Tag: NFI.TO

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

10 Clean Energy Stocks for 2020: The Waiting

by Tom Konrad, Ph.D., CFA

Despite high valuations, a rampaging pandemic, and the end of the $600 weekly supplemental unemployment payments from the CARES Act, the stock market continued upward in August.

Like most ordinary people in this economy, my Ten Clean Energy Stocks model portfolio is still not feeling the recovery the way the big tech companies and the ultra wealthy are, although my real-money Green Global Equity Income Portfolio (GGEIP) is now hitting new highs for the year.

The difference between the model portfolio’s performance and GGEIP is mostly a result of trading: It had a large cash position at...

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

10 Clean Energy Stocks for 2020: July Update on Valeo MiX, and NFI

A secular shift in the transportation paradigm?

by Tom Konrad, Ph.D., CFA

I'm continually surprised at the strength and length of the stock market recovery in the face of a worsening pandemic in the US.

The stock market may not be the economy, but it's not totally divorced from the economy either. Perhaps the Senate's unwillingness to even talk about another aid package and the subsequent failure to pass one until after the benefits in the initial CARES act expire will trigger the market reversal I've been expecting at least since late April. Or it won't. I have a long track record...

10 Clean Energy Stocks For 2020 May Update: Red Eléctrica, Ebay, NFI Group

by Tom Konrad, Ph.D., CFA

Market Outlook

The continuing market rebound in the face of a worsening epidemic in the US (outside of the initially hardest hit states) widespread protests against lack of police accountability, and a President who thinks the right response to mostly peaceful protests is to call in the military continues to befuddle me.

The risks in today's stock market outweigh the possibility of future potential gains. Although I was buying aggressively in March, I've shifted back to a more cautious stance, and am mostly starting to sell covered calls on my positions with the greatest gains. I generally...

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

You can see overall performance for January and February in the following chart. Not that...

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...

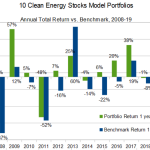

Ten Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

If it's tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

I've been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year's returns were also achieved in the context of full- to over-valuation of most of the clean energy...

List of Alternative Transportation Stocks

Alternative Transportation Stocks are publicly traded companies that offer transportation options that use less fuel per passenger-mile or freight-mile than traditional options. Includes mass transit (both rail and bus), bicycles, and two wheel vehicles.

A. P. Moller - Maersk Group (MAERSK-B.CO)

Accell Group (ACCEL.AS)

Blue Bird Corporation (BLBD)

Bombardier Inc (BDRBF)

Construcciones y Auxiliar de Ferrocarriles (0MK5.L)

CSR Zhuzhou Electric Locomotive (ZHUZF)

Canadian National Railway Company (CNI)

Canadian Pacific Railway Limited (CP)

CSX Corporation (CSX)

Cubic Corporation (CUB)

Dorel Industries (DIIBF)

Firstgroup, PLC (FGP.L)

Giant Manufacturing (9921.TW)

Grande West Transportation Group Inc. (BUS.V)

Great Lakes Dredge and Dock (GLDD)

Greenbrier (GBX)

L. B. Foster (FSTR)

Merida Industry Co. Ltd. (9914.TW)

National Express Group (NEX.L)

New Flyer Industries (NFYEF, NFI.TO)

Norfolk...