Brilliant Light Power – Commercialization Status

by Daryl Roberts

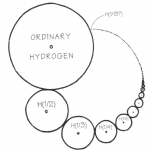

A potentially paradigm-shifting technology has been under development at an R&D firm in NJ called Brilliant Light Power. For people monitoring the situation, the question currently is about the status of commercialization. It is not a publicly held firm, but is in mid-stages of private equity capitalization in the range of $100-120M.

I recently read a book titled "Randall Mills and the Search for Hydrino Energy", offering a detailed and compelling history of the development of this novel renewable energy technology, authored by an insider, an intern who stayed on to work there for several years (published in...

List of Power Production Stocks

Alternative energy power production stocks are companies whose main business is the production and sale of electricity from alternative energy installations, such as solar farms, wind farms, hydroelectric generators, geothermal plants, cogeneration facilities, and nuclear plants.

This list was last updated on 9/11/2020.

7C Solarparken AG (HRPK.DE)

Acciona, S.A. (ANA.MC, ACXIF)

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Avangrid, Inc. (AGR)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Partners L.P. (BEP)

Capital Stage AG (CAP.DE)

Edisun Power Europe AG (ESUN.SW)

Elecnor, S.A. (ENO.MI)

Foresight Solar Fund plc (FSFL.L)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Innergex Renewable Energy Inc. (INE.TO,INGXF)

John Laing Environmental Assets Group Limited...

List of Wind Farm Owner and Developer Stocks

Wind farm owner and developer stocks are publicly traded companies that site, permit, develop, construct, own, or operate wind farms for producing electricity.

This list was last updated on 3/22/2022

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Atlantic Power Corporation (AT)

Avangrid, Inc. (AGR)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy Partners (BEP)

China Longyuan Power Group Corporation Limited (0916.HK, CLPXF)

China Ruifeng Renewable Energy Holdings Limited (0527.HK)

Orsted (ORSTED.CO, formerly DENERG.CO)

E.ON AG (EONGY)

Enel SpA (ENEL.MI, ESOCF)

Greencoat UK Wind (UKW.L)

Infigen Energy Limited (IFN.AX, IFGNF)

Innergex Renewable Energy Inc. (INE.TO, INGXF)

Neoen S.A (NEOEN.PA)

NextEra Energy Partners, LP (NEP)

NextEra Energy, Inc. (NEE)

Nordex AG (NRDXF, NDX1.DE)

Northland Power Inc....

One Week, Three YieldCo Deals. Are More Buyouts on the Horizon?

by Tom Konrad, Ph.D., CFA

It's been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent...

Brookfield’s Yieldco Buying Spree

by Tom Konrad Ph.D., CFA

Last week, a Bloomberg reported on a rumor that Brookfield Asset Management (BAM) was in talks to buy Abengoa's (ABGOY) stake in its former YieldCo Atlantica Yield (ABY). Atlantica had been looking for a new sponsor for well over a year since parent Abengoa filed for bankruptcy.

Purchasing Yieldcos (companies that own clean energy infrastructure and use the cash flows to pay large dividends to shareholders) is not new to Brookfield. Not only has BAM long sponsored Brookfield Renewable Partners, LP (BEP), a limited partnership that has essentially been a Yieldco since before the term was...

Juhl Energy Diversifies

by Debra Fiakas CFA Renewable energy producer Juhl Wind filed to terminate registration of its common stock and cease filing financial reports with the Securities and Exchange Commission in September 2015, but the company was not withdrawing from the wind energy industry. Instead Juhl expanded. Now called Juhl Energy (JUHL: OTC/PNK), the company’s corporate website boasts of its corporate headquarters in Minnesota powered exclusively by wind and solar energy. The company also claims the successful development of over 350 megawatts of wind power generation capacity at 25 different wind projects. Additionally, the company has dipped its corporate toe...

Power REIT: Why David Should Defeat Goliath

by Al Speisman, Esq. Al Speisman, Esq. Power REIT1 (NYSE MKT:PW) is a micro-cap Real Estate Investment Trust with assets generating consistent, secure cash flow. Power REIT’s assets consist of long-term railroad infrastructure as well as 600 acres of land leased to solar farms. Power REIT’S current underlying value of $11.07 per share is delineated in a shareholder presentation on Power REIT’S Web-Site. This valuation does not factor in potential success in Power REIT’s pending Federal Appeal. A recent article appearing in Value Investors...

Yin and Yang of Yield for Abengoa

by Debra Fiakas CFA The atmosphere started getting uncomfortably hot for power developer Abengoa SA (ABGB: Nasdaq) in early August last year - and it was not just the seasonal high temperatures in the company’s home town of Seville, Spain. Management had finally admitted that operations could not generate as much cash as previously expected, causing worries about Abengoa’s ability to meet debt obligations. At the heart of the company’s cash flow woes is the reversal of Spain’s policies on solar power that has reduced subsidies and feed-in tariffs for solar power producers. In August 2015,...

Abengoa Seeks Insolvency Protection

Jim Lane In New York, NASDAQ shares in Abengoa SA (ABGB) plunged 49% in Wednesday trading after the embattled renewable energy developer said it would seek bankruptcy protection as it seeks to reorganize nearly $9.4 billion in debt. The protective filing was announced after an expected infusion of nearly $300 million from Spanish steelmaker Gonvarri did not materialize. The company’s debt had been previously downgraded to a B3 rating by Moody’s, six rungs on the ladder beneath investment grade. Last week, Moody’s described the company’s cash reserves as “insufficient” and expressed that asset sales and a round of...

Investors Awaken to NextEra YieldCo

by Debra Fiakas CFA Last week NextEra Energy Partners, LP (NEP: NYSE) reported financial results for the third quarter ending September 2015. The numbers were released in along with quarter results from its parent, Florida-based utility NextEra Energy, Inc. (NEE: NYSE). The partnership is the operating arm of clean energy projects originated by the NextEra parent. The ‘yieldco’ as these operating entities have been kindly dubbed by shareholders, delivered $1.0 million in reported net income, but operating cash flow was a whopping $36 million in the quarter. The consensus estimate had been for $0.24 in earnings per...

SunEdison Spinning Yieldcos

by Debra Fiakas CFA Two weeks ago TerraForm Global, Inc. filed yet another amendment to its S-1 registration statement as the SunEdison, Inc. (SUNE: NYSE) spinout grinds forward with its initial public offering. TerraForm is a collection of SunEdison’s renewable energy properties, primarily its solar, wind and hydro-electric power generation facilities around the world. The current portfolio sums up to over 1,400 megawatts in total generating capacity, of which over 900 are spoken for through power purchase commitments that cover the next 19 years. On a pro forma basis, the assets produced $298.9 million in total revenue, providing...

My Yieldco Raised Its Dividend With This Weird Trick

Tom Konrad CFA Clean energy yieldcos buck the general trend by paying out a large proportion of cash flow to investors, and rapidly increasing their dividends at the same time. The key to this trick has been their rapidly appreciating stock prices. High yield companies generally grow slowly, while high growth companies have low dividend yields. Normal companies grow by investing some profits in new business opportunities. Early stage growth companies typically retain all their earnings to invest in new business. More mature companies have fewer opportunities, and so share a larger proportion of...

Power REIT Loses; What Now?

Tom Konrad CFA On April 22nd, the court ruled against Power REIT (NYSE:PW) in the summary judgement phase of its litigation with Norfolk Southern Corp (NYSE:NSC) and Wheeling and Lake Erie Railroad (WLE). At issue were if NSC and WLE were in default on a lease of 112 miles of track, and a number of claims surrounding the lease, and if they owed Power REIT's legal fees under the lease. Had power REIT prevailed on any of a number of counts, it could have been worth as much as $15 dollars a share to Power...

Sol-Wind: A Unique Yieldco

By Jeff Siegel President Obama gave renewable energy investors a very nice gift this week... As a part of his new budget proposal, the president is seeking a 7.2% increase in funding for “clean energy.” As well, he is asking for a permanent extension for the solar investment tax credit (ITC) and the wind energy production tax credit (PTC). The solar ITC is set to expire at the end of 2016, and the wind energy PTC has already expired. I can pretty much guarantee that a permanent extension of these tax credits is not going to happen....

Sol-Wind: New Yieldco With A Tax Twist

By Tim Conneally The pool of public solar yieldcos keeps growing. Just before the Christmas holiday, Sol-Wind Renewable Power LP filed for a $100 million initial public offering with the Securities and Exchange Commission. This will be the eighth Yieldco to debut since 2013, and the stock will trade on the NYSE under the symbol SLWD. But there's something different about this one. Sol-Wind is a yieldco that utilizes a Master Limited Partnership (MLP) structure, so it will be taxed differently from the other Yieldcos. Generally speaking, a Yieldco is similar to MLPs by nature, but the taxation...

Yield Co Pricing Less Irrational, But Plenty Of Opportunity Left

Tom Konrad CFA Yieldcos are companies which own clean energy assets and use the cash flows from them to deliver a high level of current dividend yield and (in some cases) the promise of significant dividend growth. Investors like them because yield is scarce in the current low interest rate environment. While investors like the relatively high yield offered by yield cos, they are only starting to discriminate between yield cos on the basis of current and future dividends. Four months ago, I published the following chart and noted that the yield cos...