Tom Konrad Ph.D., CFA

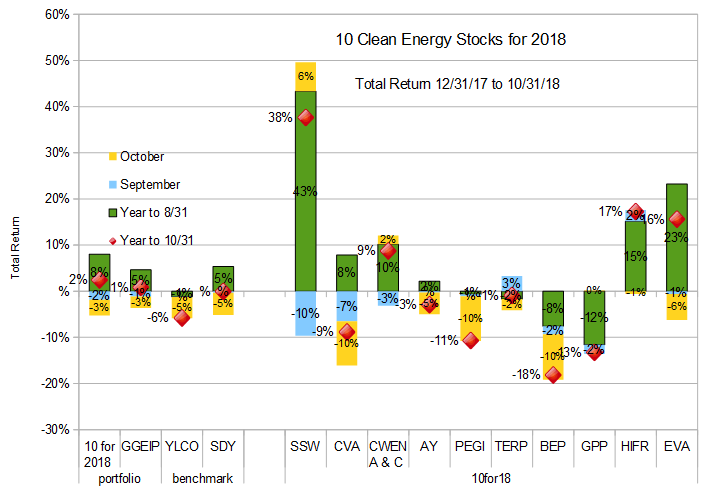

After a fairly brutal September and October my Ten Clean Energy Stocks model portfolio is barely hanging on to positive territory for the year (up 2.4%) as is the private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP, up 0.8%). Yet I can take comfort in superior relative performance, since my broad dividend income benchmark SDY is now down 0.1% for the year, and the clean energy income benchmark YLCO has fallen 5.8%. All returns are total return after fees and dividends.

The strong relative performance in a weak market is most likely due to the conservative nature of my picks, and mostly positive third quarter earnings, the details of which I will discuss below.

Top Picks

At the end of September, I emphasized that my top “stock” pick was cash rather than any particular stock, saying “This month’s pick is… increasing your cash position…, but if you really want to buy a stock, try GPP, CVA, or Brookfield Renewable (BEP).” This turned out to be a good call with the model portfolio down 3.4% for the month and the benchmarks down 4.8 and 4.6%. These picks were up 0.1%, down 9.6%, and down 9.9%, so I’m glad I pointed to cash as the best investment. I’m not confident that the correction is over, but we seem to be heading into a temporary lull, and so I’m going to abandon cash as my top pick for November. I liked third quarter earnings at Covanta (CVA) and even as the market sold the stock, and I continue to believe that both Green Plains Partners and Brookfield are undervalued, so I will maintain these as my top short term picks.

Stock discussion

Below I describe each of the stocks and groups of stocks in more detail. I include with each stock “Low” and “High” Targets, which give the range of stock prices within which I expect each stock to end 2018.

Seaspan Corporation (NYSE:SSW)

12/31/17 Price: $6.75. Annual Dividend: $0.50 (7.4%). Expected 2018 dividend: $0.50 (7.4%). Low Target: $5. High Target: $20.

10/31/18 Price: $8.73 YTD dividend: $0.50 (7.41%) YTD Total Return: 37.6%

Leading independent charter owner of container ships Seaspan reported a strong third quarter, and the stock shot up, losing the water it had taken on since its high in June.

Although I feel the company still has good potential for further gains as the recovering containership market floats all boats, it is time for me to bail on this one. During the quarter, Seaspan agreed to make a $200 million investment in Swiber Group, including a $180 million investment in an Liquefied Natural Gas (LNG) to power project in Vietnam. Seaspan’s green credentials were always more marginal than most of my other investments. While Seaspan’s vessels are generally more efficient than other containerships, there is some question as to if the global container shipping industry has a net positive or negative effect on the environment.

On the plus side, if we assume that a certain quantity of goods is going to be transported one way or another, container ships are clearly the most efficient way for that to happen. On the other hand, if the low cost of container shipping boosts global consumption of stuff we don’t really need, or if it enables those items to be manufactured at lower costs in locations with lax environmental standards, the industry does net harm. Given the arguments both ways, I was willing to consider Seaspan “green” because its ships are generally best in class from an efficiency standpoint, but now that the company is directly investing in the transportation and use of fossil fuels, I feel it’s time to exit with my gains.

I will not be dumping my positions in Seaspan and its Preferred securities (SSW-PG, SSW-PD, and SSW-PH) all at once, but I will be winding them down, and the company will not be in the upcoming Ten Clean Energy Stocks for 2019 model portfolio.

Covanta Holding Corp. (NYSE:CVA)

12/31/17 Price: $16.90. Annual Dividend: $1.00(5.9%). Expected 2018 dividend: $1.00 (5.9%). Low Target: $15. High Target: $25.

10/31/18 Price: $14.69 YTD dividend: $0.75 (4.44%) YTD Total Return: -8.9%

Covanta, the US leader in the construction and operation of energy from waste (EfW) plants reported third quarter earnings on October 25th. Volumes were up based on efficient operation at most plants, and the only sour note was weakness in the power markets. During the quarter the company acquired EfW operations in Palm Beach, Florida. Given existing operations in Florida, the company expects that it will be able to operate the new acquisition efficiently by sharing resources with other Florida operations.

Overall, the company still expects year end results towards the upper end of its guidance range. I’m very bullish on the stock given that the price decline this year seems completely unwarranted given the generally strengthening results.

Clearway Energy, Inc (NYSE: CWEN and CWEN/A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25.

10/31/18 Price: $19.61/$19.42 YTD dividend: $0.927 (4.90%) YTD Total Return: 9.4%/8.1%%

Yieldco Clearway Energy, Inc will report earnings on November 6th. The stock has been flat to down since the Yieldco completed its transition to its new sponsor, Global Infrastructure Partners at the end of August. Since that transaction, the company has extended the maturity of its debt by issuing a $600 million of new 5.75% senior notes and repurchasing a similar amount if 3.25% and 3.5% notes due in 2019 and 2020. This increases financial flexibility, but the increased interest payments will be a drag on profitability going forward.

Investors will be looking for signs that Clearway will be able to profitably execute on its growth plans in the earnings call.

Atlantica Yield, PLC (NASD:AY)

12/31/17 Price: $21.21. Annual Dividend: $1.16(5.6%). Expected 2018 dividend: $1.39 (6.6%). Low Target: $18. High Target: $30.

10/31/18 Price: $19.61 YTD dividend: $0.97 (4.57%) YTD Total Return: -2.9%

Yieldco Atlantica Yield reported third quarter earnings on November 5th as this article was being written. The company announced a quarterly dividend increase to $0.36, up from $0.34 from the previous quarter and $0.29 from the prior year. Atlantica has an 80% target payout ratio, and this dividend puts it near that target on an annualized basis. Future dividend increases are likely to continue, but only as the Yieldco grows through acquisition. Recent increases have been based on recovery from when the dividend was cut during Atlantica’s former sponsor Abengoa’s (ABG.MC, ABGOF) bankruptcy, more than on the growth of the business.

Further dividend increases will likely track the growth of Atlanitica’s business, but that growth has resumed now that Atlantica is once again investing in new opportunities and paying down debt. The low payout ratio over the last two years has allowed Atlantica to significantly reduce debt, and that financial flexibility is now enabling investments in additional assets. The Yieldco announced $245 million in equity investments which should add a little over $0.03 per share to Cash Available For Distribution (CAFD) annually. If 80% of that is paid out in dividends, those investments alone will allow for another quarter.

Atlantica’s relatively low debt compared to its peers may allow it’s recent rapid dividend increases to continue for several quarters, but even at the slowed 10% to 20% annual growth rate I expect, the current annual yield of over 7% is quite attractive.

Pattern Energy Group (NASD:PEGI)

12/31/17 Price: $21.49. Annual Dividend: $1.688(7.9%). Expected 2018 dividend: $1.70(7.9%). Low Target: $20. High Target: $30.

10/31/18 Price: $17.94 YTD dividend: $1.266 (5.89%) YTD Total Return: -10.7%

Yieldco Pattern Energy Group announced third quarter results on November 4th, so the market reaction is not included in the numbers above. Investors loved that sales and cash from operations were both up strongly, and that the company reaffirmed its guidance. Investors had been worried (needlessly, in my opinion) that the company might need to cut its dividend to achieve its target payout ratio of 80%. This quarter seems likely to put most of those fears to rest.

The company is avoiding raising new capital at its current depressed share price, but is still able to make new investments by selling non-core, difficult to service wind farms like its Chilean operations and reinvesting in wind farms within its current footprint. These include a acquiring a 51% stake in a Quebec wind farm, and a plan to repower (replace the turbines) on its Gulf Wind project while it can take advantage of the US Production Tax Credit.

Brookfield Renewable Partners, LP (NYSE:BEP)

12/31/17 Price: $34.91. Annual Dividend: $1.872(5.4%). Expected 2018 dividend: $2.02(5.8%). Low Target: $28. High Target: $45.

10/31/18 Price: $27.25 YTD dividend: $1.47 (4.21%) YTD Total Return: -18.2%

Brookfield Renewable Partners reported 3rd quarter earnings on October 31st. Like Pattern, Brookfield is strategically selling assets to raise money for growth opportunities and to strengthen its balance sheet despites rising interest rates and a weak share price. In Brookfield’s case, it is selling 50% of its state in a portfolio of contracted Canadian hydropower assets. The company will retain the management of the entire portfolio, along with associated fees, allowing it to earn a slightly higher return per dollar invested in the portfolio.

The company continues to develop a number of small hydro and wind projects in Europe, Brazil, and the US. Projects expected to come on line in the 4th quarter can be expected to increase funds from operations by approximately 3% on an annual basis. The company has a target per-share annual dividend increase of 5% to 9%, which I expect to be announced in conjunction with the fourth quarter dividend in December or January.

Green Plains Partners, LP (NASD: GPP)

12/31/17 Price: $18.70. Annual Dividend: $1.84(9.8%). Expected 2018 dividend: $1.90(10.2%). Low Target: $13. High Target: $27.

10/31/18 Price: $14.92 YTD dividend: $1.42 (7.59%) YTD Total Return: -13.3%

Ethanol MLP and Yieldco Green Plains Partners will report thierd quarter results on November 11th. The stock has been selling off for most of the year in large part due to the Trump EPA’s attacks on the ethanol industry. While Trump also announced a long-planned move to allow the sale of 15% ethanol blended into gasoline (E15) year round, this move is insignificant compared to the Trump EPA’s continued undermining of the Renewable Fuel Standard mandate that oil refiners blend a certain amount of ethanol into the gasoline they produce. Effectively, the Trump administration is permitting a slight increase in ethanol sales while greatly reducing the level of mandated ethanol sales.

Slowly rising gas prices and falling corn prices will at some point lead to a revival of the ethanol industry, as ethanol becomes cheaper to produce than the gasoline it displaces, even without support from the EPA. Until then, Green Plains Partners has minimum revenue guarantees from its parent, Green Plains (GPRE) which I believe will sustain it and keep the company from having to cut its dividend until that revival materializes. For that reason, I think GPP’s low stock price represents an excellent buying opportunity despite the currently weak ethanol market.

InfraREIT, Inc. (NYSE: HIFR)

12/31/17 Price: $18.58. Annual Dividend: $1.00(5.4%). Expected 2018 dividend: $1.00 (5.4%). Low Target: $16. High Target: $30.

10/31/18 Price: $21.02 YTD dividend: $0.75 (4.0%) YTD Total Return: 17.2%

Electricity transmission REIT InfraREIT agreed to be acquired by private utility Oncor for $21 a share. The deal is expected to close by mid-2019, until which time the company will continue to pay its $0.25 per share annual dividend, including a pro-rated dividend for any partial quarter prior to closing.

I expect the stock price to remain very stable around $21 until the deal closes. Investors who consider the low-risk 4.76% yield to be attractive should hold until the deal closes, while other investors can sell as the need for cash arises.

Enviva Partners, LP. (NYSE:EVA)

12/31/17 Price: $27.65. Annual Dividend: $2.46(8.9%). Expected 2018 dividend: $2.65 (9.6%). Low Target: $25. High Target: $40.

10/31/18 Price: $30.02 YTD dividend: $1.875 (6.78%) YTD Total Return: 15.6%

Wood pellet Yieldco and Master Limited Partnership Enviva will report third quarter earnings on November 9th. Since its strong second quarter earnings, the partnership has announced an increased distribution of $0.635 payable in November, announced long term contracts for the sale of wood pellets with three Japanese customers. Two of those contracts have been subsequently finalized. Given the business progress slow downward drift of the stock since second quarter earnings were announced, I’m optimistic that third quarter earnings will give the stock a boost.

Final Thoughts

The results of Tuesday’s election are likely to cause more volatility in the stock market no matter what happens, but I feel that we have reached at least a short term pause in the market correction that started in September. Over the medium term, I feel it pays to be cautious and keep a healthy allocation to cash, but in the short term, market volatility has lead and will to some good valuations in quality dividend paying clean energy stocks.

As a side note. I picked CVA, GPP, and BEP as my top picks for the month, but that’s only because I’m not cheating and basing those picks on the strong earnings reports from PEGI and AY after the end of the month before I got this out.

Disclosure: Long PEGI, NYLD/A, CVA, AY, SSW, SSW-PRG, SSW-PRD, SSW-PRH, TERP, BEP, EVA, HIFR, GPP, AQN.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Thank you very much for all this valuable work!

Was there nothing to be said about TERP?

It was an oversight. When I noticed it, I decided to write a short follow-up about TERP, BEP, and EVA, after I have a chance to digest their earnings announcements. There really wasn’t much to say about TERP pre-earnings.

Hi Tom. I own PEGI, AY, and NEP. What’s your take on NEP?

I’m short NEP (in a small way) as a hedge against the others. Think it’s overvalued on a relative basis.

NPIFF might be a good replacement for SSW. Have you picked one yet?