plans for new coal powered generation because of lack of funding and climate risk. At the same time, there is a growing movement to convert many existing coal plants to natural gas for environmental reasons.

Against this backdrop of rising demand for natural gas, proponents place the promise of abundant new supply from shale gas. I’ll let Eamon do the talking here again, but to sum up, shale gas will have serious problems ramping up enough to 1) replace the decline in conventional gas and 2) meet all the new sources of demand. It will be very difficult for natural gas production to ramp up quickly enough just to replace diesel used in trucking. Even if they did, refineries don’t have much flexibility in the ratio of diesel and gasoline produced, so displacing only trucking diesel would create a diesel supply glut, but not offset the need to import any oil, since we’d still need as much gasoline.

Electric Vehicles and Hydrogen are not Viable for Long Distance Trucking. True. But natural gas isn’t either. Ask the trucking industry. They don’t like the fact that the fuel tanks weigh more (so fully loaded trucks can carry less) or and even so have much shorter range than diesel trucks. The fuel tanks on parked trucks can overheat in the sun, causing the tank’s pressure release valve to vent fuel, costing money and adding to greenhouse gas emissions. Even if a national network of natural gas fueling stations were built, the trucking industry would worry about price gouging unless there were multiple competing stations to choose from. The extra $40 to $70 thousand initial cost of a natural gas truck and lack of competition among truck vendors is also a significant barrier.

NGVs are a Natural Fit or Fleet Vehicles So are EVs and PHEVs, but EVs and PHEVs have the advantage that they can charge up somewhere other than the home base. NGVs can’t.

Natural Gas is the Cleanest Fossil Fuel. Fine, if we assume we have to run our fleet on fossil

fuels.

Existing Natural Gas Infrastructure. There’s an existing electric infrastructure, too, and most garages have outlets that can (slowly) charge an EV. None can refuel an NGV without major upgrades. EVs can even be charged on the street with a good extension cord. The fire department probably wouldn’t be too happy if you tried that with natural gas.

Investments

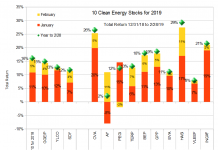

The case for natural gas vehicles is only convincing if you don’t compare them to the alternatives, or you think you might be able to make money by selling natural gas for fuel. In most cases, EVs provide a better solution, despite the problems I outlined in Part II. The only two stocks I’m aware of in this industry are Westport Innovations (WPRT), and Clean Energy Fuels (CLNE). Westport makes fuel injection systems and engines for gaseous fuels, including natural gas as well as hydrogen and LPG. Clean Energy Fuels is majority owned by T Boone himself and builds natural gas fueling infrastructure and liquefied natural gas (LNG) shipping terminals. I’m not sure what the LNG terminals have to do with energy independence… T. Boone does not go into that in his eponymous Plan.

If I had to buy one of these, it would be Westport, because at least they have a diversified business that is not totally reliant on natural gas. Fortunately, I don’t have to buy either… so I won’t. Clean Energy might be worth a short, the next time it spikes, though. Here’s Eamon’s take on CLNE.

DISCLOSURE: None.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

While I agree that nat gas is not a panacea as a transportation fuel, I offer a few quick observations:

Wrt “if this is off-the-shelf technology and it’s such a wonderful thing, why aren’t we already using it?”

Until recently, USA supplies of nat gas were thought to be quite limited. This was “confirmed” by a steadily increasing price until the recent recession. Therefore aggressive expansion of demand was not deemed reasonable. With the “game change” due in large part to the “mega” shale gas plays, but also due to the substantial expansion of nat gas production and liquifaction globally, it is now much more reasonable to pursue this option. And, pursue it we are, as indicated by these press releases: Daimler Trucks North America Introduces Natural Gas Powered Vehicle with Cummins Westport Engine

June 11th, 2009

Peterbilt Announces Availability of Natural Gas Powered Vocational and Aerodynamic Vehicles

August 31st, 2009

And, most recently

Kenworth Expands Natural Gas Truck Line with T440 Powered by ISL G

March 24th, 2010

WRT “refineries don’t have much flexibility in the ratio of diesel and gasoline produced, so displacing only trucking diesel would create a diesel supply glut”. This ignores the impending dramatic increase in gasoline engine fuel economy. The reality is that, due to excess capacity, more USA refineries will close during the next decade.