Bottom line: Traditional car makers will suffer from weak sales growth and plunging margins in China in 2015 and into 2016, while EV makers will start the new year slow but could see improvement by the end of 2015.

A flurry of headlines this week are sending ominous signals for the car industry in the year ahead, with both traditional and new energy vehicle makers likely to face an uphill road as China’s economy slows. The problem could be compounded as big new capacity comes online from many major automakers that have invested billions of dollars on expansion over the last 3 years. Other headwinds could come as major cities take steps to ease traffic congestion, with the southern boomtown of Shenzhen becoming the latest to implement a new program to control the number of cars on the road.

Things were already looking tough for the new energy vehicle industry, following recent reports of slower-than-expected sales for electric vehicles (EVs) from domestic leader BYD (HKEx: 1211; Shenzhen: 002594; OTC:BYDDF) and US high-flyer Tesla (Nasdaq: TSLA). (previous post) Most of the sector’s problems owe to wariness among Chinese consumers, who worry about the lack of infrastructure to support the new energy vehicle industry.

Sensing the lack of progress, Beijing is now signaling that government incentives for people who buy so-called “green” vehicles will be extended to 2020. (English article) The incentives were originally set to expire at the end of 2015, so this latest move could reassure some people who are still waiting to see whether infrastructure will improve. Such improvement is likely to come around the middle of next year, when many recent infrastructure initiatives start come on stream, helping sales of these new-technology vehicles to gain some momentum by the end of the year.

But improvement for EVs won’t come as much consolation to makers of traditional cars, which are probably looking at a much longer downturn that will put a chill on sales for 2015 and into 2016. In the latest signal of that accelerating slowdown, Toyota (Tokyo: 7203) has just said that it’s likely to miss its target of selling more than 1.1 million cars in China this year. (English article)

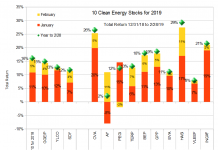

Toyota cited a faster-than-expected acceleration in the slowdown for China’s auto market for its latest forecast, and said growth next year will also be sluggish. China’s car market zoomed in the years after the global economic crisis on government buying incentives as part of a broader economic stimulus package. But it slowed sharply this year as China’s broader economy undergoes a major adjustment, and forecasters are now predicting relatively anemic sales gains in the 5-10 percent range for next year.

In another sign of headwinds the industry is facing, another media report is detailing complaints that many car dealers are making about aggressive sales targets set for them by the big automakers. (English article) The bottom line is that many dealers have ordered more cars than they can sell in order to please the car manufacturers, and as a result now have large inventories of unsold vehicles in their showrooms. That means they’re likely to sharply slow their new orders in 2015 as they sell off existing inventory, putting a further damper on car shipments from manufacturers.

As all these storm clouds build, another report is detailing one more of the industry’s problems in the form of looming overcapacity. That particular report says Korean automaker Hyundai (Seoul: 005380) is planning a major expansion of its Chinese capacity with plans for 2 new factories. (English article) Hyundai is the latest company joining a trend that has seen most of the world’s top car makers announce multibillion-dollar expansions of their China operations over the last 3 years.

Just how bad the automakers will suffer next year won’t become clear until the spring, as business returns to more normal levels after the Chinese New Year period. But I do expect that profit margins and sales growth will drop sharply for most major traditional car makers. New energy car makers will also suffer in the first half of they year, though their prospects could pick up towards the end of 2015.

Doug Young has lived and worked in China for 15 years, much of that as a journalist for Reuters writing about Chinese companies. He currently lives in Shanghai where he teaches financial journalism at Fudan University. He writes daily on his blog, Young´s China Business Blog, commenting on the latest developments at Chinese companies listed in the US, China and Hong Kong. He is also author of a new book about the media in China, The Party Line: How The Media Dictates Public Opinion in Modern China.