Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...

529 Plans Without The Fossil Fuels

by Tom Konrad Ph.D., CFA

The most popular way we have to save for our children's future education is destroying their future.

A 529 savings plan is a tax-advantaged savings plan designed to help pay for education. There are also prepaid tuition plans set up under the section 529 tax rules, but this article is focused on 529 savings plans, and will be what I mean by “529 plans” for the rest of the article.

The money in 529 plans can be used for college as well as K-12 education, apprenticeship programs, and paying off some student debt. Savings plans grow...

Step By Step Fossil Fuel Divesting With Mutual Funds

by Tom Konrad Ph.D., CFA

A large and growing number of individual investors are showing an interest in divesting from fossil fuels. Where in the past I have been asked to give a talk on divestment once every year or two, I’ve spoken on the subject three times so far in 2020. (Here is a recording of a presentation I did for my college alumni association.)

The response to these talks has been overwhelmingly positive, but I’m left with the impression that a lot of the less financially sophisticated attendees are still not sure where to start. For most of these...

Updates to Clean Energy Mutual Fund and ETF Lists

Thanks an email from a diligent reader, I have just updated our lists of Clean and Alternative Energy Mutual Funds and Clean and Alternative ETFs and Other Exchange Traded Funds. Please follow the links to the updated lists.

Thanks to him and all the readers who help me keep AltEnergyStocks.com stock lists up to date with your comments and emails.

ESG5 Summit brief

A conference hosted in NYC in early April, 2019 ESG5 SUMMIT showcased the issues of current concern to institutional asset managers. ESG as a term is a rebranding of SRI (socially responsible investing) and CSR (corporate social responsibility) now under broad headings of Environment Social & Governance, to reflect that it is more than just an investing style, but is concerned with risk management and value creation. ESG strategies are being pursued by a range of participants, including public and private pension funds, mutual funds and ETFs, family offices and sovereign wealth funds, and advisors and advocacy groups.

The goals are...

Are Aspiration’s Deposits Really Fossil Fuel Free?

Fossil Fuel Free Claims

If you are reading this, you've probably also seen advertisements for Aspriation's “Fee-free and fossil fuel free” banking services. Like the advertisements the company's product page encourages visitors to “Earn high interest on what you save with an account that is fee-free and fossil fuel free.“

As a professional green money manager, I know that “fossil fuel free” is in the eye of the beholder. For many mutual funds, “fossil fuel free” simply means avoiding the 200 largest fossil fuel companies, but investing in the 201st largest fossil fuel company, even if its primary business is mining...

Screening For the Best Clean Energy ETF

by Vic Patel

There are over a dozen major Clean Energy ETFs available to investors. But which one is the best one to put your hard earned money into? Best can mean different things to different people based on their investment preferences and risk profile.

In this article, I will provide a more empirical based reason behind why I believe that PZD is the most attractive Clean Energy ETF at the moment. I have based on my analysis of 4 primary factors: liquidity, diversification, recent price action, and last but not least expense ratio.

Liquidity has to be a major consideration in the...

List of Clean Energy and Alternative Energy Mutual Funds

Alternative energy and clean energy mutual funds are open-ended funds that invest primarily (at least 50% of the portfolio) in the securities of clean energy and alternative energy companies. Closed-end funds are included in the list of alternative energy and clean energy ETFs.

This list was last updated on 2/20/2021.

Allianz RCM Global EcoTrendsSM Fund (ADGLECO.TT)

Calvert Global Energy Solutions Fund Class A (CGAEX); Class C (CGACX)

Calvert Green Bond Fund (CGAFX)

Ecofin Global Renewables Infrastructure Fund (ECOIX)

Erste WWF Stock Environment CZK (AT0000A044X2.VI)

Eventide Multi-Asset Income (ETNMX)

Fidelity Select Environment and Alternative Energy Portfolio (FSLEX)

Firsthand Alternative Energy (ALTEX)

Gabelli ESG Fund Class AAA (SRIGX); class C (SRICX)

Guinness Atkinson Alternative Energy...

List of Alternative Energy and Clean Energy ETFs

This list was last updated on 4/27/2022.

ETFs are Exchange-listed funds which pool investor's money for the purpose of making Alternative Energy investments. Exchange Traded Funds (ETFs) track a specified Alternative Energy index. This list also includes closed-end mutual funds and other pooled investments which trade on exchanges.

ALPS Clean Energy ETF (ACES)

ASN Groenprojectenfonds (ASNGF.AS)

Bluefield Solar Income Fund (BSIF.L)

Defiance Next Gen H2 ETF (HDRO)

Evolve Funds Automobile Innovation Index ETF (CARS.TO)

First Trust Global Wind Energy Index (FAN)

First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID)

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

Foresight Solar Fund Limited (FSFL.L)

Global X Lithium...

Index Funds Are Climate Change Denial

Garvin Jabusch You probably know that index funds have become all the rage in investing over the past several years, as investors flock to their low fees and reject the gospel of active management. But you probably don’t know that investing in a broad-based index fund not only ignores rapid changes in the energy economy but also makes the investor complicit in climate change denial. And just as climate denial ignores the inherent risks of fossil fuels to environment, economy, and society, “set it and forget it” index investing ignores the inherent risks of fossil fuels and related stocks...

A Buying Opportunity for Alternative Energy Mutual Funds and ETFs?

By Harris Roen Alternative Energy Mutual Funds Trade Down for the Year Alternative energy mutual funds have taken a hit, down 6.5% on average over the past 12 months. Just three of the 15 mutual funds we track are up for the year. The largest gainer, Brown Advisory Sustainable Growth Inv (BIAWX), is only up an anemic 6.2%. Much of the difficulty is due to a drop in solar stocks over the past 12 months. For example, if you look at the top weighted holdings of Guinness Atkinson Alternative Energy (GAAEX), nine out of 15...

2015: a Mixed Year for Alternative Energy Funds

By Harris Roen Alternative Energy Mutual Funds Trade Flat for the Year Alternative energy mutual funds followed the overall stock market this year, closing about flat on average for 2015. The story gets more interesting, though, when you look at gains in the last quarter. Sectors such as solar and wind took a big hit by September, but then rebounded handsomely before years end. Green MFs were up 7% on average for the past three months, with 14 out of the 15 funds trading in the black… ETFs are Widely Lower 2015 was a year...

Sharp Drops for Alternative Energy Mutual Funds and ETFs

By Harris Roen Alternative Energy Mutual Funds Down for the Quarter, Mixed for the Year Alternative energy mutual funds have turned sharply lower over the past three months. Of the 14 MFs that the Roen Financial Report tracks, all but one are down for the quarter. Five are posting double-digit declines. On average, the drop in MFs are similar to that of the S&P 500 and Down Jones Industrial Average, which fell 7.44% and 9.6% respectively. The only MF showing a gain… ETFs are Widely Lower Green ETFs are showing poor returns on both a...

Alternative Energy Mutual Funds and ETFs Go In All Driections

By Harris Roen Alternative Energy Mutual Funds, Solid Long-Term Gains Returns for alternative energy mutual funds are virtually flat on average for the past three months, down slightly at a loss of 0.3%. The best short-term performer is Pax World Global Environmental Markets (PGRNX), up 2.1%… Over the longer term, returns for alternative energy mutual funds remain very strong. MFs are up 14.7% on average, with all companies showing double-digit gains on an annualized basis… Returns for ETFs are ranging widely Returns for ETFs are ranging widely, both in the short and long...

Green Mutual Funds and ETFs Show Signs of Life in 2015

By Harris Roen Alternative Energy Mutual Fund Recovering Alternative energy mutual funds are continuing to recover from a slump which started in fall 2014. Annual returns range greatly, though, from a high of 15.6% for Brown Advisory Sustainable Growth (BIAWX), to a low of -15.8% for Guinness Atkinson Alternative Energy (GAAEX). The large 12-month drop by GAAEX was precipitated by painful losses in some of its top weighted holdings… Alternative Energy ETFs Remain Volitile Green ETFs are showing a wide variety of returns, reflecting the volatility of the renewable energy sector....

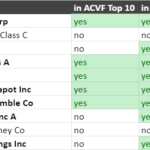

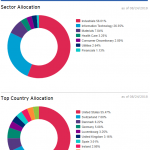

How Green Is Your Mutual Fund?

By Harris Roen Not all alternative energy mutual funds are created equal. In a recent interview with the Wall Street Journal, a reporter asked me which alternative energy mutual funds were the most focused on renewables, noting that many mutual funds hold non-energy related companies such as Apple, PepsiCo and Google. The answer to this question is not as straight forward as one might think. This article sorts out which mutual funds are truly invested in the dynamic and growing green energy sector, and which ones are more peripheral. Greener Than Thou–Revealing How Much...