Will 2012 Finally be the Year of the Strong Grid?

Tom Konrad CFA

Utility infrastructure companies are seeing the beginnings of the long-anticipated infrastructure boom, and have the rising revenues and backlog to prove it.

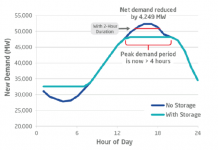

Investing in electric utility infrastructure has long been one of my favored ways to invest in the growing renewable energy sector without having to take a bet on unproven technology. The North American grid is in badly in need of an upgrade, and increasing penetration of variable and distributed resources such as solar and wind will require further upgrades in order to link these resources to the grid and distribute the effects of these resources variability over a wider area. Smart grid projects also allow the grid to better cope with solar and wind variability, and tap the energy efficiency potential at customer sites.

Further, the natural gas boom has led to a gas pipeline building boom, which also helps the bottom line of many of these companies.

Over the last couple years since I asked if 2010 might be the “Year of the Strong Grid” this building boom has been delayed, as many companies delay capital projects amid economic uncertainty. Now, it appears that these projects cannot be delayed much longer, and most companies in the sector are showing strong earnings growth and stronger backlogs.

Earnings Surprises

On May 8, Pike Electric (NYSE:PIKE) missed earnings expectations by 2 cents, due to low storm repair revenue. Core revenue was up, and management increased their revenue guidance for the rest of 2012.

On May 3rd, MasTec, Inc. (NYSE:MTZ) reported first quarter earnings, beating analyst expectations by a cent on revenues up 26% over Q1 2011. More importantly, MasTec increased revenue guidance for the full year to $3.35 billion, compared to current analyst estimates of 3.27 billion. They also increased earnings guidance for the second quarter to $0.35 per share, compared to analyst expectations of $0.32 per share. MasTec anticipates strong growth from both wind and solar work this year. MasTec was up 4% at 11 AM.

Also on May 3rd, Quanta Services (NYSE:PWR) reported first quarter profits of 22 cents vs. expectations of 16 cents, and reversed a first quarter loss of 8 cents in 2011, and also projected a improved results in 2012, providing guidance of $1.00 to $1.20 earnings per share, and revenues of $5.4 to $5.7 billion, compared to average analyst estimates of $5.29 billion. The stock rose 4%.

On May 1, General Cable (NYSE:BGC) beat revenue estimates by $1.65 billion compared to $1.60 billion, and earnings by 49 cents a share compared to expectations of 33 cents a share. The stock jumped 11%.

On April 20, Wesco International (NYSE:WCC) beat analyst expectations for both revenue ($1.61 billion to $1.58 billion) and earnings ($1.03 to $0.96), and increased revenue projections.

On March 8, MYR Group (NASD:MYRG) beat Q4 2011 earnings expectations by 2 cents and revenues by $32 million (16%).

Canada’s CVTech Group (TSX: CVT) had a disappointing Q4 2012, but has announced strong contract awards since then, and so also seems likely to report a strong first quarter. Other companies likely to benefit from this trend are large cap companies like Honeywell International (NYSE:HON), ABB Group (NYSE:ABB), and Siemens (NYSE:SI).

2012 looks like it’s finally shaping up to be the Year of the Strong Grid.

Disclosure: Long ABB, CVT, MTZ.

An earlier version of this article first appeared on the author’s Forbes.com Green Stocks blog.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.