Brilliant Light Power – Commercialization Status

by Daryl Roberts

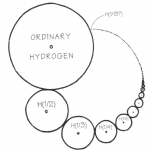

A potentially paradigm-shifting technology has been under development at an R&D firm in NJ called Brilliant Light Power. For people monitoring the situation, the question currently is about the status of commercialization. It is not a publicly held firm, but is in mid-stages of private equity capitalization in the range of $100-120M.

I recently read a book titled "Randall Mills and the Search for Hydrino Energy", offering a detailed and compelling history of the development of this novel renewable energy technology, authored by an insider, an intern who stayed on to work there for several years (published in...

List of Solar Farm Owner and Developer Stocks

Solar farm owner and developer stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

This list was last updated on 3/21/2022.

See also the list of Solar Manufacturing Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

7C Solarparken AG (HRPK.DE)

Abengoa SA (ABG.MC, ABGOY, ABGOF)

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Azure Power Global Ltd. (AZRE)

Bluefield Solar Income Fund (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy...

List of Solar Manufacturing Stocks

This list was last updated on 6/6/2022.

Solar manufacturing stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

See also the list of Solar Farm Owner and Developer Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

5N Plus Inc (VNP.TO, FPLSF)

Amtech Systems Inc (ASYS)

Array Technologies, Inc. (ARRY)

Apollo Solar Energy (ASOE)

Ascent Solar Technologies Inc (ASTI)

Canadian Solar (CSIQ)

DAQO New Energy Corp. (DQ)

First Solar Inc (FSLR)

GCL-Poly Energy Holdings Ltd. (3800.HK)

Guggenheim Global Solar ETF...

Why CSP Should Not Try to be Coal

Joe Romm, at the influential Climate Progress blog, has hit on a formula for countering the coal industry's claims that we need baseload power sources. Since Concentrating Solar Power (CSP) in conjunction with thermal storage can be used to generate 24/7 or baseload power Joe has renamed it "Solar Baseload." This is win-the-battle-lose-the-war thinking. While it does neatly counter the argument we need coal or nuclear, since there are renewable power sources which can produce baseload, such as CSP, Geothermal, and Biomass. I fell into this coal-industry trap myself in a 2007 article about Geothermal, as did AltEnergyStocks...

Mirrors in the Mojave

by Debra Fiakas CFA Last week the Ivanpah solar thermal power plant in California went operational last week. Ivanpah is a marvel. Located in the Mojave Desert, the power plant generators are driven by steam like any other. However, at Ivanpah the steam is created by acres of large mirrors that reflect and concentrate the desert sunlight onto water-filled boilers. The boilers tower 150 feet above the mirrors that are spread across 3,500 acres. Ivanpah scale has required the cooperation of a number of players. Brightsource Energy is running the show with the...

The Future Shape of CSP

Parabolic Troughs have dominated Concentrating Solar Power (CSP) until recently, but several companies are vying to replace them. Will the upstarts succeed, or will incumbency and improvements to trough technology ward off the competition? Dr. Arnold Leitner, CEO of Skyfuel, Inc., thinks the battle for dominance of CSP will be "winner-take-all." The technology which can deliver power when it is needed at a reasonable price should triumph. Photovoltaic (PV) technologies are rapidly producing price reductions, and can be used almost anywhere, but only produce power when the sun is shining. In contrast, CSP is still cheaper than PV enables...

Letter to the Editor: Advantages of CLFR

We appreciate AltEnergyStocks.com’s coverage of the CSP industry with its recent article, The Future Shape of CSP. Unfortunately, the article fails to recognize that compact linear Fresnel reflector (CLFR) companies like Ausra are making tremendous progress in advancing the technology and creating new and diverse market segments for CSP. CLFR is already on a path to being commercially demonstrated in the U.S., as well as in Australia and Southern Europe. In fact, Ausra recently commissioned the first major solar thermal power plant to be built in California in nearly two decades and developed...

Concentrated Solar Power and the New ITC

When the financial turmoil began, I sold my riskiest stocks. Even a successful bailout bill is unlikely to return us to the heady days of 2006 and 2007. Yet there is a bright side for clean energy investors. Despite the recent evidence to the contrary, a financial crisis is likely to convince legislators of the importance of getting the economy going again, and of doing so with the least amount of public money possible. Concentrating Solar Power It was with this thought in mind that I attended CSP Today's Second Annual CSP Summit US in San Francisco. ...

From Solar 2009: Investment Opportunities in Solar Stocks: Solar Millennium (SMLNF.PK)

Tom Konrad, Ph.D. This is the third in a series of entries on opportunities in solar stocks, based on a panel at Solar 2009. The the first article introduced the panelists, and took a look at the solar sector as a whole. The second was about First Solar. Allen Goodman on Solar Millennium (SMLNF.PK) "Project developers stand out because of their ability to have a relationship with the customer." Peter Lynch on Solar Millennium (SMLNF.PK) "I liked Solar Millennium before it ran up to $90 last year, I liked it at $90, and I like it today at...

Chinese Green Subsidies: When Lifting All Boats Becomes Bailing Them Out

Doug Young Bottom line: Strong response to Tesla’s latest EV in China and a major new solar plant plan from SolarReserve reflect Beijing’s strong promotion of new energy, which is also creating big waste by attracting unqualified companies to the sector. A series of new reports is showing how Beijing’s strong support for new energy technologies is benefiting both domestic and foreign companies, as China tries to become a global leader in this emerging area. But the reports also spotlight the dangers that come with such aggressive support, which often leads to abuse of subsidies and other...

Solar Stocks As the Best Play On The Cleantech Revolution? (Part I)

I just got around to reading a new report by Merrill Lynch (link at the end of this article) identifying cleantech as "The Sixth Revolution" (the other five being: Industrial Revolution; Age of Steam & Railways; Age of Steel, Electricity and Heavy Engineering; Age of Oil, the Automobile and Mass Production; and Age of Info and Telecommunications). Periodically, sell-side firms will release free cleantech/alt energy reports, which lay out their macro theses but stop short of providing stock picks to non-clients. I don't generally pay these reports too much attention as I find they rarely - if ever...

Cheap Photovoltaics Are Eating Solar Thermal’s Lunch

Tom Konrad CFA The falling price of photovoltaic (PV) solar is undermining the case for Concentrated Solar Thermal Power (CSP). According to a recent report from Pike Research, of the 6886 MW of CSP projects awarded in the United States since 2004, 36% have been replaced with PV. That's more than the number which are actually under construction (1,532 MW, or 21% of announced projects), and all of those required the backing of the US DOE loan guarantee program. With this recent track record, and no ...

A New Solar Fuel to the Rescue?

Cerium - an oil saviour? Eamon Keene Making fuel from solar energy is the holy grail of the renewable industry. In 2008, David Nocera, an energy professor from MIT, gushed about a "major discovery" which would unleash a solar revolution. The MIT press reported on a "simple, inexpensive, highly efficient process for storing solar energy". Ostensibly this was a way to split water to store solar energy in the form of hydrogen and each house would have its own solar panel, which would mean that "electricity-by-wire from a central source could be a...

Bragawatts

Tom Konrad, Ph.D. When Solaren announced they are seeking PUC approval for a power purchase agreement (PPA) with PG&E (NYSE:PCG) for solar power from outer space, I wasn't too surprised. California utilities signing deals for large solar projects which quite likely may never be built is something of an industry trend. At a Concentrating Solar Power (CSP) conference last fall, John White, the Executive Director of Cleanpower.org, said that competitive solicitations for power supplies in California are becoming a sideshow, and that the "Process lacks credibility among the most serious and qualified developers." Rainier Aringhoff, the president of one...

Renewable Energy: a Better Bribe

Bribing and Pressuring Fissile Regimes On July 25th, France offered to build a nuclear reactor for Libya to power a water desalinization plant. Russia is delaying the delivery of nuclear fuel for Iran's nearly completed Bushehr to help pressure them to comply with UN Security council demands for less secrecy. South Korea, Japan, China, Russia, and the United States promised to provide 950 thousand tons of oil or equivalent aid to North Korea in return for permanently disabling all its nuclear facilities. I'm not going to argue about whether using energy aid is the best way to influence this...

Ten Solid Clean Energy Companies to Buy on the Cheap: #10 United Technologies

Like most conglomerates, United Technologies Corporation (UTC), (NYSE:UTX) won't be found in any of the Clean Energy indices, but its growing portfolio of clean energy businesses makes it fit well into a diversified portfolio with a clean energy tilt. A conservative capital structure and solid earnings and cash flow, and a decades long history of constantly increasing dividends make this a company that I'm comfortable holding for the long term. In terms of sustainability, the company has been recognized by Dow Jones as in the top 10% of the world's most sustainable companies. Long before it became fashionable for...