Tag: FSLR

First Solar Jettisons Its O&M Business

by Paula Mints

In August, CdTe manufacturer First Solar (FSLR) sold its North America O&M business to NovaSource Power. According to First Solar CEO Mark Widmar, the decision was due to contracting O&M margins and customer demands for more services. The company is also exploring jettisoning its EPC business. First Solar plans to focus on its module manufacturing business.

Comment: Apparently, First Solar finally realized that O&M is low margin and that the EPC business may also not have much margin cushion. Now the company can concentrate on another low margin sector of the solar manufacturing chain, manufacturing.

First Solar has occasionally...

US Solar Manufacturing Announcements: The Real And The Hype

by Paula Mints

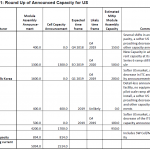

In 2018, the US market for PV deployment is estimated at ~12-GWp. As the US does not have sufficient domestic cell manufacturing capacity to meet its demand, most of the 12-GWp will be met by imports of cells or, modules. Following the implementation of cell/module tariffs there were, as expected, new capacity announcements in the US, primarily for module assembly. If all the current announcements came true it would add an additional 4.2-GWp of module assembly and 1.7-GWp of cell manufacturing (thin film and crystalline) capacity to the US. First Solar (FSLR) is responsible for 1.3-GWp of the new module assembly and...

Sunpower’s Tariff Exemption: When You Win, You Lose

SunPower gets an exemption for its interdigitated back contact (IBC) solar cells – did it win the battle and lose the war?

by Paula Mints

If SunPower (SPWR) was playing a game of chicken with the Trump Administration to give it an edge towards the goal of getting an exemption, it a) won its gamble and can now focus on manufacturing p-type monocrystalline cells and modules to compliment imports of its n-type IBC cells and modules, b) won its gamble and now must keep its word and invest in resuscitating the long-in-the-tooth SolarWorld US manufacturing facility, or, c) won its gamble...

First Solar: Companies Plan, God Laughs

by Paula Mints

First Solar (FSLR) offered a great lesson about the announcing of plans (man plans, god laughs) in July when during its Q2 release call it discussed the yield problems slowing commercial production of it’s Series 6 large format module. The production delays are due to a single point of failure causing a bottleneck. First Solar expects to enter volume production with its Series 6 module early in 2019.

Muted-kudos to First Solar for discussing a not-so-secret problem with Series 6 production. The kudos are muted because if the company had been more circumspect in the first place there...

List of Solar Farm Owner and Developer Stocks

Solar farm owner and developer stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

This list was last updated on 3/21/2022.

See also the list of Solar Manufacturing Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

7C Solarparken AG (HRPK.DE)

Abengoa SA (ABG.MC, ABGOY, ABGOF)

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Azure Power Global Ltd. (AZRE)

Bluefield Solar Income Fund (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy...

List of Solar Manufacturing Stocks

This list was last updated on 6/6/2022.

Solar manufacturing stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

See also the list of Solar Farm Owner and Developer Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

5N Plus Inc (VNP.TO, FPLSF)

Amtech Systems Inc (ASYS)

Array Technologies, Inc. (ARRY)

Apollo Solar Energy (ASOE)

Ascent Solar Technologies Inc (ASTI)

Canadian Solar (CSIQ)

DAQO New Energy Corp. (DQ)

First Solar Inc (FSLR)

GCL-Poly Energy Holdings Ltd. (3800.HK)

Guggenheim Global Solar ETF...

First Solar and SunPower Lobby Shareholders to Sell 8point3 YieldCo

by Tom Konrad Ph.D., CFA

Will shareholders accept the deal?

On Monday, 8point3 Energy Partners, the joint YieldCo from First Solar and SunPower, entered into a definitive agreement to be acquired by Capital Dynamics.

When public companies are sold, it's almost always at a premium to the market price. It's that price premium that persuades shareholders to sell. So why would 8point3 (NASD: CAFD) shareholders accept a deal that offers them only $12.35, or 15 to 20 percent below the roughly $15 price CAFD has been trading around for the past three months?

To answer this question, we need a little history.

Jan Schalkwijk, founder...

What Just Happened: First Solar’s Strategy Shifts

2016 was a wild year and not just for solar and after decades of reliance on government incentives, subsidies and mandates the global solar industry may be inured to unpredictability but the industry as a whole should be wary of global trends. Solar PV expert Paula Mints looked at a number of the developments for solar companies in the December edition of SPV Market Research's Solar Flare. Adapted for AltEnergyStocks.com, this series of articles is reprinted with permission.

Though First Solar (FSLR) indicated recently that 2017 would be a transition year there is no indication from the company’s behavior...

How Economics Finally Brought Community Solar to IREA

by Joseph McCabe, PE My uber-conservative utility, Intermountain Rural Electric Association (IREA) has been against solar since before I moved into the service territory in 2007. IREA's long-serving general manager, Stanley Lewandowski Jr., would include climate change denial leaflets in the envelope along with the monthly electric bills. Now he is gone, and attitudes seem to be changing towards solar. With a new general manager, a couple of forward thinking board of directors and a handful of active IREA owners/members the solar landscape has changed and now includes a large solar project. Currently IREA...

First Solar’s Surprising Strategy Switch

by Paula Mints CdTe and crystalline manufacturer and project developer First Solar (FSLR) announced positive results for Q1 as well as a switch in strategy emphasis from deployment to module sales. Honestly, revenues, positive net income and other financial metrics matter less in this case than the company’s strategy switch to module sales. Downward price pressure and margin compression along with continued aggressive pricing from China makes this move confusing. Cost leadership is mutable in the PV industry and it is difficult to imagine that First Solar will have an advantage in this regard for long. ...

First Solar And Trina: Dueling Ratings

by Debra Fiakas CFA Solar module producer First Solar, Inc. (FSLR: Nasdaq) received a boost last week from a new rating upgrade from Hold to Buy. There are at least fifteen sets of analytical eyes scrutinizing First Solar. The prevailing view on First Solar had been ‘hold’ or ‘neutral’ with a median price target of $70.00, representing a 13% return potential from the current price level. Solar power generation has on a roll in recent years as lower solar cell prices have helped find demand at higher volumes. The U.S. Solar Energy Industries Association...

2020 Solar Investment Outlook

If you Hate Money, Don't Invest in Solar! It took the solar industry forty years to reach a cumulative global capacity of 100 gigawatts … By 2020, more than 100 gigawatts will be installed in a single year! According to a new report from the good folks over at Greentech Media, the solar industry will install a mind-blowing 135 gigawatts of solar PV projects all across the globe in less than five years. This will push the cumulative market to nearly 700 gigawatts - or about the size of all the electrical generating capacity in Europe today....

Yingli is Tanking, but the Solar Industry Remains Vibrant

By Jeff Siegel Solar stocks are getting a thrashing today after Yingli Green Energy (NYSE: YGE) came clean about a possible bankruptcy. The stock tanked at the open and is still trading below $1.00 – down from yesterday's closing price of $1.70. Of course, the writing was on the wall with this one. Yingli's been struggling for a long time. And while I'm extremely bullish on solar, I've kept a safe distance from Yingli, as well as a lot of other China solar stocks. That being said, even the solid, revenue-generating companies not operating out of China are...

India Hates Coal

By Jeff Siegel If you think the war on coal in the U.S. is bad, you ain't seen nothing yet! We recently got word that India is set to double the tax on coal production, while promoting electric vehicles and renewable energy projects. I'm pretty sure there's some Luddite reporter in Mumbai right now who's head's about to explode. But that's neither here nor there. While I'm no fan of regulatory regimes of any kind, I'd be lying if I said I wasn't happy to know that a crap-ton of money is getting funneled into renewable energy and electric...

Solar: Energy, But Not Oil

by Garvin Jabusch Solar photovoltaic (PV) as a means of deriving energy is fundamentally different from fossil fuel-based commodities (oil, coal, and gas). Consider: A solar PV panel can be thought of as nothing more than a hugely oversized computer chip a bunch of circuitry embedded in a silicon wafer. Indeed, in most economic sector classification schemes (GICS, etc.), PV manufacturers are defined as "semiconductors," which is basically true (if misleading in other ways). So different are the driving economics behind tech-based and commodities-based means of deriving energy, that we at Green Alpha are recommending to Standard &...

Five Solar Stocks To Own In 2015

By Jeff Siegel This past Saturday afternoon, Rick Diaz locked in another customer. A former roofing contractor, Rick is now a sales rep and installation manager for a small roofing and solar company in Maryland. He tells me most people he talks to about solar have pretty much already made up their minds before he even walks in the door: The investment works out for young couples who are going to be in these homes for more than ten years. But most seem more concerned about the environment than the return on investment. Either way, it's a...