by Debra Fiakas CFA

The water series continues as we attempt to get arms around the very large market to package, deliver, purify, treat, and recycle water. As the need for water increases with population and economic activity, the use of waste waters has become an imperative. In this post we look at three companies helping to clean up, reclaim and otherwise recycle waste water.

Ecosphere Technologies, Inc. (ESPH: PK) has introduced several water solutions that can be used in agriculture, mining, industry, or municipal applications. The company’s flagship Ozonix Technology is a chemical-free system to recycle waste waters. Instead, the system saturates the water ozone using hydrodynamic and acoustic cavitation and then destroys the cell walls of harmful micro-organism with electrochemical oxidation. Even highly reactive bacteria can be wiped out through this process.

The Ozonix mobile system can be wheeled into even remote locations such as mines or oil and gas well sites. The company recently signed an exclusive licensing agreement with a distribution partner in the mining industry. Abandoned Mine Cleanup LLC has agreed to pay an upfront licensing fee of $5 million for exclusive access to the Ozonix system for mining market in North and South America. Ecosphere will also earn royalties on future sales and the licensee has guaranteed a minimum of two sales.

The company is late in filing its financial report for the year ending December 2015, notifying the SEC at the end of March 2016 that a discrepancy with its auditors related to “certain payment issues” has delayed the completion of the annual audit. In the late notice, the company provided preliminary financial results with sales totaling $736,874 and an operating loss of $4.9 million. In light of the protracted downturn in the oil and gas industry, which has been Ecosphere’s primary addressable market, its auditors have recommended a write-off of $11.9 million in intangible assets. That will bring the net loss for the year 2015 to an estimated $22.6 million. The late notice filing provided no balance sheet or cash flow details. At the end of September 2015, the company held $4,822 in cash on its balance sheet and had a negative working capital profile.

With the troubled financial profile it should be no surprise that the Company trades at nickel per share. The recent licensing agreement appears to be coming at a critical point for Ecosphere. The share price thus represents an option on this payment and the ability of management to use the cash flow as a springboard to market penetration.

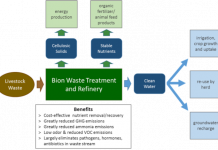

Industry is not the only place to find foul water. Excess nutrients in water runoff from fields have led to algal blooms deadly to fish and livestock waste has contaminated downstream water sources. Bion Environmental (BNET: OTC) has patented a biological process that facilitates the growth of naturally-occurring bacteria that converts most the nitrogen in waste streams to harmless inert gas. The rest of the nitrogen and phosphorus is converted to a cellulosic biomass that is later recovered from the water stream. When put to work, Bion’s process removes up to 95% of the excess nutrients from agricultural waste streams and reduces 90% or more of greenhouse gas emissions. The clean water can be reused at the farm for animals or crops or allowed to return to ground water reservoirs. The cellulosic solids can be repurposed for energy production. The company has also patented technology to recover nitrogen-rich fertilizer from livestock waste streams.

Under provisions of the Clean Water Act of 1972, the U.S. Environmental Protection Agency is responsible for regulating animal waste. The 1998 Clean Water Action Plan identified a strategy for addressing pollution from animal feeding operations. Dairies in particular are prone to releasing untreated wastewater into neighboring environments since they use large amounts of water to remove manure from milking barns and corrals. Stricter regulatory action is likely needed to get livestock owners the incentive to invest in water clean-up technology.

As promising as the story sounds, Bion has had trouble penetrating the U.S. agricultural market. Sales have yet to reach even the $100,000 hurdle. Management appears to be moving forward with a bare bones budget, using $1.0 million in cash to support operations in the twelve months ending December 2015. The company only had $185,560 in the bank at that time, suggesting a critical need to find paying customers. At $0.84 per share, the stock appears to be a rather expensive play on management’s ability to get livestock owners to adopt its system.

If these two companies leave you wheezing and coughing, France’s water industry giant Veolia Environment P.A. (VIE: PA or VEOEY: OTC) may provide an ‘emergency inhaler.’ Water treatment and clean-up solutions are only parts of a wide menu of environmental products and services offered by the Veolia. A recent contract win from Petrofac, a British oil and gas producer, is typical of Veolia’s water clean-up business. Veolia will provide treatment systems for wastewater generated at the Rabab Harweel oil and gas project in the Sultanate of Oman. Veolia is already familiar with Oman, having completed the expansion of the Sur desalination plant near Muscat, Oman.

Veolia reported $25 billion in sales in the fiscal year ending December 2015, providing $450 million in net income or $0.69 per share. Operations generated $2.4 billion in operating cash flow. The company ended the year 2015 with $4.6 billion in cash on the balance sheet. Even at the very low interest rates now offered by banks, Veolia’s cash balances would produce enough interest income to provide working capital for both Ecosphere and Bion. Veolia might be conserving its cash for to support its debt burden. Veolia carries enough debt to propel its debt-to-equity ratio to 130.0.

To get a taste of Veolia investors must pony up a price 30.4 times trailing earnings, suggesting that a position in a large, well established operation comes with a price. One plus is that the shares come with a 3.4% current dividend yield. Another plus is low volatility. Shares quoted on the U.S. Over the Counter listing have a beta of 0.90.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.