by Debra Fiakas CFA

Last week US Geothermal (HTM: AMEX), a power generator from geothermal projects in California, Oregon, Nevada and Idaho, made an appearance at the Marcum Microcap Conference in New York City. The company stood out among most of the companies appearing in Marcum’s so-called ‘energy track’ as one of the few with solid revenue and profits. US Geothermal reported a net profit of $1.9 million on $28.8 million in total sales in the twelve months ending March 2014. The net profit is commendable, but what I find more interesting is the conversion of 30% of sales to operating cash flow of $11.4 million.

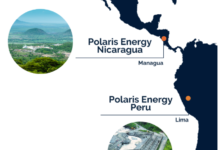

US Geothermal’s San Emidio power plant in Nevada

|

The ability to generate cash flow is vital for a growing company like US Geothermal. Over the last three years the company has spent an average of $16.5 million annually on capital investments. The company has also been acquisitive. Most recently the company bought the Ram Geysers project in Sonoma County, California for $6.4 million in cash. Ram Geysers has five completed wells available for immediate production near 30 megawatts of total steam assuming 25% of the geothermal liquid is re-injected back into the reservoir.

US Geothermal management thinks they got quite a bargain in the Ram Geyser’s deal. The Ram Power subsidiaries had already invested over $90 million in the project, implying that US Geothermal paid seven cents on the dollar for the capital investment value. Once the company’s development plans have been carried out it seems likely the Ram Geyser’s will make a strong contribution to return on assets

At the end of March 2014, US Geothermal reported a total of $204.5 million in tangible assets or $1.97 per share of which $0.38 is in the forms of cash and financial assets. It is instructive to compare tangible assets per share to the company’s share price of $0.65. Trading at 33% of tangible asset value suggests investors have little confidence in the long-term potential of these geothermal assets. Alternatively, investors might be simply concerned about the required investment for the projects the company currently has under development in Guatemala and Nevada. The company current estimates a capital cost near $195 million.

The current price for HTM could also represent an egregiously undervalued situation if US Geothermal’s assets prove out. So I will continue to follow the company’s progress and view the stock at the current price level as an option on full operation of all assets.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in t