See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

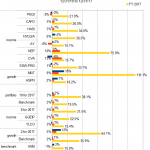

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

Ten Clean Energy Stocks For 2018

Tom Konrad Ph.D., CFA

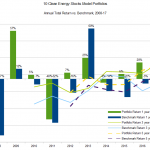

Ten Years of "10 Clean Energy Stocks." A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don't know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was...

A Decade Of Unexpected Curves In The Bioeconomy

By Jim Lane

Over the years we’ve all seen a lot of curveballs in the advanced bioeconomy. You see companies like Valero, which lobby the United States Congress with unbridled intensity to get rid of the Renewable Fuel Standard, on the verge of becoming the single-biggest producer of RINs in the United States (with news that they might take capacity at Diamond Green Diesel up to 540 million gallons).

You see companies like Solazyme which love the Renewable Fuel Standard and drive up to nearly a billion-dollar post-IPO valuation based on delivering fuels at volume, then announcing that there are even...

Ten Clean Energy Stocks For 2017: Taking Profits

By Tom Konrad Ph.D., CFA

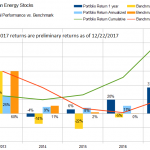

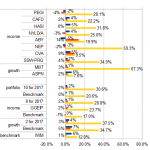

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year's list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model...

10 Clean Energy Stocks For 2018 Preview

Like last year, I will be offering paying readers a preview of my Ten Clean Energy Stocks for 2018 list. I plan to publish the final article after market close on January 1st. If you would like to see a draft version mailed on December 29th (a full trading day before the final publication) please PayPal $10 to me at with a note that it's for the 10 for 2018 preview. The draft will contain the full list, but may not have a complete stock discussion for each stock. I plan to finish the article over the next couple days.

Note...

Vulnerable Solar Markets and What Makes Them Tick

by Paula Mints

All industries and the companies that populate them are vulnerable to macro and micro economic shocks, substitutes, changing tastes and other economic, political and social events.

The global solar industry is vulnerable for all-of-the-above reasons and as it is incentive, subsidy and mandate driven while trying to unseat the conventional energy status quo, it is particularly vulnerable. The solar landscape remains low margin and requires government intervention of some type to thrive.

It is correct to say that the global solar remains primarily policy driven, but this statement does not go descriptively far enough. Many deny that solar deployment still requires incentives, mandates and/or subsidies...

Green Plains to Adopt Syngenta’s Enogen Corn Ethanol Tech Across Fleet

by Jim LaneGood news arrives from Minnesota that Syngenta has partnered with Green Plains (GPRE) to expand its use of Enogen corn enzyme technology across GPRE’s 1.5 billion gallon production platform.

The Enogen backstory

Enogen corn enzyme technology is an in-seed innovation available exclusively from Syngenta and features the first biotech corn output trait designed specifically to enhance ethanol production. Using modern biotechnology to deliver best-in-class alpha amylase enzyme directly in the grain, Enogen corn eliminates the need to add liquid alpha amylase and creates a win-win-win scenario by adding value for ethanol plants, corn growers and rural communities.

We reported in January that Syngenta had reached...

Five Last Minute Gifts For The Environmental Anti-Materialist

What do you get for the person who hates stuff?

My family has this problem every year. As a somewhat rabid environmentalist, I think of stuff as part of the problem. I'm not a big fan of clutter, either. So I always have mixed feelings when I receive gifts. No matter how useful, I can't help but thinking about all the resources that were used to make it. Not to mention wondering where I'm going to put it.

You may have someone in your family who feels the same way, for whatever reason. Here are five of the best gifts I've...

The Price Of Ocean Power

by Debra Fiakas CFA

For Ocean Power Technologies (OPTT: Nasdaq) the sea is more a utility than Whitman’s source of romantic miracles. The company has developed a wave turbine to capture the energy in ocean waves and turn it into electrical power. Last month the company was successful in convincing investors of the merits of its ‘ocean utility’ technology, raising $8.2 million through the sale of common stock.

Branded as the ‘PowerBuoy’, Ocean Power’s product line is headed by its PB3system that has the capacity to generate up to three kilowatts of peak power. An onboard power storage system has the capacity to store up...

EPA’s 2018 Renewable Fuel Targets Disappoint Producers

In Washington, the Environmental Protection Agency released its final Renewable Fuel Standard renewable volume obligations for 2018. The agency finalized a total renewable fuel volume of 19.29 billion gallons , of which 4.29 BG is advanced biofuel, including 288 million gallons of cellulosic biofuel.

As the Renewable Fuels Association explained: “That leaves a 15 BG requirement for conventional renewable fuels like corn ethanol, consistent with the levels envisioned by Congress in the 2007 Energy Independence and Security Act. The 2018 total RFS volume finalized today represents a minor increase (10 million gallons) over the 2017 standards, and a modest increase...

Companies Helping New York Take the Lead in Offshore Wind

by Debra Fiakas

The Lieutenant Governor of New York, Linda Hochul, has predicted that the state will be a world leader in off-shore wind power - a bold assertion for a state that still derives three-quarters of its electric power from fossil fuels. Natural gas has become the most important fossil fuel source. Yet in 2016, for the first time, over one million megawatt hours of electricity were sources from solar power and 24% of electricity is generated by renewable sources. This is remarkable given that just a few years ago even that accomplishment was given very low odds. There...

Energy Destiny? Try Energy Density

By Jim Lane

ARPA-E has been working hard on feedstock diversity — so much so that we kid them about changing their name to ARPA-Agriculture — yes, from time to time they work on fuels, but not so much on energy density.

Too bad — because a moonshot-oriented mission aimed at transforming energy density sets up really well for revolutionizing the way we do lots of things. Like moonshots. And other ways we use transport fuels, all of us back here on the good Earth.

Density matters, that’s how we see it. Super-dense fuels are superfuels and they have a real place in our economy...

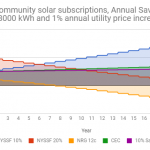

Buyer’s Guide To Community Solar in New York

by Tom Konrad Ph.D., CFA

An updated version of this article is available here.

After a painfully long wait, community solar (also called shared solar) is finally coming to New York state. After years of regulatory uncertainty, the state Public Services Commission (PSC) has put enough of the enabling regulations in place for a number of developers to move forward.

What is Community Solar?

A community solar installation is a large scale (typically 1 to 3 MW, or the size of about 150 to 800 residential solar installations) in which subscribers can sign up to lease or purchase a share of the production...

Second Largest Quarter For Green Bonds Ever

Third quarter reflects strong growth and new market entrants

Overview

The green bond market has kept its strong pace in Quarter 3 2017, reaching a total of USD27.7bn from July to September.

On September 28th, the total amount of green bonds issued in 2017 ytd (USD83.2bn) overtook last year’s total issuance of USD81.6bn.

We covered the big moment in our Blog Post here.

Lots of new issuers

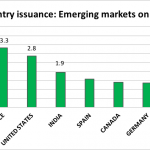

The top sources of issuance were:

Mexico - USD4bn

China - USD3.9bn

France - USD3.3bn

U.S. - USD2.8bn

India - USD1.9bn

Mexico was a surprising addition to the number one spot, after issuing no green bonds in Q1 or Q2 this year.

Big...

Renewable Fuel Producers Score A Win

Despite Trump’s vow to roll back all measures endorsed by Obama, his Environmental Protection Agency head Scott Pruitt is backing off plans to scuttle the U.S. biofuel policy. The Trump administration had planned to change regulatory standards to reduce the amount of renewable fuel that must be blended with conventional fossil fuel for gasoline and diesel supplies. In the third week in October 2017, Pruitt sent a letter to Congressional leadership indicating the renewable fuel volume mandates for 2018 would remain unchanged.

Most analysts saw the about face as a win for ethanol and renewable diesel producers such as Green Plains (GPRE: Nasdaq), FutureFuel...

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...