by Debra Fiakas CFA

To understand UR Energy, Inc. (URG: NYSE AMEX, URE: TSX) investors need to polish up on their Latin phrases. UR Energy is planning to mine uranium for the nuclear power industry using a mining practice called in situ or literally in position. In conventional mining operations large amounts of uranium-laced rock are cut out of the earth and sent to a milling center where the rock is crushed as the first step in separating uranium from the other minerals. In situ miners like UR Energy leave the earth and rock undisturbed, instead injecting oxygenated water and baking soda down into the strata suspected to hold uranium. In limestone formations the water mix – which has the unlikely name lixiviant – coaxes the uranium out of the rock. Then the mix is pumped back up top where it is sent through an osmosis process to remove the uranium. The water is reclaimed to be used again and the uranium then goes through conventional processes that turn it into yellowcake for sale to nuclear power plants.

In situ is beguiling in its simplicity. It reduces radiation exposure to animals and humans compared to conventional mining and milling operations. The land is largely undisturbed beyond the roads and processing facilities needed for mixing, pumping and water reclamation. The downside is that the in situ approach is only appropriate in formations with soft, porous rocks. Uranium in hard rock formations is impervious to a water and baking soda injection.

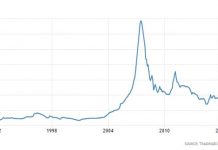

UR Energy is counting on consumers and governments to stand by nuclear energy despite the Fukushima disasters in Japan. The World Nuclear Association has forecast worldwide construction of 10.2 reactors per year for the next ten years. This is a bit slower than the rapid pace of expansion in the 1980s when an average of 21.9 reactors were added each year, but it represents an acceleration from the past two decades when developers could only muster up four reactors every twelve months. Of course, some nuclear reactors are taken off-line each year as they reach their full life. Others are going off-line prematurely as in Germany where all nuclear power plants will be shuttered by 2022 after Germans decided they no longer have the stomach for the risks in nuclear power.

There appears to be no ground swell for a similar decision in the U.S. UR Energy expects no change in that sentiment. Indeed, the company thinks there is a particularly enticing opportunity in the U.S. market. The U.S. imports over 50 million pounds of uranium each year, well over 90% of the country’s total annual uranium needs. The U.S. is currently producing only 4 million pounds domestically. UR Energy is counting on making good as a domestic uranium producer.

UR Energy has yet to record a sale. In 2011, the company used $12.7 million in cash to support operations. With $16.7 million in cash in the bank at the end of 2011, it looked like there about a five-quarter “runway” ahead. In February 2011, the Company completed $15 million private placement, giving it a nice cushion against delays in opening its first mine operation.

Engineering designs have been completed for the Company’s Lost Creek Mine site in Wyoming, where UR Energy plans to processing two million pounds of uranium per year. The Company continues to prepare an economic plan for Lost Creek and is seeking the appropriate permits. The Company is expects to begin production in the second quarter 2013, and ramp at least one million pounds in 2014.

UR Energy has signed three supply agreements for the uranium it expects to bring out of the Lost Creek property. The most recent covers 100,000 pounds per year over multiple years at delivery prices near $60 per pound. The three agreements together cover well over 300,000 pounds per year.

URG trades near a buck and as such may not be appealing for some investors. However, with about a year to go before initial production, the pricing presents an interesting option on an aspiring domestic uranium producer.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.