by Debra Fiakas CFA

How often do we see the crowd rooting for the underdog? You could hear the cheers for Mantra Energy (MVTG: OTC) last week at the Marcum Microcap Conference in New York City. Mantra is a developmental stage company pursuing technologies to harness carbon dioxide for energy. Of course, the company has no revenue and therefore no earnings. Indeed, its technologies are so unique and as yet at such an early stage some might find them almost fanciful. Yet for some investors, a fanciful underdog is even better than another.

Mantra sees itself as a technology incubator, building on intellectual properties the company bought from the University of British Columbia. The company is perfecting what they call the electro-reduction of carbon dioxide. The idea is to use electrochemistry to convert carbon dioxide to usable products such as formic acid. A wide range of end products depend on formic acid, such as preservatives and antibacterial agents in livestock feed and materials for de-icing runways. Another important product might be formate salts, which are increasingly being considered as chemical carriers in hydrogen storage and transportation.

Turning a waste from industrial processes – a nasty one at that with far reaching climatic impact – into a useable product could have very impressive economic attributes. The cost of carbon dioxide capture could be partially or fully covered by sales of the commercially viable products. Mantra management believes the economics of its carbon capture and recycling solution attractive.

At least one company has already been convinced. Lafarge Canada (LFRGY: OTC) has agreed to work with Mantra with a pilot project at Lafarge’s cement plant in Richmond, British Columbia. The pilot plant will have the capacity to convert 100 kilograms of carbon dioxide per day to formate salts.

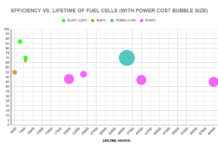

Also under development is what Mantra calls its Mixed-Reactant Fuel Cell (MRFC). In conventional fuel cells it is necessary to incorporate expensive membranes in the design prevent the fuel and oxidant from mixing. In Mantra’s fuel cell the fuel and oxidant are allowed to mix, eliminating the cost and weight of membranes. A variety of fuels can be used, including the formic acid that Mantra hopes to produce from its carbon capture and recycling technology. Manta does not expect its fuel cell to have as much efficiency a conventional fuel cells, but the MRFCs are expected to have higher volumetric power densities.

Mantra has many steps to complete before reaching revenue stage. Even more time will probably be needed to reach profitability and positive cash flow. Before then the stock will trade on investor’s willingness to back an underdog if not confidence in management’s ability to execute on its strategic plans. The company recently received a vote of confidence from a group of investors who infused $1.7 million in new capital into the company. The company is using the money to take care of a few outstanding obligations and begin assembling the pilot plant.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.