Two Stocks That Could Benefit From NuScale’s Sucess

After toiling away for almost two decades, perfecting its nuclear power reactor design, NuScale Power is on the cusp of commercial stage with its innovative Small Modular Reactor (SMR). The company has applied for certification by the U.S. Nuclear Regulatory Commission (NRC) and expects to approval by 2021. In a departure from conventional construction methods NuScale’s SMR is to be manufactured in a factory setting and assembled on site. NuScale has also lined up a first customer, the Utah Associated Municipal Power Systems (UAMPS), which is planning to build a nuclear power plant with twelve of NuScale’s 50-gigawatt SMRs. UAMPS expects its project to be...

List of Nuclear Energy Stocks

Nuclear energy stocks are publicly traded companies that develop, own, or manage nuclear power plants or the technology and equipment used in such plants.

This list was last updated on 2/10/2022.

Ameren Corp (AEE)

Areva (ARVCF)

Assystem SA (ASY.PA)

Brookfield Business Partners (BBU)

BWX Technologies, Inc. (BWXT)

Cameco Corporation (CCJ)

Centrus Energy Corp (LEU)

China General Nuclear (1816.HK)

Dominion Energy Inc (D)

Duke Energy Corp (DUK)

Electricite de France S.A. (EDF.PA, US ADR: ECIFY, US OTC: ECIFF)

Exelon Corp. (EXC)

FirstEnergy Corp (FE)

Fluor Corporation (FLR)

Fortum Oyj (FORTUM.HE)

General Electric (GE)

Global Power Equipment (GLPW)

Global X Uranium ETF (URA)

GSE Systems, Inc. (GVP)

Hitachi, Ltd. (6501.T, HTHIF, HTHIY)

IBC Advanced Alloys Corp (IAALF)

International Isotopes (INIS)

Kansai Electric Power Co Inc...

NuScale’s Small Nuclear Reactors Land A Big Investor

by Debra Fiakas, CFA

NuScale Power is in a new pact with South Korea’s Doosan Heavy Industries and Construction Co. to support development of NuScale’s small modular reactor (SMR). In addition to direct investment of $40 million in NuScale, Doosan has agreed to provide parts and equipment for the innovative nuclear power reactor valued at a total of $1.2 billion.

NuScale has been working on its power reactor for several years. The new design is based on pressurized water reactor (PWR) technology that has been used to power nuclear submarines and naval vessels. The design uses ordinary water as a coolant rather than ‘heavy’ water used by...

Yellow Cake Debut

by Debra Fiakas, CFA

Investors have a new opportunity for a stake in nuclear power. Last week a successful initial offering was staged by a new player in the uranium supply chain. Yellow Cake, plc. (YCA: LON) sold 76 million shares at £200 per share, raising £151 million (US$200 million). Uranium Participation Corporation (U: TO)took US$25 million of the deal, giving the Canada-based uranium speculator a 16% stake in the company. Yellow Cake is listed on AIM under the symbol YCA. In its third day of trading the stock closed up 1.25% from its debut.

Yellow Cake means to be a player in the uranium market, buying and...

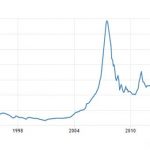

Spotting A Uranium Rebound: Inventories Are Key

The chart of spot uranium prices presents a dismal picture for this key energy commodity. After a brief spike in early 2006, the spot price has been in a long-term slide down hill. In the last year and a half it appears the price as found a level of support at the $20.00 price level as the shares have bounced around between that support level and up to the high 20s. With each bound higher shareholders of uranium producers cheer the end of what has been a long ‘down’ cycle. A click up to US$27.50 in recent days has...

Flocking to Uranium

The post Yellow Cake Debut described the capital raising effort of one of the newest players in the uranium supply chain. Yellow Cake leadership brought the aspiring intermediary to the capital market at a critical time for uranium producers. The uranium market has been in an extended trough period since the industry peak in 2007. At that time considerable development had been undertaken and capacity was beginning to generate sufficient supply to create stockpiled inventories. As this bloated condition persisted, in 2011 the nuclear power and its uranium supply chain were shocked by a Pacific Ocean tsunami that led to a nuclear spill at...

Nuclear and Solar From Down Under

by Debra Fiakas CFA Last week the Aussies invaded New York City, bivouacking at a popular hotel and parading a string of Australia-based companies in front of investors. Of course, there were the usual mining and minerals companies for which resource-rich Australia is so famous. However, the Australia Stock Exchange - one of the event sponsors - has diversified with listings in communications, biotechnology and alternative energy. One of the presenters, Silex Systems, Inc. (SLX: ASX and SILXY: OTCQX) is a talented little company with technologies for solar and nuclear power generation. Silex has developed a laser...

Yankee Graphite

Several graphite developers have made plans to integrate forward into the hottest segment of the market - battery-grade graphite. According to Industrial Minerals, spherical graphite suitable for lithium ion battery anodes is priced in a range of $2,700 to $2,800 per metric ton in China where many battery manufacturers are located. This compares quite well to the range of about $655 to $790 per metric ton for flake graphite concentrate.

The integration strategy has sent the sector into a frenzy of activity to prove their graphite meets expectations of battery manufacturers. The only graphite deposit in the U.S. mainland is under development by Westwater Resources...

Nations in Nuclear Play And The Companies To Benefit

by Debra Fiakas

Saudi Arabia plans to build 17.8 gigawatts of nuclear capacity by 2032, requiring about sixteen reactors. It is an ambitious plan and one that could have a significant impact on the nuclear power construction industry. Now the Saudi government is moving forward with a bidding process with nuclear power plant construction companies. Bids are expected before the end of 2018 and signing of contracts will be sometime in 2019.

Our review of possible bidders began with Toshiba’s (6502: Tokyo) Westinghouse Electric Company and Russia’s Rosatom Group. The last two posts, “Saudi Arabia Goes Nuclear” on January 16th and “Answering Saudi Arabia Request...

Epic Changes Are Coming in the Electric Power, Transportation and Energy Storage Sectors

John Petersen Epic is the only word I can use to describe an evolving tragedy that killed tens of thousands of people, inflicted hundreds of billions in property damage, destroyed 3.5% of Japan's base-load power generating capacity in a heartbeat and will cause recurring aftershocks in the global electric power, transportation and energy storage sectors for decades. While I'd love to believe the worst is behind us, I fear the times of trouble have just begun. Since it's clear that Japan will have to turn inward and serve the urgent needs of its own population first, the...

Admin Reviews Fuel Production To Mixed Nuclear Reactions

by Debra Fiakas, CFA

The U.S. Administration took a swing at the uranium ball, but it is not clear if it was a miss and strike out or just a walk. Some in the uranium industry are applauding a decision by the Trump Administration on the January 2018 petition by U.S. uranium producers Energy Fuels (UUUU: NYSE) and Ur-energy (URG: NYSE), requesting protection from uranium imports. The U.S. Commerce Department had investigated the petition under Section 232 of the 1962 Trade Expansion Act. No new trade restrictions are being implemented at this time, but the Administration is establishing a working group to analyze U.S. nuclear fuel production. A report...

A Nuclear Waste Disposal Stock

Debra Fiakas CFA Many are firmly opposed and a few more are skeptical of the nuclear energy industry. A big concern is the waste resulting from the uranium enrichment process that is part and parcel of the reactors we have chosen to use for nuclear power generation. Some see recycling of the waste as an answer. First a short primer on uranium and then the recycling story. Natural uranium consists of a mixture of three radioactive isotopes which are identified by the mass numbers U-238 (99.27% by mass), U-235 (0.72%) and U-234 (0.0054%). Uranium is everywhere...

Clean Energy Stocks to Fill the Nuclear Gap

Tom Konrad, CFA If the Japanese use less nuclear power, what will take its place? I'm astounded by the resilience and discipline of the Japanese people in response to the three-pronged earthquake, tsunami, and nuclear disaster, perhaps in large part by my cultural roots in the egocentric United States, where we seem to have forgotten the virtue of self-sacrifice for the greater good. Yet while Japanese society has shown itself to be particularly resilient, the Japanese electric grid is much less resilient. According to International Energy Agency statistics, Japan produced 258 TWh of electricity from...

Exelon’s Dividend Siren Song

by Debra Fiakas CFA When the market gets volatile, many investors dive behind the protective shield of dividends. Exelon Corporation (EXC: NYSE) is an owner of nuclear power generation plants and is included in Crystal Equity Research’s Atomics Index of companies using the atom to create energy because more than half of its power output is generated at nuclear power plants. The company offers a handsome dividend near $1.24 per year. Granted it is not a small-cap company, which is the usual target for this column, but yield is beguiling. At the current price the dividend yield is...

Four Green Money Managers’ Top Stock Picks

Green money managers' stock picks after the Japanese nuclear crisis. Even as the nuclear disaster in Japan unfolds, it's clear that the world's energy industry will be forever changed. Russian reactors were never considered safe, but a Japanese to have a nuclear meltdown is an entirely different story. Market Reaction Since Monday, nuclear stocks and ETFs have been plummeting. As of Wednesday night, The Market Vectors Uranium + Nuclear Energy ETF (NYSE:NLR), the iShares S&P Global Nuclear Energy Index (NASD:NUCL), PowerShares Global Nuclear Energy Portfolio ETF (NYSE:PKN), and the Global X Uranium ETF (NYSE:URA) are down...

Lightbridge Flirts with Areva

by Debra Fiakas CFA Last week nuclear fuel developer Lightbridge Corporation (LTBR: Nasdaq) announced an agreement with nuclear power plant builder Areva (AREVA: Paris; ARVCF: OTC/QB) to form a joint venture. The present pact is a precursor to a formal joint venture agreement that would team up the two companies - one very large multinational nuclear power house and one still quite small fuel developer - in joint development of Lightbridge’s metallic nuclear fuel technology. Lightbridge has developed and patented a novel design that replaces conventional tubes filled with ceramic uranium pellets now used by pressurized...