by Debra Fiakas, CFA

Last month Greystone Logistics (GLGI: OTC/PK) announced a new purchase order valued at $6.8 million to supply recycled plastic pallets to a national food and agribusiness company. The order requires the fledgling Greystone to manufacture and deliver an unspecified number of the company’s proprietary plastic shipping pallets. Whatever the number, the contract promises a big shift in Greystone’s prospects given that the contract value represents 9% of total sales in the fiscal year.

It seems Greystone is gaining visibility in the logistics supply chain. However, trading at less than a buck a share its stock seems to not have yet registered on the radar screen of investors. This seems a auspicious time to get acquainted with GLGI.

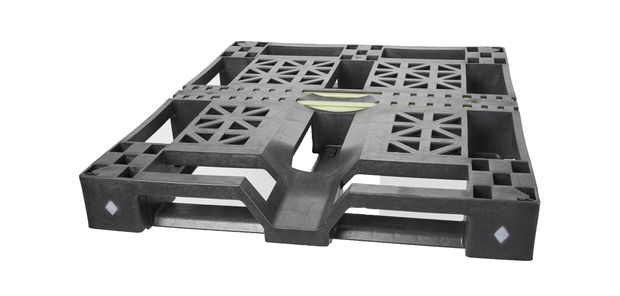

In the twelve months ending May 2019, Greystone reports $71.1 million in total sales of its plastic pallets. The company has a line of beverage, drum and mixed-use pallets as well as those that can be nested, stacked or racked up. Additionally, the company sells processed recycled plastic resin.

All of Greystone’s pallets are made from recycled petrochemical resins using the company’s proprietary pallet designs. Using recycled resins gives customers advantages in both cost and reputation. The company’s designs make possible greater production efficiency using standard injection molding equipment. Important to efficiency rates is capacity at Greystone’s manufacturing facility at Bettendorf, Iowa to grind over 200,000 pounds of plastic, making it possible to use low-grade resins.

For investors who might dismiss such a ‘simple’ business model, take note that Freedonia estimates there are at least 2.6 billion pallets in use in the U.S. alone. Fortune Business reported in June 2019, that the total global pallet market generated $60 billion in total sales in 2019. Wooden pallets still represent at least 80% of the market in terms of units, but plastic is gaining ground in the food and beverage industry where clean surfaces are especially important.

With those respect-worthy industry facts in mind, let us return to Greystone’s financial performance. The company managed to draw $2.1 million in net income off sales in fiscal year 2019, representing a 3% net profit margin. A total of $6.8 million or 10% of revenue was converted to operating cash flow. This is a lower rate than was reported in the previous fiscal year when the sales-to-cash conversion was 17%. However, we note that deferred revenue has had a strong influence on operating cash flow.

The availability of cash resources for operations is important to Greystone, which has been making capital investments near $6 million to $7 million per year. The company also has long-term debt of $22.6 million outstanding, of which $3 million is due within the next twelve months.

Greystone management has its eye on the prize of a large and growing market. Interest in recycled plastic over plastic products made with virgin polymers is rising. Judging by the recent purchase order from a large food company, Greystone is well positioned to benefit from this trend. Investors would be well advised to take a serious look at this simple but fast growing business.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 9/6/19 as “Greystone Logistics: Play on Pallets”.