It turns out that the US and Canada also had a 100 year supply of natural gas in 2001: “Natural gas is also plentiful. An estimated 2,449 trillion cubic feet of reserves in the United States and Canada is enough to meet today’s demand for 100 years.”

In the interim there was a panic in 2005:

“

We need to declare a national crisis,” Andrew N. Liveris, the chief executive of the Dow Chemical Company, said in recent testimony before the Senate. Dow, the nation’s largest chemical maker, has shut 23 plants in the United States in the last three years in places like Somerset, N.J.; South Charleston, W.Va.; and Elizabethtown, Ky., as it shifted production to Kuwait, Argentina, Malaysia and Germany, where natural gas is cheaper.“Call it demand destruction,” Mr. Liveris said. “Dozens of plants around the country have closed their doors and gone away, and are never coming back.”

…

“There’s still a shortage of drilling rigs. We skipped a generation-and-a-half of rigs in the United States.”

Now we’re back to 100 years of supply, and have returned to the feast stage of the feast-or-famine natural gas cycle. Unless this time is different, then the NG scene will not always be this rosy. This 100 year statistic which was derived from the Potential Gas Committee’s (PGC) 2009 report. Nowhere in the PGC’s press release was a 100 year figure mentioned, but the intense need for journalists to find a soundbite gave birth to the centennial stat. These articles gave none of the caveats that the PGC’s director gave in the release:

“Dr. Curtis cautioned, however, that the current assessment assumes neither a time schedule nor a specific market price for the discovery and production of future gas supply. “Estimates of the Potential Gas Committee are ‘base-line estimates’ in that they attempt to provide a reasonable appraisal of what we consider to be the ‘technically recoverable’ gas resource potential of the United States,” he explained.”

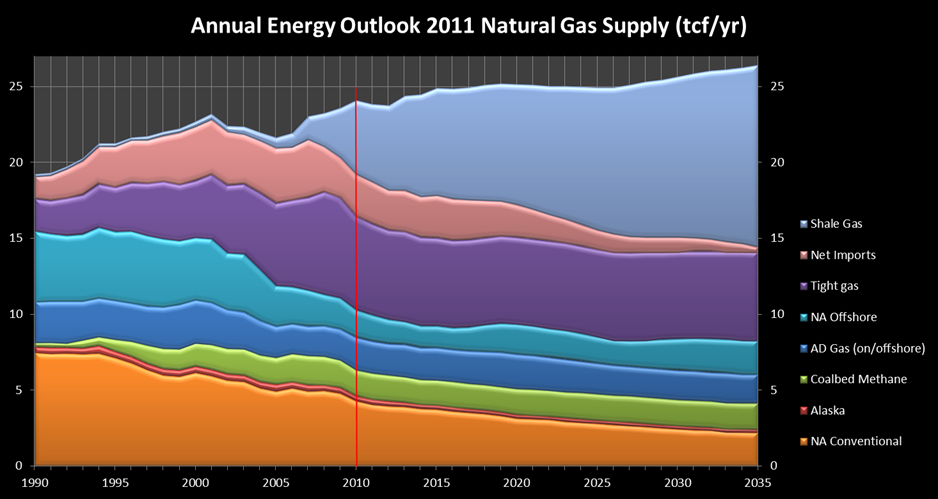

I thought I had clarified the situation in an article a year ago, although apparently not, and a frequent rejoinder to any talk about renewables or [insert x] remains to point to the “abundant” shale. More discerning types will know that when it comes to energy, it is the flow that is much more important than the stock. To that end, it will be noted that the flow of the other NG components is decreasing, and hence if shale lives up to expectations, the outcome will merely be a very gradual increase in total gas production.

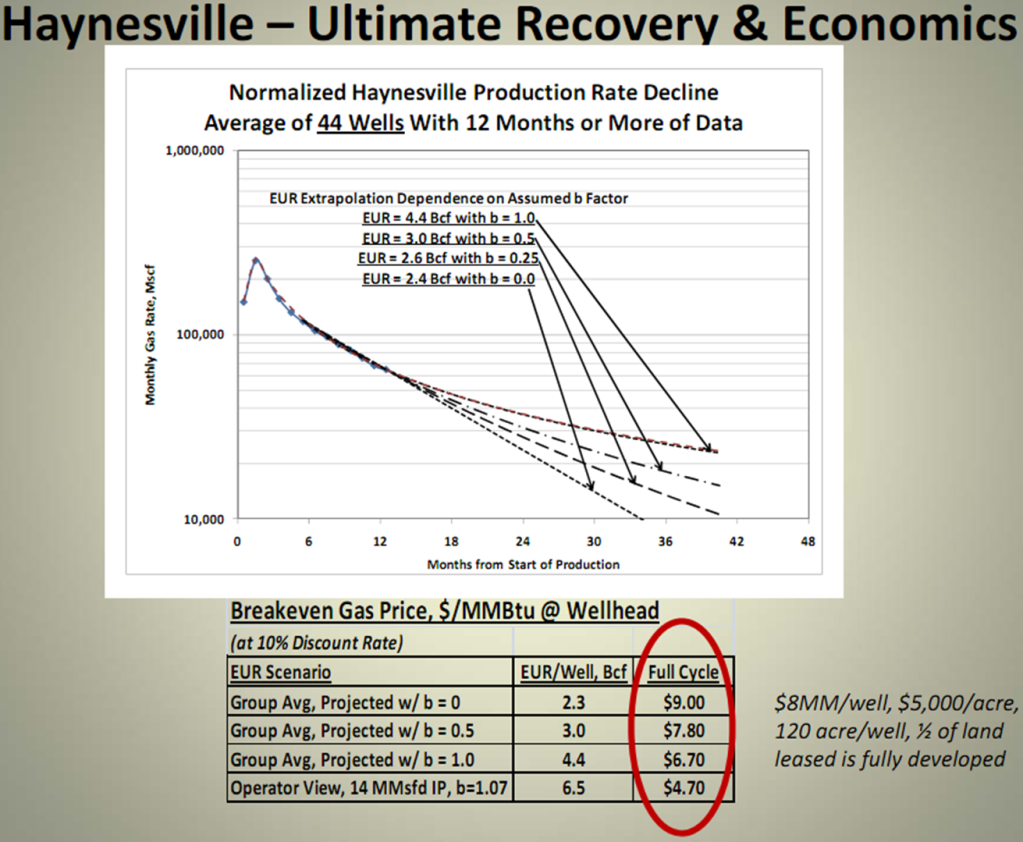

There’s a reasonably large if. The chief critic is Art Berman, much maligned for his skepticism. The main disputed variable is the decline rate of wells, which is dictated by the “b-exponent”. It has a major influence on the economics of shale as shown by a slide from one of Art’s recent presentations:

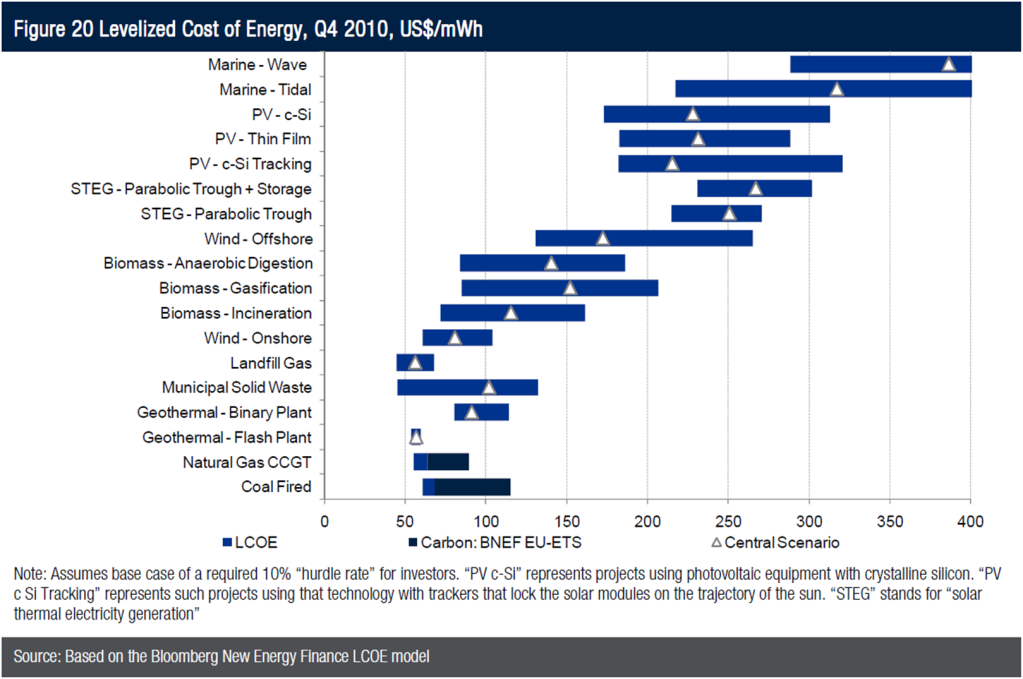

If the levelised cost of shale is closer to $8/MMBtu, this will have a large bearing on the competitiveness of renewable generation, since the natural gas price accounts for approximately 75% of the levelised cost of nat gas fired generation. As the recently released World Economic Forum’s Green Investing 2011 shows, onshore wind in some cases is competitive with nat gas, and a significant increase in gas costs would mean that many more locations would be:

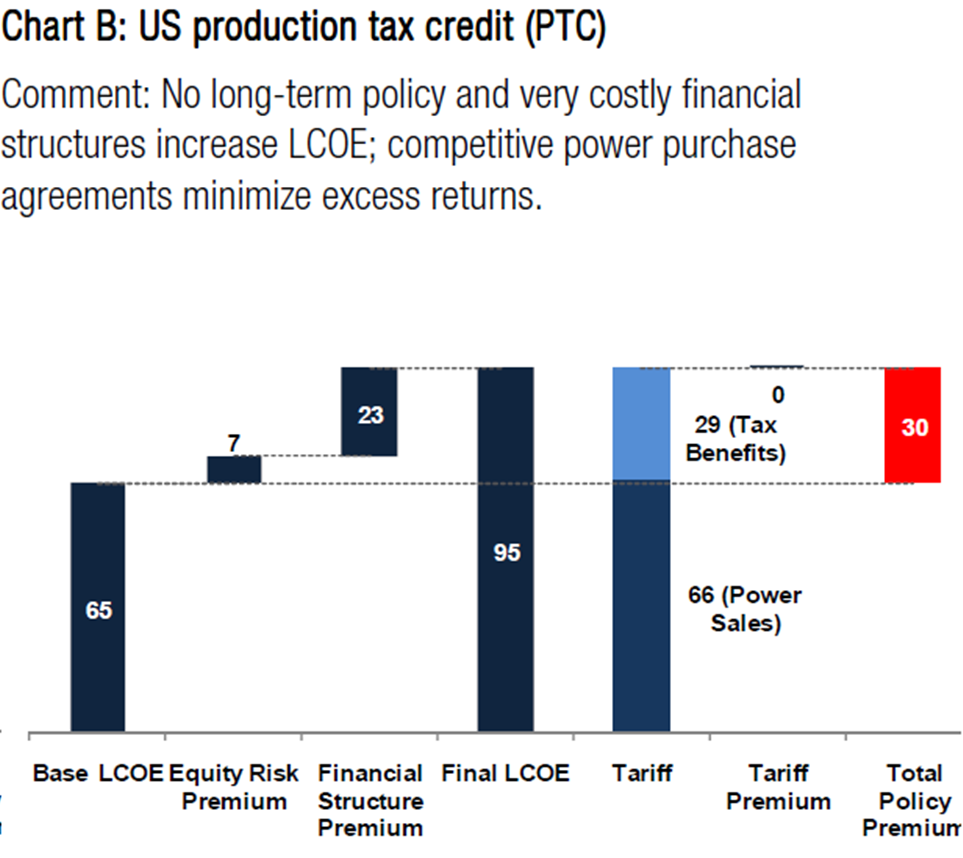

The Green Investing report introduces an interesting new term “Policy Premium” to indicate “the amount governments overpay for renewable energy generation above the rates required for investors to earn a standard return”. This premium is very high in the US relative to other countries, which if reformed and coupled with a higher gas price would be doubly positive for onshore wind.

I’d suggest that there is still energy policy after shale gas, and rather than going full retard about it solving the world’s energy problems for the next 100 years, hopefully bets will be hedged.