Tag: ABGOY

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

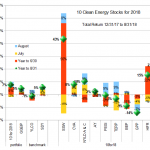

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

List of Solar Farm Owner and Developer Stocks

Solar farm owner and developer stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

This list was last updated on 3/21/2022.

See also the list of Solar Manufacturing Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

7C Solarparken AG (HRPK.DE)

Abengoa SA (ABG.MC, ABGOY, ABGOF)

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Azure Power Global Ltd. (AZRE)

Bluefield Solar Income Fund (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy...

Ten Clean Energy Stocks For 2017: Summer Harvest

Tom Konrad Ph.D., CFA

Colossal Fossil Failure

With a president actively hostile towards renewable energy and focused on promoting fossil fuels, it would be easy to think that clean energy stocks would underperform their fossil cousins. The exact opposite has been true. Despite the administrations' efforts and tweets bragging about new highs for the Dow, energy funds are down over 10% for the year. For example, the Energy Select Sector SPDR (XLE), largely composed of oil and gas companies, is down 13% for the year. The tiny coal sector did better, with the VanEck Vectors Coal ETF up 18%.

Even so, Trump's...

Stock Picks for US Energy Dominance

Tom Konrad, Ph.D. CFA Thursday night (Friday morning in Sinapore) CNBC Asia's Street Signs program must have had an interview cancellation, because they needed someone to give them 3 energy stock picks in response the Trump's "Energy Dominance" speech on last minute notice. They sent me (and probably a bunch of other people) an email two and a half hours before air. I did not see it until 20 minutes before the actual interview. I warned them that I do clean energy, not fossil fuels, but apparently they had no other takers who were awake and able to...

Ten Clean Energy Stocks For 2017: First Quarter Earnings

Tom Konrad Ph.D., CFA In the two months since the last update, most of the stocks in my Ten Clean Energy Stocks model portfolio have reported first quarter earnings. There were few surprises, and those were mostly pleasant ones, allowing the model portfolio to add to its gains, and pull a little farther ahead of its benchmark. For the year to the end of May, the model portfolio is up 13.8%, 2% ahead of its benchmark. The benchmark is an 80/20 blend of the clean energy income...

Ten Clean Energy Stocks For 2017: Earnings Season

Tom Konrad Ph.D., CFA Earnings season began in earnest in February. My Ten Clean Energy Stocks model portfolio gave back a little of its large January gains because a mix of good and bad earnings mostly offset each other. One pick (Seaspan Preferred) gave back its large January gains. Neither the original gain nor the loss were driven by news. Instead, they seemed driven by investors changing expectations for global trade in an uncertain political environment. For the year to March 17th, the portfolio and...

Ten Clean Energy Stocks For 2017: Finessing Trump

Tom Konrad Ph.D., CFA The History of the "10 Clean Energy Stocks" Model Portfolios 2017 will be the ninth year I publish a list of ten clean energy stocks I expect to do well in the coming year. This series has evolved from a simple, off-the-cuff list in 2008, to a full blown model portfolio, with predetermined benchmarks and (mostly) monthly updates on performance and significant news for the 10 stocks. While there is much overlap between the model portfolio and my own holdings (both personal and in the Green Global Equity Income Portfolio (GGEIP),...

Election Jitters Spell Opportunity: Ten Clean Energy Stocks For 2016

Tom Konrad, Ph.D., CFA This October saw falling leaves and falling stocks. Then came the first week of November with its election jitters and stripped the trees of the rest of their leaves like a fifty mile an hour wind sending stocks flying as well. While Donald Trump's unpredictable performance has the whole stock market rattled (at least when it looks like he might win), his anti-environment and pro fossil fuel rhetoric have had stocks in the sector quaking like the leaves on an aspen. Although all its benchmarks were decidedly in the red for October...

Green Plains Primes The Pump

by Debra Fiakas CFA Ethanol producer Green Plains Renewable Energy, Inc. (GPRE: Nasdaq) announced today plans to build a fuel terminal point in Beaumont, Texas. The terminal will be located at a facility owned by Green Plains’ partner in the venture, Jefferson Gulf Coast Energy Partners. It will be helpful to have a friend in the project that is expected to cost $55 million to complete just ethanol storage and throughput capacity. Planned storage capacity is equivalent to 500,000 barrels, with the potential to expand to 1.0 million barrels. Capacity to handle biofuels or other...

Yieldcos: Boom, Bust, and (Now) Beyond

The Yieldco model is not broken. But investor expectations have changed. by Tom Konrad Ph.D., CFA The Yieldco bubble popped almost exactly a year ago after a virtuous cycle turned vicious. Last May, I explained how these public companies (which own solar farms, wind farms and similar assets) could grow their dividends at double-digit rates despite no internal growth or retained earnings. This “weird trick” can work so long as the Yieldco’s stock price is rising, allowing it to sell stock at higher valuations and increase the amount of money invested per share. As long...

Ten Clean Energy Stocks For 2016 Spring Forward

Tom Konrad CFA March and April were months of recovery for the broad market and for clean energy income stocks, but most clean energy stocks failed to participate in the rally. By design, my Ten Clean Energy Stocks for 2016 model portfolio is heavily weighted towards income, recovering 9% in March and 6% in April so that it is now back in the black, up 0.8% year to date. This puts it ahead of its benchmark, which is down 0.8% through the end of April. I want to thank Aurelien Windenberger...

SunEdison: Giving Optimism A Bad Name

by Paula Mints Potentially stranding a significant number of solar development plans as well as some assets, SunEdison (SUNE) finally took the step that many expected and filed for bankruptcy. Pondering where things went wrong for the troubled firm leads to a winding road of overexpansion, debt and the traditional sidekick of highly visible companies and people, hubris. Hubris, of course, happens quite often in the corporate world and there is a long list of companies that were swayed by it – who knows, one is probably being swayed at this very minute. In the solar...

Abengoa Bioenergy files for Chapter 11

In Missouri, Abengoa (ABGB) Bioenergy US Holding, LLC filed for Chapter 11 bankruptcy relief in the US Bankruptcy Court for the Eastern District of Missouri on behalf of itself and 5 of its US bioenergy subsidiaries. The companies involved in the filings include the US holding company; companies that own and operate four of Abengoa Bioenergy’s six US starch ethanol plants; as well as various support/service companies for Abengoa’s US bioenergy operations.

This action follows the filing of two separate involuntary bankruptcy proceedings in Nebraska and Kansas earlier this month concerning the company’s starch ethanol facilities located in Ravenna and...

Yin and Yang of Yield for Abengoa

by Debra Fiakas CFA The atmosphere started getting uncomfortably hot for power developer Abengoa SA (ABGB: Nasdaq) in early August last year - and it was not just the seasonal high temperatures in the company’s home town of Seville, Spain. Management had finally admitted that operations could not generate as much cash as previously expected, causing worries about Abengoa’s ability to meet debt obligations. At the heart of the company’s cash flow woes is the reversal of Spain’s policies on solar power that has reduced subsidies and feed-in tariffs for solar power producers. In August 2015,...

Comparative Valuation of 15 Yieldcos

Tom Konrad CFA Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third. Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to...

What Yieldco Managers Are Saying About The Market Meltdown

by Tom Konrad Ph.D., CFA Note: This article was first published on GreenTechMedia on Noveber 27th. In the last six months, YieldCos have fallen from stock market darlings to pariahs. YieldCos are companies that buy clean energy projects such as solar and wind farms, and use the majority of free cash flow from these projects to pay dividends to investors. Many are listed subsidiaries or carve-outs of large developers of clean energy projects. Last year, investors repeatedly punished leading solar developers and manufacturer First Solar and SunPower for their reluctance to launch YieldCos. When...