By Tom Konrad, Ph.D., CFA

Supply and Demand

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

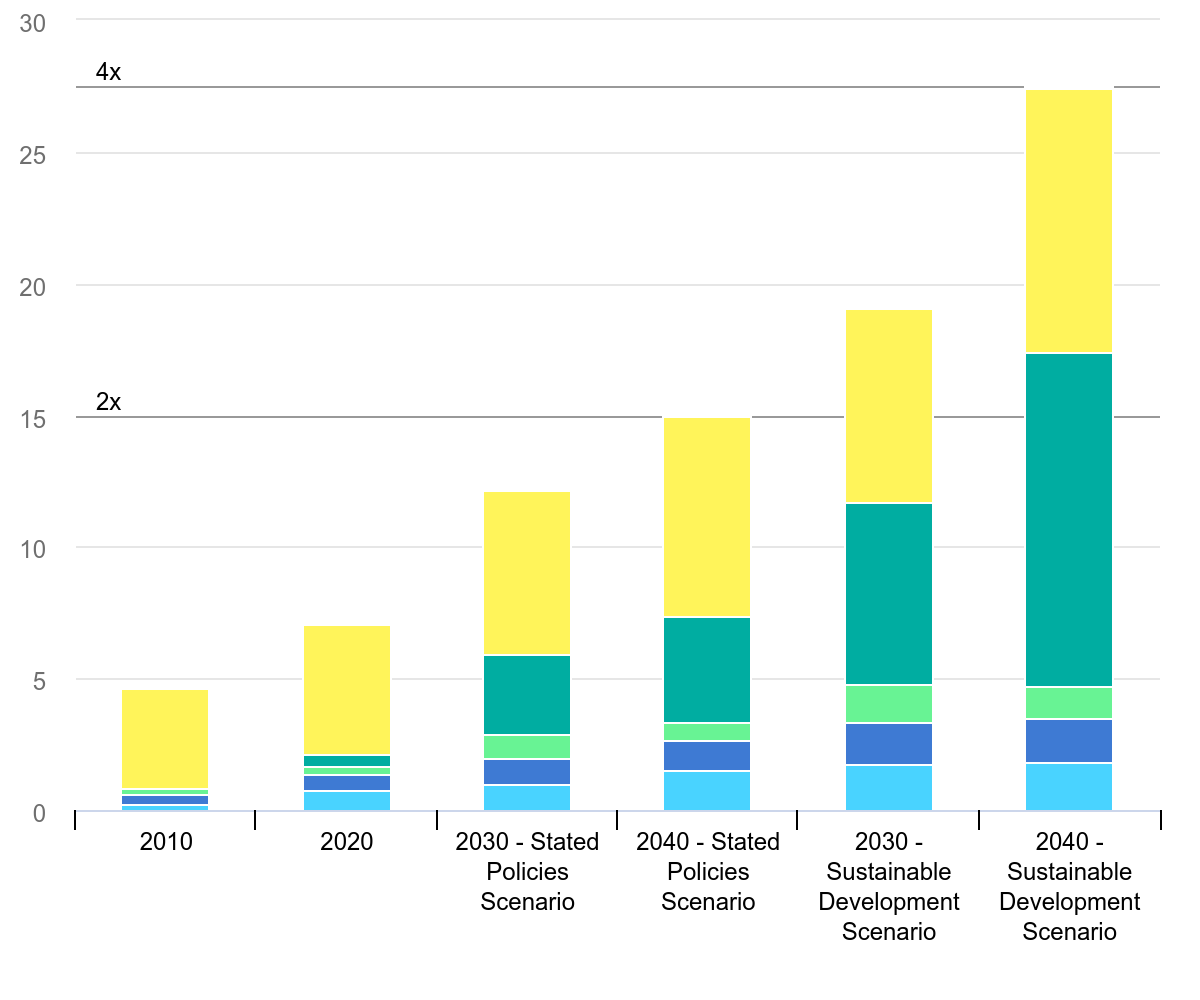

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not something that we can accomplish without paradigm-shifting changes to the mining sector. It’s difficult to imagine a scenario where we construct enough mines to supply all the materials needed to even reach the world’s stated goals for clean energy development, let alone the scale we would need to keep global warming below 1.5℃ or 2℃.

Economics 101 tells us that when demand for anything increases much faster than supply, price will also rise until the two can be balanced again through demand destruction (reduced purchases because it’s too expensive) or increases in supply (companies increasing production), usually both.

Investing 101 tells us this is an opportunity for companies that already supply the commodity or can supply the coming future demand are likely to do well, and we should buy them. The obvious suppliers are existing mining companies. This investing theme was particularly popular two years ago when the expected increase in demand for materials was frequently in the news. This led to a peak in the S&P/TSX Global Mining Index at 133 in April 2022, which has since fallen to 103 as of February 20 (data from spglobal.com).

Little has changed in the long term bullish outlook for commodities in the last two years since the mining index peaked. Except the stock prices, that is. Hence, with the mining index down over 22% at the same time that the broad market has been rising, now seems like an excellent time to invest in companies which seem likely to profit from the coming clean energy minerals boom.

Reduce, Reuse

While I expect that investors in mining companies will do well financially over the next decade, as an environmentally minded investor, mining is one sector I’m simply not willing to invest in. While I believe that there are likely some mining companies that behave as environmentally responsible as possible, I do not have the skills or the inclination to determine which are which.

Environmentalism 101 (Is that a class? If not, it should be.) tells us to reduce, reuse, or recycle before we buy something new. When it comes to these materials, mining is making new. I expect there are good investing opportunities in all three principles. We can reduce the use of the most expensive and rare materials by substituting more common ones. Origami Solar (not a public company) is working on replacing expensive aluminum with cheaper and stronger steel in the frames for solar modules, while Form Energy (also not public) is making batteries with cheap and abundant iron instead of the commonly used (and much more expensive) lithium.

We can also reuse existing infrastructure, such as repurposing the sites and grid connections of old coal plants for energy storage. We can also extend and expand the usefulness of power lines with grid-enhancing technologies like better monitoring and software.

Recycle

As astute readers have noted, most of the examples of reduction and reuse of clean energy materials listed above involve new businesses trying to create new markets. Such opportunities can lead to incredible investment returns, but they also come with a level of risk that I, as a relatively conservative investor, try to avoid. Recycling, however, is an established business that already produces profits. This is the type of investment opportunity I look for: Currently profitable businesses that can profit from the transition to a clean energy economy.

Historically, lithium-ion batteries have not been recycled at all due to the lack of facilities to recycle them. That situation is changing rapidly.

The Inflation Reduction Act’s requirement that electric vehicle batteries is leading to a boom in the construction of battery recycling plants in North America. With all the announcements of new recycling plants, I’ve become concerned that there may not be enough used batteries to go around.

If I’m right that we are likely to soon have more battery recycling plant capacity than we have used batteries that are easy to recycle, then the companies most likely to make a good profit are the companies that already have systems for gathering used batteries in place. In the case of used electric vehicle batteries, that means companies that already have vehicle part recycling and reuse facilities, commonly known as junkyards. Two such companies are Radius Recycling (RDUS – until recently known as Schnitzer Steel) and LKQ Corp (LKQ).

Radius is vertically integrated, using its junkyards as one source of scrap metal for its recycled steel mills. It’s also widely recognized as an environmental leader. Corporate Knights named it the world’s most sustainable company for 2022.

In contrast, LKQ Corporation is a manufacturer of non-OEM replacement car and RV parts as well as running junkyards. I don’t think I’ve ever seen LKQ on a list of sustainable companies, although much of its business is inherently sustainable. Repairing a vehicle is usually a more sustainable option when compared to replacing it. It’s also what I usually call a “boring” business… I like these because I think they are less prone to selling at inflated earnings multiples. That’s certainly the case for LKQ today.

My final recycling holding is Umicore SA (UMI.BR, UMICY). Umicore is a European processor of recycled battery materials and other precious metals. They are a little farther up the value chain, making them relatively more vulnerable to future spikes in the price of used batteries, but I expect that their established relationships, proprietary recycling expertise, and participation in the more mature European battery recycling industry should help them weather increased competition for a limited supply of used batteries.

Conclusion

It’s widely accepted that the clean energy transition will lead to the demand for many industrial commodities growing faster than supply, although many investors have moved on to other themes since the interest in commodities peaked in 2022. That makes it a great time to get in.

Investing in mining companies is an obvious, but environmentally problematic way to profit from coming price increases. Investing in the recycling supply chain may be a less obvious method, but it is much more environmentally sound. Three stocks to consider are Radius Recycling (RDUS), LKQ Corp. (LKQ), and Umicore (UMI.BR, UMICY).

DISCLOSURE: As of 2/21/24, Tom Konrad and accounts he manages own the following securities mentioned in this article: RDUC, LKQ, and UMI.BR. He does not plan to sell any of them in the next two weeks, and may buy more.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. All investments contain risk and may lose value. Past performance is not an indication of future performance. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

ABOUT THE AUTHOR: Tom Konrad, Ph.D., CFA is the Editor of AltEnergyStocks.com (where this article first appeared) and a portfolio manager at Investment Research Partners.