Tag: TERP

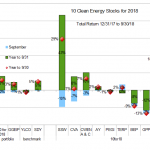

Ten Clean Energy Stocks For 2018: September Quick Update

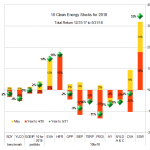

As you can see from the chart, September was a tough month for my model portfolio of Ten Clean Energy Stocks for 2018. Seaspan (SSW) fell back on trade war fears and Green Plains Partners (GPP) fell on ethanol market weakness caused by retaliatory ethanol tariffs and the Trump EPA's continued undermining of the Renewable Fuel Standard. I'm less sure why Covanta (CVA) is down, but Clearway Energy's (CWEN and CWEN-A formerly NRG Yield) small decline is due to a recent secondary offering.

Two of these (CVA and GPP) were my top picks last month, while the third was Terraform Power (TERP). ...

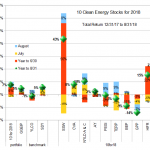

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

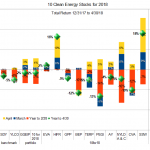

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

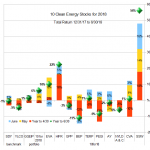

Ten Clean Energy Stocks For 2018: First Half Update

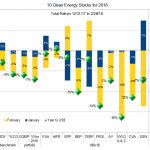

The first half of 2018 has been difficult for most investors, including clean energy investors and dividend income investors. Through June, my broad dividend income benchmark SDY lost 0.6%, while my clean energy income benchmark YLCO lost 4.7%, including dividend income.

My picks were also down for most of the year, finally struggling back into positive territory at the end of May. They finished the first half up a solid 5.9%. The real money strategy I manage, the Green Global Equity Income Portfolio (GGEIP), also squeaked in to positive territory by 1.2% at the end of June.

Details of then stocks'...

How Weather Risk Transfer Can Help Wind & Solar Development

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

Ten Clean Energy Stocks Back In Positive Territory Year To Date

Stay tuned for a full update next month, but it's nice to be back in the black... especially with the benchmarks still struggling. Thanks to Enviva (EVA), Covanta (CVA), and Seaspan (SSW). Until then, here's the May update, where I said EVA and CVA were two of my 3 top short term picks , and I commented that "I still think Seaspan has significant room to the upside."

AY (at $18.91) and TERP (at $10.83) are my top short term picks right now.

Disclosure: Long EVA, HIFR, GPP, BEP, TERP, PEGI, AY, NYLD, NYLD/A, CVA, SSW.

Ten Clean Energy Stocks For 2018: Oddballs Spring Back

After a stormy winter for the broad market and clean energy stocks, including my picks, March and April brought relative calm. Better yet, my model portfolio has rebounded from its February lows, although its benchmarks (SDY for the broad market of income stocks and YLCO for clean energy income stocks) have mostly been treading water.

The gains were led by two of my less conventional clean energy picks, Seaspan (SSW) and InfraREIT (HIFR). Seaspan owns (mostly very efficient) container-ships, which most people would not associate with clean energy, but which I include because they they are much less energy intensive...

Ten Clean Energy Stocks For 2018: Stormy Winter

Tom Konrad Ph.D., CFA

While the broad market has been turbulent for the start of 2018, clean energy stocks have fared worse than most. The Trump administration's anti-environmental efforts had little effect on clean energy stocks in 2017 (it was a banner year for this model portfolio). So far, this year has been quite different. Last year, investors seemed unfazed by the chaos in Washington, but with the single "win" of the Republican tax give-away to corporations, investors now seem to think that Trump may indeed be able to deliver on his polluter-funded agenda.

Income-oriented stocks have also been taking a...

One Week, Three YieldCo Deals. Are More Buyouts on the Horizon?

by Tom Konrad, Ph.D., CFA

It's been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent...

Ten Clean Energy Stocks For 2018

Tom Konrad Ph.D., CFA

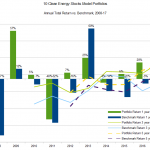

Ten Years of "10 Clean Energy Stocks." A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don't know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was...