by Tom Konrad, Ph.D., CFA

Two of the cash covered puts in the 10 Clean Energy Stocks for 2020 model portfolio have now expired, and I am left with a difficult decision as to what to replace them with.

As I discussed last month, I feel the market is overvalued given the economic impact of the pandemic and little prospect of fiscal stimulus before January. Yes, the market is not the whole economy, and large tech firms and high income workers and the wealthy are doing great while people on the bottom half of the income ladder are being crushed. With the pandemic worsening just as we head into the colder months, it’s going to be a hard winter.

This is no time to be buying stocks. Rather, we should be squirreling away our cash and waiting for a significant market decline, possibly even a crash before we invest.

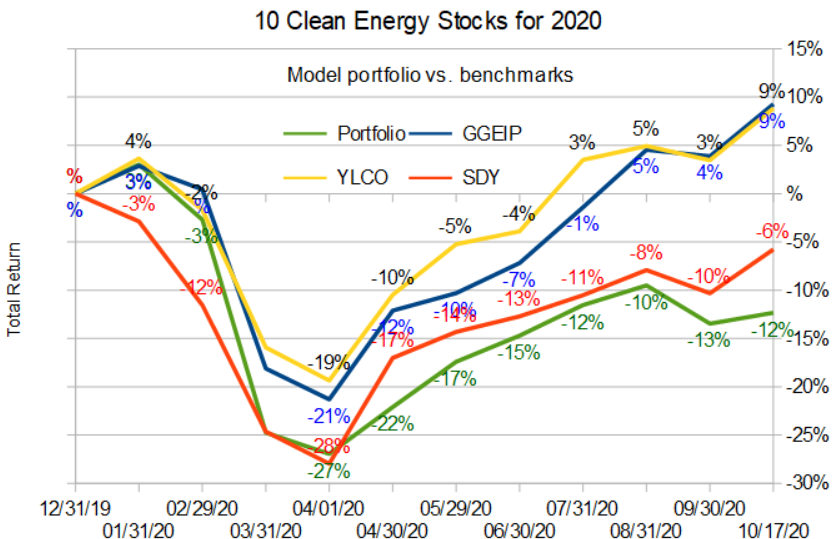

Making matters even more difficult, the model portfolio has significantly underperformed this year, a good 16% below both its clean energy income benchmark, YLCO, and my real money managed portfolio, GGEIP, both of which are now up slightly for the year.

The model portfolio (at -13%) looks less bad in comparison to its broad market benchmark, SDY, but as of the end of September, it was still below that even in the relative performance game.

Behavioral psychology tells us that most people hate to lose even more than they like to win, and I am no different. When I find myself in a situation like this where I am “behind”, I have a strong temptation to make a risky move as long as it has a chance to pay off big and let me “catch up.”

Fortunately, I know behavioral psychology, and while I am tempted to take undue risks, I don’t have to give in to temptation. One such bet I considered was purchasing put options on a market index. After all, I believe the market is overvalued, and options can easily return many times the initial investment when they pay off. Unfortunately, the market’s overvaluation does not guarantee a near-term market correction.

A common market aphorism (sometimes attributed to Keynes and other times to Shilling) is that the market can stay irrational longer than you can stay solvent. No matter what the origin, it’s good to keep in mind whenever we are tempted to bet on market rationality. It is also why I do not ever totally get out of the market and into cash, even at times like these when I am very concerned about valuations and potential market shocks.

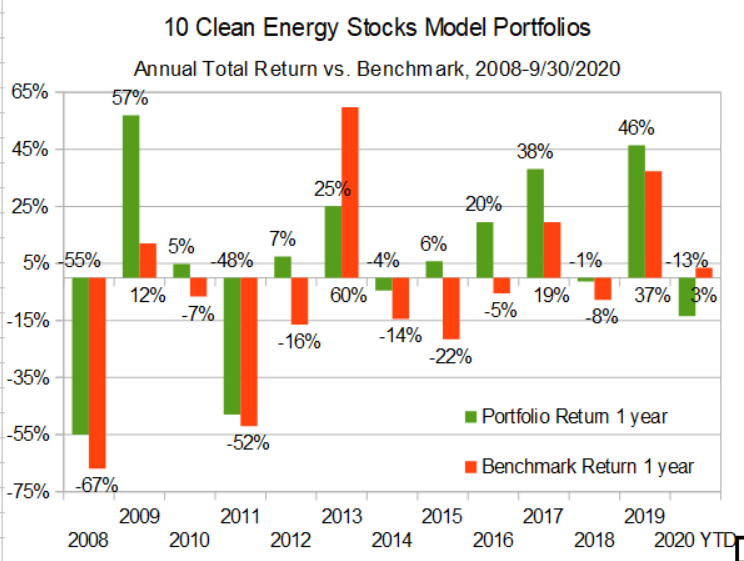

So, the goal of these selections is to maintain a defensive posture while avoiding the temptation of making any big bets to try to make up for previous losses by year end. When considered against the portfolio’s longer term track record, it’s worth noting that 2020 is likely to be the first year the model portfolio falls behind its benchmark since 2013.

Picks

Between accumulated dividends, and the cash freed up by the expiration of the puts on Hannon Armstrong (HASI) and Covanta (CVA), the portfolio had $3,533 in available cash. On valuation, I continue to like Covanta, Green Plains Partners, and MiX Telematics (MIXT). In general, I would prefer to sell out-of-the-money cash puts because of the protection they give against a small decline in the stock market compared to buying the stock outright.

Only Covanta has exchange traded options available, and I will attempt to sell two March 2021 $7.50 puts using a good-til-canceled limit order of $0.70. If executed, the puts will sell for $140 and $1500 cash will be needed to cover the potential assignment of 200 shares of CVA at $7.50.

This will leave $2173 to invest, which I will split between a good-til-canceled limit order to buy 120 shares of MIXT at $8.60 or better and 131 shares of GPP at $7.83 or better.

These prices are all a little below the market, so I will only count the trades towards the model portfolio if the stocks or option actually trade at or better than these prices starting on Monday 10/19.

Final Thoughts

I was tempted to leave the portfolio holding most of the cash, but I generally try to keep it mostly invested. If you use the 10 Clean Energy Stocks model portfolio as a guide for your own trades, keeping a decent allocation to cash is probably a good idea right now.

Disclosure: Long positions all the stocks in the model portfolio with the exception of NFYEF is now a very small position. My supporters on Patreon got an early look at this article on October 18th.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.