Elevance’s $100M IPO: The 10-Minute Version

Jim Lane Like to quickly understand the surge in renewable chemicals and one of the hottest companies in the hottest sector of the bioconomy? Here’s our 10-minute version of the IPO from Elevance Renewable Sciences. Complete with the risks, translated into English from the original SEC-speak. In Illinois, Elevance Renewable Sciences filed its S-1 registration statement relating to a proposed $100 million initial public offering. The number of shares to be offered and the price range for the offering have not yet been determined. The company indicated that it has apply to list the stock on NASDAQ under the ERSI symbol. The...

BioAmber Sets Price Range for IPO

Jim Lane 8 million share offering at $15-$17 aims to raise $128 million. “We are selling 8,000,000 shares of common stock,” begins BioAmber’s latest SEC update, written in IPO-legalese. “The initial public offering price of our common stock is expected to be between $15.00 and $17.00 per share, which is the equivalent of €11.48 and €13.01 per share, based on an assumed Bloomberg BFIX Rate for USDEUR at the pricing of this offering. If completed, it would be the first successful IPO in the sector since Ceres (CERE) and Renewable Energy Group (REGI)...

Mitsui Raises Stake In BioAmber JV

Jim Lane In Canada, Mitsui has invested an additional CDN$25 million in the BioAmber (BIOA) joint venture for 10% of the equity, increasing its stake from 30% to 40%. Mitsui will also play a stronger role in the commercialization of bio-succinic acid produced in Sarnia, providing dedicated resources alongside BioAmber’s commercial team. BioAmber will maintain a 60% controlling stake in the joint venture. “Mitsui is continuously committed to renewable chemistry and through our increased equity stake we will be more actively involved in joint venture management and sales, leveraging our global sales platforms,” said Hidebumi Kasuga, General Manager, Specialty...

Bion: Waste To Dollars

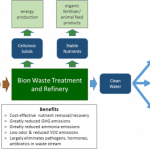

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Novozymes Ignites Yeast Wars

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) moved into yeast this week with a new organism, Innova Drive.

It’s saccharomyces cerevisae — the workhouse yeast that has been powering wine fermentation since the days of Noah and the Ark. But here’s a new strain engineered to cut fermentation times up to two hours, and yield boosts of up to two percent.

A 2% yield increase and a 5% faster rate of production — let’s illustrate it — would mean something like 7.1 million gallons per year of more ethanol from the same standard 100 million gallon nameplate plant. Retailing at up to $10 million dollars, per year (yes,...

The “Jesus” Molecule: Paraxylene

Jim Lane The Coca-Cola Company invests in Gevo, Virent and Avantium partnerships, in the race to develop renewable plastic bottling entirely from renewables. There’s been an awful lot of press this week about progress in the search for the God particle. That’s the subatomic Higgs Boson a key, but as yet undetected, anchor in the standard model of the universe. Then there’s the Jesus molecule. As in, “Kind lord Jesus in Heaven, grant me an affordable way to make one of those.” It’s renewable PX, also known as your friend, paraxylene a key, but as...

From Fuel To Fudge

by Debra Fiakas CFA This week the last reminder of the renewable fuels business that was once called Solazyme will be gone. The old Solazyme has abandoned the goal of producing renewable fuels using the oils from algae. Instead, under a new name TerraVia, the company is directing its algae cultivation and harvesting knowhow toward growing edible algae for food and personal care products. To make the change complete the old stock symbol ‘SYZM’ gives way this week to a new trading symbol ‘TVIA.’ No doubt there is more than just a little hope in Terra...

Interview With Dan Oh, CEO Of Renewable Energy Group

Jim Lane Leading a series this week, “The Strategics Speak", in which we’ll look at what a number of major strategic investors see in the landscape relating to industrial, energy and agricultural investment, Biofuels Digest visited with Dan Oh, CEO of Renewable Energy Group (REGI), which has long been the US’s leading independent biodiesel producer but in recent years has steadily diversified and expanded operations. In many ways, REG is the entire industrial biotech business in a nutshelll. They’re fermentation (through REG Life Sciences), and thermocatalytic (through REG Geismar and their extensive biodiesel business). They use both...

Solazyme Launches Biodegradable Encapsulated Lubricant For Drilling Market

Jim Lane Enters oil & gas drilling market with world’s first encapsulated lubricant. Solazyme: “Targeted delivery technology provides improved performance and sustainability.” In California, Solazyme (SZYM) announced its entry into the oil and gas drilling fluids additive market. Building upon its proprietary platform of high performance, sustainable Tailored oils, Solazyme has introduced Encapso, the world’s first encapsulated biodegradable lubricant for drilling fluids designed to deliver high-grade lubricant precisely at the point of friction where and when needed most. At the same time, the company announced its intent to offer $100M in aggregate principal notes due in 2019 and...

Leather Without The Cow

Flokser launches Artificial Leather based on DuPont Tate & Lyle, BioAmber ingredients Jim Lane In Canada, BioAmber (BIOA) announced that the Flokser Group has successfully developed an innovative artificial leather fabric using bio-based materials supplied by DuPont (DD) Tate & Lyle Bio Products and BioAmber. Flokser has launched this new synthetic leather fabric under its SERTEX brand. The novel fabric comprises a polyester polyol made from BioAmber’s Bio-SA bio-based succinic acid and DuPont Tate & Lyle Bio Products’ Susterra bio-based 1,3-propanediol. Flokser’s artificial leather fabric has 70% renewable content and delivers improved performance. It provides better scratch resistance...

Biofuels & Biobased Earnings Roundup: Corbion

by Jim Lane

The Top Line. In the Netherlands, Corbion (CRBN.AS; CSNVY) reported H1 2018 sales of € 439.2 million, a decrease of 4.9% compared to H1 2017, entirely due to negative currency effects. Organic sales growth was 3.1%. EBITDA excluding one-off items in H1 2018 decreased by 19.0% to € 71.5 million due to negative currency effects and the inclusion of the Algae Ingredients business. Organic EBITDA excluding one-off items increased by 1.2% in H1 2018.

The Big Highlights. The acquisition of the Algae Ingredients business (TerraVia assets + SB Renewable Oils joint venture) has added an algae fermentation platform to Corbion. In H1 2018,...

Solazyme’s Detours on the Way to Algae Biofuel

by Debra Fiakas CFA Investors who took the time to read my last two posts on algae-based biofuel – “Algae Takes Flight” and “Emission Standards Driving Aviation Fuel Sourcing” - might have wondered why there was no mention of Solazyme, Inc. (SZYM: Nasdaq). California-based Solazyme has been pursuing algae-based oils for transportation since 2004, and managed to record its first product sales in 2011. However, that revenue was not from biofuel. On the long road to finding a scalable and efficient way to get renewable fuel from algae, Solazyme scientists found an interesting extract...

TerraVia: No Going Back

Jim Lane At the outset of his historic Conquest, Cortés gathered the men and burned the boats. As TerraVia jettisons its break-out industrial product line and completes the pivot to Food, what lies ahead in the New World? Gromeko: They’ve shot the Czar. And all his family. Oh, that’s a savage deed. What’s it for? Zhivago: It’s to show there’s no going back. Dr. Zhivago In California, TerraVia (TVIA) recorded a loss of $27.4M for Q2 2016 on revenues of $9.9M as the company made milestone announcements in its transition from industrials to nutrition including...