Solar & Storage Finance Conference Notes

I attended the Solar & Storage Finance conference hosted in NYC in late October 2018. Presenters included a mix of capital providers & asset managers, private non-profit entities & public agencies, legal, accounting & consulting firms, intermediaries, firms providing risk analysis, ratings & mitigation, & various vendors of energy storage and IT-related services. The tone of the discussions was noteworthy for its near total absence of ideological comments about environmental urgency. Rather, it was a meeting of finance technicians and technocrats focused on the nuts & bolts of accomplishing those ends, with the merits and relevance of mission assumed.

The...

SolarWindow: A Unique But Risky Opportunity

by Debra Fiakas, CFA

SolarWindow (WNDW: OTC/QB) raised $25 million this week to build a manufacturing plant for its electricity-generating glass. Three investors subscribed to 16.7 million shares of common stock. The company is getting $19.8 million in new capital in addition to conversion of $3.6 million in debt to common stock.

The SolarWindow is unlike any other energy producing innovation. Rather than relying some sort of dedicated production plant or facility, the SolarWindow is a part of the electricity user’s own facility. Ultra-thin layers of liquid coatings are sprayed onto a glass surface, forming a network or array of miniature solar cells.

This is a type of photovoltaic technology that uses...

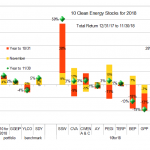

Ten Clean Energy Stocks For 2018: Quick November Update

by Tom Konrad Ph.D., CFA

At the start of November, I abandoned my short-term bearish stance on the market, writing "I’m not confident that the correction is over, but we seem to be heading into a temporary lull, and so I’m going to abandon cash as my top pick for November." This turned out to be a good call, with my Ten Clean Energy Stocks model portfolio up 4.3% for the month, slightly behind its broad dividend income benchmark, SDY, which was up 4.9%. Its clean energy income benchmark YLCO gained 1.6%, as did the private portfolio I manage, the...

Biofuels Industry Reacts To The New RVO Requirements

by Jim Lane

What a whirlwind weekend after the U.S. Environmental Protection Agency announced their final renewable volume obligations (RVO) under the Renewable Fuel Standard program for 2019. “It’s just numbers,” some say, but oh no, not in the biofuels world. It’s never just numbers. This time it’s about waivers, fixing the damage done, and ensuring a bright future for biofuels. It’s about hollow chocolate bunnies and two steps back for some.

French mathematician Rene Descartes is best known for “I think, therefore I am,” but he also said “Perfect numbers, like perfect men, are rare.” So true in this case as not...

Advanced Energy: Overlooked and Undervalued

Investors interested in renewable energy often get singularly focused on innovators new energy sources at the expense of companies that provide the nuts and bolts of the energy infrastructure. Advanced Energy Industries (AEIS: Nasdaq) is a stalwart of the electric power network, providing power conversion and control components that convert energy to the proper current for use by consumers and business. The company has a broad product line that has applications with a diverse customer base, including semiconductor manufacturers and chemical processing plants. The 2017 acquisition of Excelsys Holdings Ltd. based in Ireland added products targeted at medical and industrial applications.

As popular as Advanced...

Westport Fuels Natural Gas Conversion

Earlier this week Westport Fuel (WPRT: Nasdaq) reported financial results for the quarter ending September 2018. Based on British Columbia, Westport is a developer and manufacturer of clean fuel systems for both fossil and renewable fuel sources. It has taken some years, but Westport management has worked hard and overcome a number of obstacles to bring a mix of engines and systems capable of handling various fuels such as natural gas, hydrogen and liquid petroleum gas.

Revenue jumped to $65.5 million in the September 2018, quarter delivering $4.3 million in cash earnings. The company’s relationship with truck engine manufacturer Cummins (CMI: NYSE) is proving to be...

Does The Beyond Meat IPO Spell The End Of The Cow?

by Jim Lane

It’s Thanksgiving week in the United States but we are feasting alternatively on acronyms here in Digestville. I.E., e.g., ICYMI, BYND IPO PDQ, and FYI Perfect Day AKA Muufri JDA w/ ADM.

As they said at Bletchley Park, let’s get out the Enigma machine and decode.

In New York and California this week, the nutrition side of industrial biotechnology — and specifically, the “beyond the cow moovement is, ahem, mooving faster with news that Beyond Meat has filed for its IPO and Perfect Day has inked a Joint Development Agreement with Archer Daniels Midland(ADM) to scale up the production of dairy proteins using fermentation...

Report Alleges EPA Tests Skewed Against Ethanol By Oil Industry Influence

by Jim Lane

In Washington, researchers for a report published by the Urban Air Initiative contend that “technical data that shows the nation has been exposed to decades of flawed test fuels and flawed driving tests, which in turn means flawed emissions results and mileage claims”. The complete Beyond a Reasonable Doubt series from UAI is available here.

Further, EPA emails obtained under the Freedom of Information Act reveal that, according to a report from Boyden Grey & Associates, the Agency appears to have directly solicited financial contributions and technical input, “especially on the fuel matrix,” from an oil industry controlled research organization.

Of the...

Ten Clean Energy Stocks For 2018: Terraform, Clearway, and Enviva

by Tom Konrad Ph.D., CFA

Last week, I neglected to discuss Terraform Power (NASD: TERP) in the third quarter update on the other ten clean energy stocks for 2018. I did not notice the omission until after the post had been published, so I decided to write a quick follow-up this week after I had a chance to digest the earnings announcements (including TERP's) which were scheduled for later in the week.

Stock discussion

Clearway Energy, Inc (NYSE: CWEN and CWEN/A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25.

10/31/18 Price: $19.61/$19.42 ...

Green New Deal Roadmap – Accelerating Renewable Energy Infrastructure Development

Investment in renewable energy is rising, but clearly needs to grow faster to meet the goals for an expedited transition away from carbon infrastructure if we are to avoid dangerous climate change, given that now even the Trump administration forecasts a 7°C increase by 2100, which would be catastrophic.

The Paris Agreement determined that in order to keep warming below 2°C, the global economy would need to be restricted to a 600 gigaton carbon “budget”, and completely decarbonize by 2040.

Emissions must be cut by 70% in the Paris-congruent Remap case, and 90% of those cuts in energy-related CO2 emissions can...

Conversions To Renewable Diesel

by Helena Tavares Kennedy

The seasons are changing in many parts of the world right now, but what really is changing this autumn is how the world is looking at renewable diesel. Phillips 66 and REG’s announcement about a new renewable diesel plant on the U.S. West Coast planned for 2021 comes after a notable increase in refineries that are being converted and changed over to renewable diesel. Change is good, especially in this case.

As Bob Dylan sang, “For the loser now, Will be later to win, For the times they are a-changin’.” And who knew he was singing about the RFS...

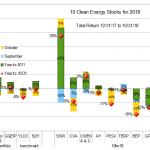

Ten Clean Energy Stocks For 2018: Third Quarter Earnings

Tom Konrad Ph.D., CFA

After a fairly brutal September and October my Ten Clean Energy Stocks model portfolio is barely hanging on to positive territory for the year (up 2.4%) as is the private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP, up 0.8%). Yet I can take comfort in superior relative performance, since my broad dividend income benchmark SDY is now down 0.1% for the year, and the clean energy income benchmark YLCO has fallen 5.8%. All returns are total return after fees and dividends.

The strong relative performance in a weak market is most likely due to...

Two Stocks That Could Benefit From NuScale’s Sucess

After toiling away for almost two decades, perfecting its nuclear power reactor design, NuScale Power is on the cusp of commercial stage with its innovative Small Modular Reactor (SMR). The company has applied for certification by the U.S. Nuclear Regulatory Commission (NRC) and expects to approval by 2021. In a departure from conventional construction methods NuScale’s SMR is to be manufactured in a factory setting and assembled on site. NuScale has also lined up a first customer, the Utah Associated Municipal Power Systems (UAMPS), which is planning to build a nuclear power plant with twelve of NuScale’s 50-gigawatt SMRs. UAMPS expects its project to be...

How China Came To Dominate Solar Manufacturing

by Paula Mints

The PV industry is global, and its pricing function has a cultural basis. Particularly as it is dominated by China, without an understanding of China and its market motivations, it is impossible to understand why PV manufacturers today, all rational actors, willingly accept 15% or lower manufacturing margins when margins for like industries are higher.

Examples from other industries include: Coal 40% to 50%, Iron and Steel 20%, Construction ~30%, Appliances 30%, Aluminum 20%, Industrial Machinery and Components 40%, Aerospace 40% and Agriculture 8%.

In the PV industry the average margin is 8%. Congratulations PV, you are on par with agriculture.

Aside from significant government...

The Environment Is On The Ballot. Vote November 6th

AltEnergyStocks.com first endorsed a presidential candidate in 2008. We endorsed Barack Obama based on his more pro-environmental, pro-alternative energy stance compared to his opponent, John McCain. Choosing between John McCain and Barack Obama took some research, since both candidates struck a somewhat pro-environment tone. Our choice rested on the fact that Obama seemed to have a deeper commitment to environmental causes. Our 2012 endorsement of Obama over Romney was also based on a comparison of their proposed policies.

Fast-forward to 2016, and the decision between the candidates was no longer one that required much analysis. The choice could not have...

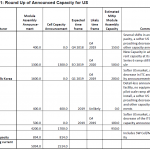

US Solar Manufacturing Announcements: The Real And The Hype

by Paula Mints

In 2018, the US market for PV deployment is estimated at ~12-GWp. As the US does not have sufficient domestic cell manufacturing capacity to meet its demand, most of the 12-GWp will be met by imports of cells or, modules. Following the implementation of cell/module tariffs there were, as expected, new capacity announcements in the US, primarily for module assembly. If all the current announcements came true it would add an additional 4.2-GWp of module assembly and 1.7-GWp of cell manufacturing (thin film and crystalline) capacity to the US. First Solar (FSLR) is responsible for 1.3-GWp of the new module assembly and...