by Debra Fiakas, CFA

Most investors, if they have heard of Hydrogenics Corporation (HYGS: Nasdaq) at all, consider them a fuel cell producer. However, about two-thirds of the company’s revenue comes from the design and manufacture of hydrogen generation products based on water electrolysis technology – a somewhat unique, but valuable electrochemical technology that could make important contributions to the world’s future energy base.

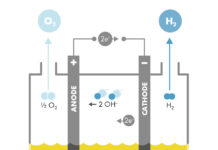

Electrolysis or the splitting of water molecules using an electric current produces hydrogen and oxygen – two elements that have market potential in a variety of industrial and power markets. It stands in high contrast to other producers of hydrogen that begin with natural gas and rely on the so-called steam reforming process to produce hydrogen from the natural gas components.

Hydrogenics expanded its production of hydrogen and oxygen gases with the acquisition of Stuart Energy Systems in January 2005. The company now manufactures the HyStat Electrolyser for on-site or on-demand hydrogen and oxygen supplies. Hydrogenics claims they “know hydrogen and know it well,” a talent that puts them in a good competitive position in the renewable energy field.

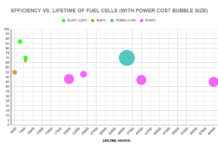

The company is applying that considerable knowledge to the production of fuel cells which convert hydrogen and oxygen back into water to produce energy. In 2009, power products and services accounted for about a third of the company’s revenue. We expect that portion to shift higher over time as Hydrogenics’ fuel cell products penetrate the market. So far Hydrogenics has focused on the forklift, commercial fleet and urban transit bus markets with its fuel cells.

Why all the fuss about hydrogen? First of all hydrogen is estimated to hold almost three times as much energy as natural gas per pound. Second, its only emission is pure water.

Why all the foot dragging about hydrogen? It is not really a fuel. It is just a way of storing or transporting energy and it has to be concocted in the first place, if not by braking down natural gas then the electrolysis method that Hydrogenics uses. (There are also thermolysis or photoelectrolysis technologies, but we will save those for science lessons another day.) Electrolysis has a theoretical maximum efficiency of about 80% to 94%, but practically speaking actual production can fall short of such efficiency.

Even excluding the production questions, hydrogen is a bit volatile and presents all sorts of technical challenges to transport. That is why Hydrogenics’ hydrogen generation solutions are located on customer sites.

In my view, Hydrogenics management has demonstrated strong execution skills that might be missed by some investors who do not look past the net losses over the past several years. The shift from fossil fuels puts a spotlight on their hydrogen-from-water technology. Furthermore, the use of water, which can be sourced anywhere facilitates on-site hydrogen production, removing transport challenges as an obstacle to customer adoption of hydrogen alternatives.

Debra Fiakas, CFA is the Managing Member of Crystal Equity Research, LLC, an alternative research resource on small-capitalization companies. Ms. Fiakas is a seasoned investment professional with a diversified and successful track record as a research analyst and as an investment banker. Her career includes solid experience in all aspects of the equity capital markets with particular emphasis on emerging growth companies.

DISCLOSURE: Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. HYGS is included in Crystal Equity Research’s The Atomics Index in the Hydrogen Electrolysis group.