Free Talk: A Permaculture Portfolio

For readers in the Hudson Valley, I will be giving a free talk next Monday night. I will speak about applying permaculture design principles to your investment strategy. While I developed my own strategy over the last two decades without any reference to these design principles, now that I'm familiar with them, I realize that I have been thinking along these lines for a long time. The design principles are remarkably robust and intuitive.

I used to think Permaculture was just about redesigning our food systems, but it's much much more than that.

The talk is sponsored by the Rondout Valley...

First Solar: Companies Plan, God Laughs

by Paula Mints

First Solar (FSLR) offered a great lesson about the announcing of plans (man plans, god laughs) in July when during its Q2 release call it discussed the yield problems slowing commercial production of it’s Series 6 large format module. The production delays are due to a single point of failure causing a bottleneck. First Solar expects to enter volume production with its Series 6 module early in 2019.

Muted-kudos to First Solar for discussing a not-so-secret problem with Series 6 production. The kudos are muted because if the company had been more circumspect in the first place there...

Plasma Arcs For Pig Waste

This week MagneGas (MNGA: NASDAQ) announced new work completed toward plans to enter the commercial pork sector with a proprietary manure processing and disposal solution. Management held a meeting with the North Carolina Department of Environmental Quality and the U.S. Army Corps of Engineers to discuss MagneGas technology to treat agriculture waste and the state’s required environmental permit protocols. MagneGas aims to sell to pig farmers equipment based on its innovations.

The company wants to help pig farmers address environmental problems cause by manure accumulation with its proprietary waste sterilization process. Handling pig waste using conventional methods can be costly, but failure to...

The Race For Silicon Anodes

Graphite is the most widely used material for battery anodes. The anode is the positively charged electron collector in a battery. It collects and accelerates the electronics emitted by the battery’s cathode. Graphite gets the anode job because it is has excellent electric conductivity and resists heat and corrosion. Plus it is light weight, soft and malleable.

As satisfied as manufacturers might be with graphite anodes, none would balk at an alternative material that boosts battery performance or reduces cost. Scientists believe battery capacity can be increased as much as ten times by using silicon for anodes. It requires six atoms of carbon to bind one...

US Ethanol Industry Upset With 2019 Renewable Fuel Standard Proposal

The 2019 proposed US Renewable Fuel Standard proposed volumes attracted a major raspberry from the ethanol industry.

As the American Coalition for Ethanol noted:

“Unfortunately, EPA continues to take actions which undermine the letter and spirit of the statute and harm the rural economy. While refiners are reporting double-digit profits, the heart of America is being left behind. Farmers are losing money while refiners have the best of both worlds: fat profit margins and minimal RFS compliance costs. EPA needs to discard its refiner-win-at-all-costs mentality and get the RFS back on track.”

“While the proposed rule purports to maintain the 15-billion-gallon conventional...

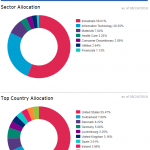

Screening For the Best Clean Energy ETF

by Vic Patel

There are over a dozen major Clean Energy ETFs available to investors. But which one is the best one to put your hard earned money into? Best can mean different things to different people based on their investment preferences and risk profile.

In this article, I will provide a more empirical based reason behind why I believe that PZD is the most attractive Clean Energy ETF at the moment. I have based on my analysis of 4 primary factors: liquidity, diversification, recent price action, and last but not least expense ratio.

Liquidity has to be a major consideration in the...

Opportunity Hiding in Plain Sight

Information asymmetry, climate investing and the active management edge.

By Garvin Jabusch

The theory of efficient markets says all stock prices are perpetually accurate, because investors always have complete and up-to-date information about their holdings.

But as any casual observer knows, information and topical awareness are not evenly distributed, even among professional analysts. Reality is always far more complicated than equity markets can quickly assimilate, meaning information asymmetry is a constant. While usually considered a type of market failure, information asymmetry is frequently used as a “source of competitive advantage.” The person with the most information is best equipped to make the best...

List of Electric Vehicle and Plug-In Hybrid Electric Vehicle Stocks

Electric Vehicle (EV) and Plug-in Electric Vehicle (PHEV) stocks are publicly traded companies which produce EVs or PHEVs, their components, or charging infrastructure.

This list was last updated on 6/3/22.

AeroVironment, Inc. (AVAV)

Blink Charging Co. (BLNK)

BYD Company, Ltd. (BYDDY)

Enova Systems, Inc. (ENVS)

EEStor Corporation (ZNNMF)

Electrameccanica Vehicles Corp. (SOLO)

Envision Solar International (EVSI)

EVgo, Inc. (EVGO)

Fisker (FSR)

GreenPower Motor Co. (GPV.V)

iShares Self-Driving EV and Tech ETF (IDRV)

Kandi Technologies Corp. (KNDI)

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS)

Leo Motors (LEOM)

Lordstown Motors Corp. (RIDE)

Navitas Semiconductor Corporation (NVTS)

Nio Inc. (NIO)

Nikola Corporation (NKLA)

Proterra Inc. (PTRA)

Tesla Motors, Inc. (TSLA)

UQM Technologies (UQM)

Valeo SA (FR.PA, VLEEF, VLEEY)

Vision Marine Technologies Inc. (VMAR)

VMoto Limited...

Biofuels & Biobased Earnings Roundup: Gevo

by Jim Lane

The Top Line. In Colorado, Gevo (GEVO) reported Q2 revenues of $9.4 million compared with $7.5 million in the same period in 2017. During the second quarter of 2018, revenues derived at the Luverne Facility related to ethanol sales and related products were $8.8 million, an increase of approximately $2.0 million from the same period in 2017. This was primarily a result of increased ethanol production and distiller grain prices in the second quarter of 2018 versus the same period in 2017. Non-GAAP cash EBITDA loss in the three months ended June 30, 2018 was $2.6 million, compared...

Biofuels & Biobased Earnings Roundup: Aemetis

by Jim Lane

The Top Line. In California, Aemetis (AMTX) reported that Q2 revenues increased $4.3 million and gross margins increased by $1.1 million compared to the second quarter of 2017. Similarly, during the first half of 2018, revenues increased $15.7 million and gross margins increased by $3.5 million compared to the first half of 2017.

Revenues were $45.0 million for the second quarter of 2018 compared to $40.8 million for the second quarter of 2017, driven by an increase in ethanol sales volumes from 15.6 million gallons to 16.4 million gallons and by stronger wet distillers grain and glycerin demand and pricing.

Operating loss...

Biofuels & Biobased Earnings Roundup: Amyris

by Jim Lane

The Top Line. In California, Amyris (AMRS) reported Q2 GAAP revenue for the second quarter of 2018 of $24.8 million, compared with $25.7 million for the second quarter of 2017. Grants and collaborations revenue was $11.4 million for the second quarter of 2018 compared with $10.3 million for the year-ago period. The company noted that Q2 revenue was $24.8 million compared with the same period in 2017 of $21.7 million when adjusted for the low margin product sales on contracts assigned to DSM (DSM.AS). This reflects 15% growth on an absolute basis. GAAP net loss for the first half was $89.1...

Biofuels & Biobased Earnings Roundup: Novozymes

by Jim Lane

The Top Line. In Denmark, Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) reported 4% organic sales growth for the first half and a 5 percent jump in Q2 with bioenergy reporting a 14% jump. Overall, net profit grew 5% and the company affirmed its 2018 guidance. Sales dipped to DKK 7,018m from DKK 7,278m, and EBITDA was flat at DKK 2,464m, although we primarily attribute that to currency shifts.

The Big Highlights. Growth in Food & Beverages and Agriculture & Feed; Bioenergy particularly strong. Good ramp-up of recent product launches. +7% organic sales growth in emerging markets; Freshness & hygiene platform in Household Care developing according to...

Biofuels & Biobased Earnings Roundup: Corbion

by Jim Lane

The Top Line. In the Netherlands, Corbion (CRBN.AS; CSNVY) reported H1 2018 sales of € 439.2 million, a decrease of 4.9% compared to H1 2017, entirely due to negative currency effects. Organic sales growth was 3.1%. EBITDA excluding one-off items in H1 2018 decreased by 19.0% to € 71.5 million due to negative currency effects and the inclusion of the Algae Ingredients business. Organic EBITDA excluding one-off items increased by 1.2% in H1 2018.

The Big Highlights. The acquisition of the Algae Ingredients business (TerraVia assets + SB Renewable Oils joint venture) has added an algae fermentation platform to Corbion. In H1 2018,...

Biofuels & Biobased Earnings Roundup: DSM

by Jim Lane

The Top Line. In the Netherlands, Royal DSM (Amsterdam: DSM.AS; US OTC:KDSKF; US ADR:RDSMY) reported a good H1 with organic sales growth in underlying business estimated at 10% and adjusted EBITDA growth of underlying business estimated at 7%, with sales of €4,794 million and adjusted EBITDA of €771 million.

The Big Highlights. Nutrition: an estimated 8% underlying organic sales growth and Adjusted EBITDA growth of underlying business estimated at 6%. Materials: 7% organic sales growth and Adjusted EBITDA growth of 5%. DSM also confirmed its full year outlook 2018, as provided at Q1 2018, and expects an Adjusted EBITDA growth towards...

Richard Rhodes, “Energy: A Human History”

Richard Rhodes has written an amazing book. He aspired to tell the tales of energy transitions over the past 400 years. His Energy: A Human History accomplishes that task.

The book is daunting in size for non-required reading. It is filled with brief stories of this or that device or discovery or development, and almost overwhelming in both scope and detail. I wondered, at times, when the payoff would come.

My advice: If you are at all interested in the topic, stick with it.

To my economics-trained mind the book lacks analytical structure. One story after another, linked together by fuel source or technology, layer...

List of Synthetic Fuel and Drop-in Biofuel Stocks

Synthetic fuel stocks are publicly traded companies creating transportation fuel from non-liquid feedstocks such as natural gas, coal, and municipal waste. Drop-in biofuel stocks are publicly traded companies creating transportation fuel from organic feedstock that can be used, transported, and stored by conventional petrofuel infrastructure. A synthetic fuel is a biofuel if it is made from organic feedstock. It is a drop-in fuel if it is compatible with the existing infrastructure for petroleum based fuels.

This post was last updated on 7/20/2022.

Amyris (AMRS)

Archaea Energy, Inc. (LFG)

BioAmber (BIOA)

Codexis (CDXS)

Darling Ingredients (DAR)

Gevo (GEVO)

Global Bioenergies (ALGBE.NX)

Neste, Inc. (NEF.F, NESTE.HE, NTOIF, NTOIY)

N-Viro International Corp. (NVIC)

Sasol Ltd. (SSL)

Velocys, PLC (VLS.L)

If...