by Tom Konrad, Ph.D., CFA

With interest rates as low as they have ever been, I believe there is little point in small investors investing in bonds or bond funds, even if an allocation to fixed income is needed to match their investments to their ability and desire to take on risk. With little potential upside from interest, I believe it is better to take advantage of the added safety of federally backed insurance by depositing money in a bank or credit union savings account or certificate of deposit (CD) ladder.

We can do that and avoid having our deposits fund fossil fuel companies by choosing to bank with local banks or credit unions. Last year, I wrote about Aspiration, which does this by keeping deposits with a local bank in the Puget Sound region north of Seattle. I concluded that while Aspiration’s investments were fossil fuel free, they were only interesting because I was not aware of anything better.

Thanks to a reader, now I am. That better option is Clean Energy Credit Union. I’ve already opened an account.

The following interview is with Blake Jones, a co-founder and board member of Clean Energy Credit Union.

Q: What is Clean Energy Credit Union?

Clean Energy Credit Union (“Clean Energy CU”) is a federally chartered credit union (aka not-for-profit, financial services cooperative) that focuses exclusively on providing loans for clean energy and energy-saving projects such as electric vehicles, electric bicycles, residential solar electric systems, residential geothermal systems, and other green home improvements. It is an online/digital-only financial institution and does not have any brick-and-mortar branches. Clean Energy Credit Union is based in Colorado, but it serves members who live throughout the entire USA.

Clean Energy Credit Union’s vision is a world where everyone can participate in the clean energy movement, and our credit union helps make this vision a reality by: (1) making it easier for everyone to afford clean energy and energy-saving products and services by offering clean energy loans with amazing terms; and (2) making it easier for everyone to invest in the clean energy movement by offering federally insured deposit accounts and clean energy CDs whereby the deposits are solely used to help others pursue their clean energy and energy-saving projects.

Q: Tell us a little about yourself and your role at Clean Energy CU.

I started my career as an engineer in the oil and gas industry working for a subsidiary of Halliburton. I later became passionate about renewable energy, and that’s what I’ve been doing ever since, spanning the last 20 years. I’m also passionate about cooperatives and have co-founded five of them, including Clean Energy CU. I’m happy to serve on its board of directors as one of about a dozen volunteers. I love our team, our mission, our unique credit union model, and everything about what we’re doing – in other words, I love the who, what, how, and why of Clean Energy CU!

Q: When and how was it founded?

Clean Energy Credit Union was started by a group of passionate volunteers who self-identify as cooperative geeks, clean energy geeks, and/or enviro-geeks. After an arduous three-year application process, we successfully obtained a federal charter for Clean Energy CU in September 2017. While there are currently over 5,000 banks and over 5,000 credit unions in the USA, starting a new federally insured credit union or bank has become increasingly difficult and rare. For example, we estimate that less than two-dozen new credit unions have successfully obtained a federal charter since the economic downturn of 2008. So, needless to say, we had a lot to celebrate when we finally obtained our federal charter just over three years ago, even though we fully understood that this only signified that we were “crossing the starting line” in terms of pursuing our vision for Clean Energy CU.

Q: What inspired you to help found Clean Energy CU?

Despite the barriers that we encountered while applying for a federal charter, our group was determined to start Clean Energy CU because we’re very passionate about its mission and its potential impact. We earnestly believe that Clean Energy CU can play a unique role in disrupting the retail banking sector to help address climate change and grow the clean energy movement.

Q: What were the greatest obstacles?

Initially, our greatest obstacle was getting a federal charter. Then it was raising enough donations to initially capitalize the credit union. Unlike a bank, which can raise capital from stockholders/investors, federally chartered credit unions are 501(c)(1) not-for-profit organizations which can only capitalize themselves with retained earnings – which start-ups don’t have – and with donations. Fortunately, we’ve been able to raise almost $3M in donations from over 600 individual supporters and numerous foundations and corporate donors. This has allowed us to not only start the credit union, but also to “get over the start-up hump” and reach the point where the credit union is operating sustainably and can stand on its own two feet. I’m happy to say that Clean Energy CU has achieved healthy profitability in 2020, and in turn, this gives us (and our regulators) renewed confidence that our unique strategy is indeed viable. That being said, we still face some formidable obstacles if we want to achieve the kind of scale that we’re aiming for in order to have the greatest positive impact on climate change and the clean energy movement. So, our biggest challenge now is to rapidly grow our lending capacity by hiring and training new, mission-aligned employees as quickly as we can, by attracting new members and deposits to fund our loans, and by ensuring that we’re utilizing the best available software and IT infrastructure which is critically important for an online/digital-only credit union. While we don’t “need” more donations because we’re now profitable, all of these challenges that I just mentioned can be addressed more rapidly and effectively if we’re able to raise more capital via additional donations.

Q: What can you offer to small investors that is not available at other banks or credit unions?

We offer federally insured deposit accounts and CDs whereby the funds are used solely to help others obtain financing to pursue their clean energy projects. In other words, we offer federally insured investment opportunities in clean energy. As far as we know, nothing like this can be found anywhere else.

A growing number of people are asking, “what can I do to help combat climate change?” Many of us can purchase an electric vehicle, go solar, or make our homes more energy efficient – and many of us already have – but what else can we do? And what about people who live in urban areas and don’t need a car, or people who live in a high-rise and can’t install solar – what can they do? People who can’t pursue a clean energy or energy-saving project don’t have a way to support people who can. The goal of Clean Energy CU is to provide everyone with an opportunity to support clean energy, protect our environment, and improve our economy. Whether buying an electric vehicle or opening a checking account, everyone can make a difference.

People need more “sustainable banking” or “impact banking” options. Decades ago, conscientious consumers began channeling their purchases towards companies that make products which are less harmful – or ideally are beneficial – for our environment and society. Similarly, socially responsible investors began investing in carefully selected companies and mutual funds for similar reasons. Then, people began seeking careers which are more meaningful and impactful, and this has especially been the case with millennials in recent years. We believe that the next frontier, so to speak, is to be able to do your banking somewhere in which your deposits will have a positive impact. Most of the “big banks,” of which the top 10 hold almost 50% of all deposits in the U.S., are financing fossil fuel projects like the Keystone pipeline and/or are regularly embroiled in scandals like Wells Fargo’s recent “fake account” scandal. So, while we can all probably think of consumer, investment, or careers choices that we – or someone we know – have made that seek to do some good in the world, how many examples can you think of that fit into this new “impact banking” category? Unfortunately, there are far too few choices, and this needs to change. When we started Clean Energy CU, yes, we were thinking about bringing down the cost of financing for clean energy projects, but we were also thinking about the other side of the equation – the deposits that fund the loans – and the unique opportunity that was presented by being able to invest in the clean energy movement by doing your banking at a place where your deposits would be federally insured and would solely be used to help someone else finance their clean energy or energy-saving project.

Q: What types of loans do you offer?

We offer loans for electric bikes, clean energy vehicles (e.g. electric vehicles and plug-in hybrids), residential solar electric systems, residential geothermal systems (aka ground-source heat pumps), and green home improvements. This last loan category is kind of a catch-all for many different measures like insulation, weatherization, high-efficiency HVAC systems, high-efficiency water heaters, high-efficiency windows, and many others. An Energy Star rating makes it easy for us to approve appliances and equipment, for example, and a full list of eligible measures and their requirements can be found here. Our goal is to provide the best – or among the best – loan terms in the country that are custom-tailored for these types of projects.

Public demand for clean energy is growing rapidly, and people increasingly want to purchase electric bikes, electric vehicles, residential solar electric systems, residential geothermal systems, and other green home improvements. However, the cost of these projects can range from $5K-$100K (depending on numerous factors), so there’s a growing need for affordable financing. The best source for consumer financing for other large purchases such as auto loans, home mortgages, home improvement loans, boat loans, RV loans, etc., tend to come from banks and credit unions. Unfortunately, however, among the 10,000+ banks and credit unions in the USA, only a handful currently offer clean energy loans that meet the market’s needs. Instead, the vast majority of current clean energy loans are provided by Venture Capital-backed “fintech” companies whose financing terms are much more expensive than they should be. Clean Energy CU aims to set a positive example for other credit unions and banks, to teach them how to do clean energy lending, and to demonstrate that clean energy lending is far less risky than they currently perceive it to be (e.g. because the financial savings that result from lower utility bills or lower fuel costs can be applied towards monthly loan payments) in order to mobilize the tens of trillions of dollars that are managed by the retail banking sector towards bringing down the cost of financing for projects that utilize clean energy or conserve energy.

Q: What other new products is Clean Energy CU planning for? What is the expected timeline for launching them?

The next products we want to offer are home mortgages, credit cards, and loans to businesses and nonprofits. First, we’re aiming to offer home mortgages and home equity loans by the end of 2021, and similar to all of our lending, qualifying loans will have to be mission-aligned. So, for example, in order for a home to qualify for one of our mortgages, it’ll have to be a net-zero energy home, an energy efficient home with a good “HERS” (Home Energy Rating System) score or “EPS” (Energy Performance Score) score, or a home that is certified as Built Green, LEED, Energy Star, or something similar. Next, while we already offer debit cards, we’re also aiming to start offering credit cards by early 2022. Lastly, we can currently only offer residential and consumer loans, so we want to start offering loans to businesses and nonprofits by the end of 2022. In addition to providing loans to help businesses and nonprofits go solar, go geothermal, or make energy efficiency improvements, we also want to offer business banking services and lines of credit to companies and organizations that engage in clean energy work or environmental stewardship work.

Q: One of the reasons I wanted to write about Clean Energy CU is that I think a CD ladder is better alternative than a bond mutual fund for the fixed income of a person’s portfolio, and I think that Clean Energy CU will appeal to readers who want their investments to be actively helping solve the problem of climate change. Unfortunately, it looks like that while Clean Energy CU offers 1, 2, 5, and 10 year CDs. Without 3 and 4 year CDs, investors will have large gaps in their CD ladders, or have to stick to short term ladders. Do you have any plans to offer CDs which could fill in the gaps?

To be honest, we hadn’t thought of this and it wasn’t on our radar, so thank you for proposing this excellent idea. I plan on bringing this idea to our board of directors, and if they agree, I’d like us to start offering both 3- and 4-year clean energy CDs as soon as possible and by the end of Q1 2021 at the latest. Thank you for the suggestion!

Q: Are there other ways besides banking with Clean Energy CU that readers can help Clean Energy CU grow?

First, I want to emphasize that even just banking with Clean Energy CU is tremendously helpful because we need to grow our deposits in order to keep pace with the rapidly growing demand for our clean energy loans. As a result, we need more people to join the credit union and open checking accounts, money market accounts, IRAs, and clean energy CDs. We’d also like to make more electric vehicle loans, in particular, so if any readers are considering buying a new electric vehicle or refinancing their current loan, please know that Clean Energy CU has some of the best interest rates in the country. Lastly, as I mentioned earlier, Clean Energy CU can scale up its operations and positive impact more quickly if we’re able to raise additional donations. So, any readers who already make donations – or are willing to consider making new ones – for environmental causes, please consider Clean Energy CU as a potential option for leveraging your donation dollars to combat climate change and grow the clean energy movement via what amounts to a perpetual, revolving, clean energy loan fund.

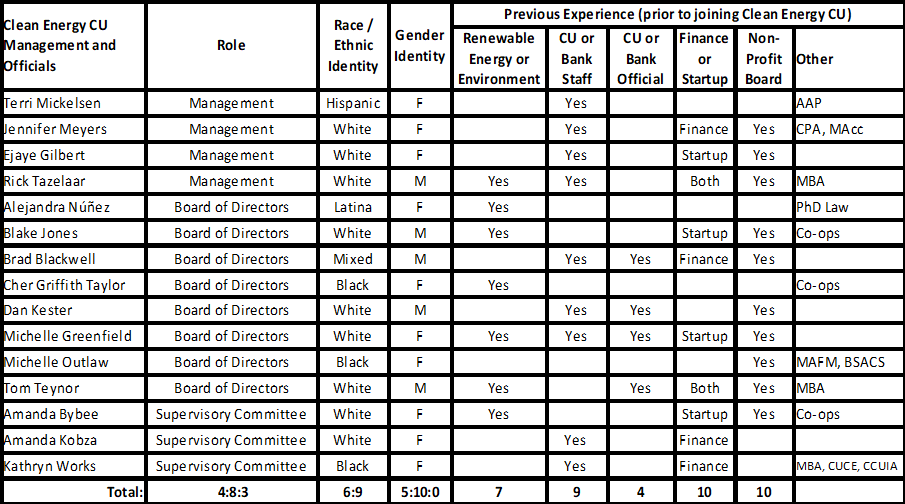

Q: My wife works with credit unions, and she notes that their management typically lacks any diversity. I notice that Clean Energy CU has a very diverse management and staff. How have you accomplished this, and what have been the biggest barriers to success in this regard?

When we started the credit union, the initial people involved were drawn mostly from our own social and professional networks, so they were people that we already knew. This was one of numerous factors that resulted in our initial team being mostly white and mostly male. For multiple reasons, it’s very important to us that the clean energy movement be as diverse and inclusive as possible, and we want to make sure that we preempt any potential perception that the movement is comprised mostly of white, male, “techie” geeks, for example (like me!).

One of the first things we did was to create a hiring committee for our first and most important hire, our CEO, that intentionally consisted of three women and one man. Out of many highly qualified candidates, we ended up hiring a Hispanic woman, Terri Mickelsen, to become our CEO. Terri’s experience and qualifications were amazing, and I’m happy to say with the benefit of hindsight that she’s been the perfect CEO for Clean Energy CU and has been an extraordinary leader for our organization.

Next, we made significant efforts to promote diversity and inclusion in our top two initial marketing initiatives: our website and our two-minute animated “explainer video”. For example, our top two “banner images” on the homepage of our website are of two families that have solar electric systems on their homes: an Asian-American family and a mixed-race family consisting of two LGBTQ parents and two adopted children. Fortunately, and partly by chance, the ~3,000 members who have already joined Clean Energy CU are diverse. However, we’ve also been proactively reaching out to mission-aligned organizations that also inherently represent diverse groups – such as the African-American Credit Union Coalition, GreenLatinos, Women in Renewable Industries and Sustainable Energy, and the National Society of Black Engineers – and trying to recruit these organizations to join our “field of membership,” which represents the groups or communities from which Clean Energy CU draws its members.

More recently, we’ve been working towards diversifying our governance teams: our board of directors and our supervisory committee (which is an important body which may be unique to credit unions). We realized that we needed to look beyond our own networks and reach out to others for help. Fortunately, we’ve recently added four women of color to our governance teams, and we’re very grateful to the Hewlett Foundation, the African-American Credit Union Coalition, GreenLatinos, and the Network of Latino Credit Union and Professionals for helping us in our search for diverse candidates. Our efforts were further helped by two of our white male board members who proactively volunteered to step down from the board in order to make way for diverse successors. For what it’s worth, we use the table below to help us monitor the diversity (in all its forms) of our leadership and officials:

Regarding our staff team, we still have lots of room for improvement, and we’re seeking new ideas for how to improve our diversity, equity, and inclusion (DEI) in the hiring and retention of mission-aligned employees. At the end of the day, I think the biggest barrier was our own willingness to make DEI a top priority for our organization. I believe it requires an unwavering commitment from the entire organization – especially the board of directors – as well as humble introspection and a concerted, sustained effort. We still have a long way to go, such as with further diversifying our staff team, and we realize that our DEI efforts need to be an ongoing practice and mindset rather than a “project” that will someday be marked as “complete.” Fortunately, I think we’re off to a good start, and we’re committed to working on this, increasing our awareness, and searching for new ideas to keep us moving in the right direction.

Q: Thank you for your work in helping create Clean Energy Credit Union, and for your time in this interview helping me tell my readers about it.

My pleasure! And thank you for introducing your readers to Clean Energy Credit Union!

—

DISCLOSURE: No conflicts of interest.

DISCLAIMER: Hey, I don’t need a disclaimer. Unlike stock market investments, deposits of up to $250,000 at Clean Energy Credit Union are NCUA insured. Well, maybe just a little disclaimer… I’m not an investment advisor, and this interview is for educational purposes, not intended as investment advice.