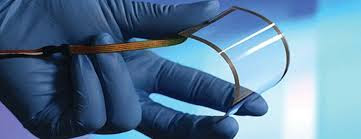

The previous post “Miracle Material” acknowledged the fallout of many of the companies that a decade ago had set out to commercialize that extraordinary form of carbon called graphene. It is a single atom thick but is a couple hundred times stronger than steel, showing promise for an ultra-lightweight material that could unprecedented performance. Unfortunately, developers found out carbon atoms do not behave as well in a production process as they might on a scientist’s laboratory bench. There are several companies that with perseverance and tenacity have been successful in bringing graphene into our lives.

Off the Bench

Haydale Graphene Industries (HAYD: LSE) offers a mix of products for manufacturers, including composites, 3D printing materials and silicon carbide. The company has patented a low temperature plasma processHDPLAS to facilitate the mixing of graphene with other materials. Haydale’s HDPLAS technology produces graphene enhanced carbon fiber prepregs that deliver advanced electrical and thermal properties in for composite materials. The company’s graphene-enhanced polylactic acid filaments for three-dimensional printing improve strength and quality of finished products.

Haydale claims its HDPLAS process is fast and cost effective. Thus we might expect profits sooner rather than later from the company that is still operating at a loss. The company has wasted no time in penetrating the market. In January 2019, management announced an agreement to supply HP1 Technologies Ltd. with Haydale’s proprietary piezorestistive ink. HP1 offers custom printed carbon-based sensor systems to monitor mechanical stress and will use Haydale’s ink for a new customer.

| SELECTED PRODUCERS OF GRAPHENE-BASED PRODUCTS | ||||

| Company Name | SYM | Price | Mkt Cap | Revenue |

| BGT Materials Ltd. | Private | Na | Na | na |

| Graphene Nanochem, Plc | GRPEF: OTC | $0.05 | $10.1M | na |

| Graphenea SA | Private | Na | Na | na |

| Haydale Graphene Industries | HAYD: LSE | $2.46 | $7.9M | $3.9M |

| Vorbeck Materials, Inc. | Private | na | na | na |

| US Dollars | ||||

Electrified

Based in Spain, Graphenea SA has pushed forward with its graphene production to produce field-effect-transistor devices in addition to graphene films and powders. The company also provides foundry services at facilities in San Sebastian, Spain and Boston in the U.S.

As a private company Graphenea says little about its financial picture and makes very few announcements about fundamental progress. Although in 2013, the company announced a $1.3 million investment from Repsol SA, an oil and gas company headquartered in Madrid, Spain and with operations around the world. The capital infusion was intended to accelerate large volume production of graphene.

Graphenea has raised a total of $7.2 million since inception in 2010. It is not clear whether the company will be back to capital markets or not. Even at the time Repsol took a stake in the operation, Graphenea was boasting of numerous customers. A company with customers is often in a position to self-fund expansion even if it is at a slow pace.

Flexible

Market opportunity for graphene is as varied as your imagination. At least that seems to be the view of Vorbeck Material, a privately-held company based in Maryland. The company has been involved in production of wearable sensors, radio frequency antennas and automotive tires. In late 2016, the company introduced Vor-flex 50, a family of graphene-enhanced elastomer products. Vorbeck also signed an agreement with Reliance Industries, Ltd., a petrochemical production company based in India, for joint development of products using the elastomer material.

On the surface it appears the Vorbeck may have lost some market momentum in the last couple of years. At least the press releases have dwindled in number and frequency. Nonetheless, we note that in November 2018, the company was recognized as an emerging leader in manufacturing in its home state of Maryland.

Vorbeck has taken in over $20 million in capital since its inception in 2006. The capital was mostly venture-oriented in small incremental rounds.

It is clear investors have few choices if their aim is for a pure-play manufacturer of graphene-based products. The next post takes a step backward in the graphene supply chain to explore those companies that are involved in graphene production.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 4/2/19 as “Graphene-based Materials on the Market.”