DowDuPont To Exit Cellulosic Biofuels

by Jim Lane

In Delaware, DowDuPont (DWDP) announced that it intends to sell its cellulosic biofuels business and its first commercial project, a 30 million gallon per year cellulosic ethanol plant in Nevada, Iowa. The Nevada project is still going through start-up.

In an official statement, the company said:

As part of DowDuPont’s intent to create a leading Specialty Products Company, we are making a strategic shift in how we participate in the cellulosic biofuels market. While we still believe in the future of cellulosic biofuels we have concluded it is in our long-term interest to find a strategic buyer for our...

Solar Trade Case Analysis and Implications

by Paula Mints

In terms of the current trade petition and the USITC decision, government interference will not correct an imbalance that is embedded in the industry (globally) particularly when it is put in place by a body that does not understand the nuances of the problem. Despite evidence to the contrary, attorneys and consultants for Suniva/SolarWorld seem to have convinced the USITC that cell manufacturing in the US can be resuscitated and that tariffs and quotas the mechanism that will stimulate manufacturing. In reality, this situation is stimulating uncertainty and doing harm.

Table 1: Tariff Recommendations

...

How Energy Deregulation Affects States and Stocks

by Elaine Thompson

Bloomberg New Energy Finance, in an executive summary of its New Energy Outlook 2017 report, predicts renewable energy sources will represent almost three-quarters of the $10.2 trillion the world will invest in new power-generating technology.

Analysts outline several reasons for this increase in spending, such as the decreasing costs of wind and solar and consumers’ increasing interest in solar panels. Competition between power sources also continues to grow, with products like utility-scale batteries upsetting coal and natural gas’s roles in the marketplace.

But more importantly, state-driven renewable portfolio standards pave the way for additional ventures in renewable energy technologies, particularly...

Renewable Fuels’ Dunkirk

by Jim Lane

It’s been a very busy week in Washington DC, the high point being a letter to seven senators sent late Thursday by EPA Administrator Scott Pruitt, who took significant (and as of a few days ago, unexpected) steps toward strengthening the foundation for ethanol and renewable fuels.

The truth? It’s a Trump Administration back-down. EPA overreached on de-clawing the Renewable Fuel Standard on behalf on some grumpy oilpatch donors (known as GODs), and the Trump Administration managed to revive a Grand Alliance around renewable fuels — one that now includes almost 40 members of the United States Senate,...

Gevo and Los Alamos To Collaborate on High Energy Denisity Biofuels

by Jim Lane

News has emerged from Gevo (GEVO) in Colorado and New Mexico’s Los Alamos National Lab that the two will collaborate to improve the energy density of Gevo hydrocarbon products to meet product specifications for tactical fuels for specialized military applications such as RJ-4, RJ-6 and JP-10, which are currently purchased by the US Department of Defense (DoD).

High energy-density fuels are currently used in air and sea-launched cruise missiles used by the US military forces. If this project is successful in scaling the fuels cost-effectively, there may be an even broader application in the general aviation sector, enabling higher energy density jet...

Brookfield’s Yieldco Buying Spree

by Tom Konrad Ph.D., CFA

Last week, a Bloomberg reported on a rumor that Brookfield Asset Management (BAM) was in talks to buy Abengoa's (ABGOY) stake in its former YieldCo Atlantica Yield (ABY). Atlantica had been looking for a new sponsor for well over a year since parent Abengoa filed for bankruptcy.

Purchasing Yieldcos (companies that own clean energy infrastructure and use the cash flows to pay large dividends to shareholders) is not new to Brookfield. Not only has BAM long sponsored Brookfield Renewable Partners, LP (BEP), a limited partnership that has essentially been a Yieldco since before the term was...

Water Out Of Thin Air

It is an irony that surrounded by the flood waters of Hurricanes Harvey and Irma, a drink of fresh, clean water may be hard to come by. Of course, the all three levels of government make plans for stockpiling and deploying emergency bottled water well ahead of natural disasters. Yet in the hours and days following the worst of both the recent storms, the media was filled with stories of people who lacked water.

What if water could be made manufactured? If such a technology existed, what a boon it might be to thirsty storm victims.

Ambient Water Corporation (AWGI: OTC/PK) has...

OriginClear: Metals out of the Muck

After the worst of the wind and rain had died down from Hurricanes Harvey and Irma, and people began making their way back home, it became apparent that citizens of Texas and Florida would have more worries. The U.S. Environmental Protection Agency disclosed that at least thirteen toxic waste sites in Texas were flooded and damaged by Hurricane Harvey and another forty-one Superfund sites were negatively affected. Legacy contamination includes lead, arsenic, polychlorinated biphenyls, benzene and other carcinogenic compounds from historic industrial processes. After Hurricane Irma over six million gallons of wastewater reportedly flowed out to the coast and...

Ethanol Blends: High Octane, Low Carbon, High Controversy

by Jim Lane, Biofuels Digest

For every ethanol blend everywhere these days, there seems to be a war on.

A war in India over 22% blends. A war in Brazil over exactly what baseline blend ratio (somewhere int he 20s) is ideal. A war on in Europe to roll back first-gen ethanol to around 2% blending. A war in New South Wales, Australia over whether there should be any ethanol mandating at all. A war in the US as conservatives aim to haul belnding down to 9.7% while ethanol producers have clearly aimed at a 15% baseline blend.

And so on and...

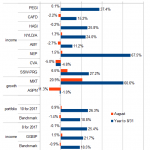

Ten Clean Energy Stocks For 2017: Sunny August Skies

by Tom Konrad Ph.D., CFA

After a strong performance all year, the stock market stumbled in August, along with clean energy stocks in general, although the sector continues to outperform the broad market. My Ten Clean Energy Stocks model portfolio again came out on top, buoyed by two winners (Seaspan Preferred (SSW-PRG) and MiX Telematics (MIXT). Both were catalyzed by strong earnings reports at the start of August, which I summarized last month.

For the month of August, the model portfolio was up 0.9%, for a 26.3% total gain for the year to the end of August. It's clean energy benchmark...

Tesla’s Buffalo Solar Tiles: As Hot As They Seem?

by Paula Mints

In August, Tesla (TSLA) announced that production of its roof tiles at its not-yet-a giga-factory in Buffalo New York would be delayed until late in 2017. Wait ... it is late in 2017. Tesla indicated that production on the tiles was continuing at its 25-MWp pilot scale facility in Fremont, California. The Fremont facility was the former home of the dearly departed Silevo. On August 31 Tesla announced that it was now manufacturing solar cells at its facility in Buffalo and indicated it would have 2-GWp of cell capacity eventually. During Tesla’s earnings call Mr. Musk showed pictures...

Green Bonds Mid-Year Summary 2017

by the Climate Bonds Team

Climate Bonds looks at the last six months numbers, the trends and our tips for the rest of 2017

Green Bonds Mid-Year Summary 2017

Headline figures for the Half Year (H1)

2017 issuance to H1: USD55.8bn

Records broken: Quarter 2 (Q2) is the largest quarter of issuance on record at almost USD30bn

82 green bond deals issued in the quarter from 74 issuers

Over 50% of issuers were first time issuers

Green Bond transactions accounted for 3% of global bond market transactions in Q2 2017

Top 5 largest issuers of H1:

Republic of France (USD7.6bn),

EIB (USD2.8bn),

...

Giant Appeals Court Victory For Biofuels

Jim Lane

As DuPont’s (DD) Jan Koninckx put it in his understated way, July 28th was “a good day for biofuels.”

But it was the biggest victory in the courts for biofuels, ever.

Specifically, the U.S. Court of Appeals for the District of Columbia Circuit ruled in favor of Americans for Clean Energy and other renewable fuels advocates, agreeing with the petitioners that the Environmental Protection Agency erred in how it interpreted and used the “inadequate domestic supply” waiver in the Renewable Fuel Standard law in setting low renewable fuel volumes for 2014-2016.

In Americans for Clean Energy et al v. Environmental Protection...

Tetra Tech’s Two-Penny Disappointment

by Debra Fiakas, CFA

Tetra Tech’s (TTEK: NASDAQ) quarter earnings report last week was met with high drama as traders reacted with surprisingly vehement disappointment over the recent financial performance of the engineering and technology business. The company’s stock price gapped down in the first day of trading following the announcement, falling through a significant line of price support. The shares continued to fall and finished the week at a price not seen since mid-April 2017 before the stock began its recent drive higher.

The drama unfolded after Tetra Tech reported net earnings of $0.52 per share on $498 million in total...

Can Investors Recover Faith In Energy Recovery?

by Debra Fiakas CFA

Despite reporting the highest gross profit margin in Energy Recovery's (ERII: Nasdaq) history, investors were sorely disappointed with financial results in the Company’s second quarter ending June 2017. On the first day of trading following the earnings release the share price gapped downward and closed even lower under above average trading volume. This is likely because there was some expectation that Energy Recovery could finally report a net profit in the quarter as sales of the Company’s flagship PX Pressure Exchanger to the desalination market had appeared to pick up in recent months. Unfortunately the Company reported...

Ten Clean Energy Stocks For 2017: Summer Harvest

Tom Konrad Ph.D., CFA

Colossal Fossil Failure

With a president actively hostile towards renewable energy and focused on promoting fossil fuels, it would be easy to think that clean energy stocks would underperform their fossil cousins. The exact opposite has been true. Despite the administrations' efforts and tweets bragging about new highs for the Dow, energy funds are down over 10% for the year. For example, the Energy Select Sector SPDR (XLE), largely composed of oil and gas companies, is down 13% for the year. The tiny coal sector did better, with the VanEck Vectors Coal ETF up 18%.

Even so, Trump's...