yieldco - search results

If you're not happy with the results, please do another search

10 Clean Energy Stocks for 2021: November. Notes on MIXT, GPP, EVA

By Tom Konrad, Ph.D., CFA

Monthly Performance

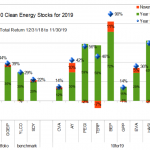

Returns for the Ten Clean Energy Stocks for 2021 model portfolio are shown below. It was a good month for clean energy stocks as well as the broader stock market, with the portfolio up 4% for a 20% total return through the end of October. Its clean energy benchmark (RNRG) was up more (8%) but is still down 6% for the year. Its broad market benchmark (SDY) rose 5% and has caught up with the model portfolio at a 20% return year to date.

Earnings

Third quarter earnings season has started. Below are some notes I’ve...

10 Clean Energy Stocks Updates: Green Plains Partners Refi; Covanta Buyout

By Tom Konrad, Ph.D., CFA

Second quarter earnings season is in full swing. Below are a couple updates and the monthly performance chart that I recently shared with my Patreon supporters.

Green Plains Partners Earnings and Future Dividend

(published August 2nd)

Ethanol Master Limited Partnership Green Plains Partners (GPP) declared second quarter earnings today. The main news remains the long anticipated debt refinancing and new dividend guidance going forward.

At the end of the first quarter, I predicted that, after debt refinancing, GPP would increase its quarterly dividend to something in the $0.25 to $0.30 range.

The new guidance is for the partnership to target...

Buying Innergex – Texas Was Bad, But Not That Bad

By Tom Konrad, Ph.D., CFA

Last week, I published this call to buy Innergex (INGXF, INE.TO) because investors had been overreacting to the losses from the February cold snap in Texas. The stock is up since then, but still seems a decent value.

Canadian Yieldco Innergex Renewable Energy (INGXF, INE.TO) took a big financial hit from the power disruptions in Texas in March.

It's complex, but their financial hedges on power prices for three of its wind farms ended up creating enormous liabilities - more, in fact, than two of their wind farms are worth. Two of their facilities also had benefits...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

Pop Goes the Clean Energy Stock Bubble

by Tom Konrad, Ph.D., CFA

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority...

Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...

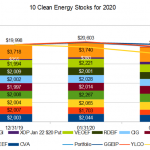

Year in Review: 10 Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

Looking Back

At the end of 2019, I was worried about overvaluation.

I wrote that my main goal for the 10 Clean Energy Stocks for 2020 list was “to find stocks which will be resilient in the event of a US bear market.” We certainly had a bear market in 2020, although it was nothing like the kind of bear market I had been anticipating. The bear market was precipitated by the coronavirus pandemic, rather than overvaluation.

While I can claim to have anticipated the 2020 bear market, if not its nature, I was surprised by two other...

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

10 Clean Energy Stocks for 2020: The Waiting

by Tom Konrad, Ph.D., CFA

Despite high valuations, a rampaging pandemic, and the end of the $600 weekly supplemental unemployment payments from the CARES Act, the stock market continued upward in August.

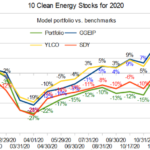

Like most ordinary people in this economy, my Ten Clean Energy Stocks model portfolio is still not feeling the recovery the way the big tech companies and the ultra wealthy are, although my real-money Green Global Equity Income Portfolio (GGEIP) is now hitting new highs for the year.

The difference between the model portfolio’s performance and GGEIP is mostly a result of trading: It had a large cash position at...

Ten Clean Energy Stocks for 2020: Trades

by Tom Konrad Ph.D., CFA

Four weeks ago, I predicted that the 12% market correction we had seen would turn into a true bear market. Bear markets are often defined as a decline of more than 20% for the major market indexes, but I find it more useful to focus on long term changes in investor sentiment.

What I did not predict was just how severe the effect of the coronovirus shutdown would be on the economy. I thought we would need the combined of the effect of the shutdown and investors re-assessing their risk tolerance to bring us into full...

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

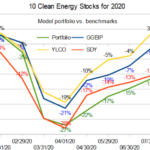

You can see overall performance for January and February in the following chart. Not that...

Should Pattern Energy Shareholders Vote Against the Merger?

by Tom Konrad Ph.D., CFA

This morning, hedge fund Water Island Capital called on Pattern Energy (PEGI) Shareholders to vote against the merger with the Canada Pension Plan Investment Board (CPPIB).

Water Island claims the merger is undervalued compared to the recently surging prices of other Yieldcos, and that PEGI would be trading at over $30 given current valuations. There are not a lot of other Yieldcos left, especially if we eliminate those with their own special circumstances. These are Terraform Power (TERP) which is subject to its own buyout agreement with Brookfield Renewable Energy (BEP), and Clearway (CWEN and CWEN/A) where...

Ten Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

If it's tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

I've been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year's returns were also achieved in the context of full- to over-valuation of most of the clean energy...

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

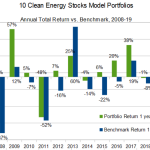

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...