By Tom Konrad Ph.D., CFA

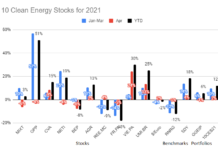

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high yield companies that own and develop clean energy assets like solar and wind farms get most of their profits from things which are already built. New subsidies, like those included in the Inflation Reduction Act, almost exclusively target new facilities. Because of this, changes in subsidies and interest rates will affect a Yieldco’s growth prospects, but will have limited effect on its short term earning potential.

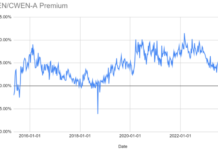

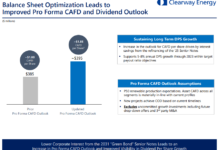

Yieldcos such as Brookfield Renewable Energy (BEP and BEPC), Atlantica Yield (AY), Clearway (CWEN and CWEN-A), and Nextera Energy Partners (NEP) fell as much as 50% in 2023. At current prices, I love them all. Collectively, these four names account for a fifth of the portfolio. My current favorite is Nextera Energy Partners, which I have historically felt was consistently relatively overvalued because investors have had faith in its strong sponsor, Nexterea (NEE). That valuation did not survive the effects when persistently high interest rates led NEP to sharply cut its dividend growth targets last September.

Among the Yieldcos, NEP got the least benefit of the strong rally in the fourth quarter, and it is still trading at a price that gives it an 11% dividend yield. That high a yield would normally signal that investors are expecting a dividend cut. I think such a cut is unlikely. First, NEP’s liquidity and cash flow ratios are in line with other Yieldcos, and if management felt that a dividend cut might be necessary in the near future, they would have done it when they were already disappointing investors by slashing their dividend growth plans. Instead, I expect NEP’s dividend growth to stall for several years. But at 11%, who needs growth?

Among the Yieldcos, NEP got the least benefit of the strong rally in the fourth quarter, and it is still trading at a price that gives it an 11% dividend yield. That high a yield would normally signal that investors are expecting a dividend cut. I think such a cut is unlikely. First, NEP’s liquidity and cash flow ratios are in line with other Yieldcos, and if management felt that a dividend cut might be necessary in the near future, they would have done it when they were already disappointing investors by slashing their dividend growth plans. Instead, I expect NEP’s dividend growth to stall for several years. But at 11%, who needs growth?

Another likely scenario would be for NEE to buy back the outstanding shares of NEP to improve its own cash flow ratios. This is far from unprecedented – Transalta (TA) did exactly that last year by buying back the outstanding shares of TransAlta Renewables (Toronto: RNW). NEE, like TA, would buy NEP at a 10-20% premium to current prices. NEP has significant convertible debt financing, much of which will need to be refinanced in 2026. If NEP has trouble refinancing this convertible debt, I expect the most likely scenario will be a buyback by it parent, NEP. I’d prefer to collect an 11% dividend for several years to come, but a small short term gain is not something to scoff at.

DISCLOSURE: As of 1/15/2024, Tom Konrad and funds he manages own the following securities mentioned in this article: Brookfield Renewable Energy, Atlantica Yield, Clearway, Nextera Energy Partners. He expects to add to (but not sell) some of these positions in January 2024. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. All investments contain risk and may lose value. Past performance is not an indication of future performance. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

ABOUT THE AUTHOR: Tom Konrad, Ph.D., CFA is the Editor of AltEnergyStocks.com (where this article first appeared) and a portfolio manager at Investment Research Partners.

Great article! Some questions:

1. What about other Yieldcos as Hasi? I think Hasi numbers in 23-24 are similar to these 4.

2. I appreciate the allocation tips, that helps a lot. So if you have around 20% on these 4, did you rebalance the portfolio recently to get there?

3. Cadeler, are you just holding or did you take any benefits?

I am far from that 20%, I like your plan, but I need to rebalance first.

Thanks in advance!