Tom Konrad CFA

April showers fell on both the broad market and clean energy stocks last month, but my picks weathered the storm relatively well. My clean energy benchmark (PBW) was down 5.9% since the last update, and my broad market benchmark (IWM) fell 1.7%. Meanwhile 10 Clean Energy Stocks for 2014 model portfolio also fell 1.7%. For the year so far, the clean energy benchmark is up 4.5%, having given back most of its large February gains, while the broad market is down 2.5%. My model portfolio is up 2.2%, having risen less than the benchmarks early in the year, but having given back much less over the last couple months. The six income oriented picks continue to outperform the four growth oriented picks (up 9% vs. down 8%), as is to be expected in this year’s choppy market.

April showers fell on both the broad market and clean energy stocks last month, but my picks weathered the storm relatively well. My clean energy benchmark (PBW) was down 5.9% since the last update, and my broad market benchmark (IWM) fell 1.7%. Meanwhile 10 Clean Energy Stocks for 2014 model portfolio also fell 1.7%. For the year so far, the clean energy benchmark is up 4.5%, having given back most of its large February gains, while the broad market is down 2.5%. My model portfolio is up 2.2%, having risen less than the benchmarks early in the year, but having given back much less over the last couple months. The six income oriented picks continue to outperform the four growth oriented picks (up 9% vs. down 8%), as is to be expected in this year’s choppy market.

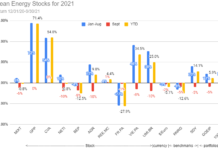

Performance details can be seen in the following chart and the stock notes below.

Individual Stock Notes

(Current prices as of May 2nd, 2014. The “High Target” and “Low Target” represent my December predictions of the ranges within which these stocks would end the year, barring extraordinary events.)

1. Hannon Armstrong Sustainable Infrastructure (NYSE:HASI).

12/26/2013 Price: $13.85. Low Target: $13. High Target: $16. Annualized Dividend: $0.88.

Current Price: $13.15. YTD Total US$ Return: -3.5%

Sustainable Infrastructure REIT Hannon Armstrong fell in April as the market absorbed 5,750,000 additional shares of stock from a secondary offering priced at $13.00 at the end of the month, including the underwriters’ full over-allotment option. The total raised was $74.75 million before deducting underwriting fees at a price slightly above the $12.50 IPO price from last year. Now that Hannon Armstrong has completed deployment of the funds raised in its IPO, secondary offerings will be necessary for the company to continue talking advantage of its many opportunities it has to invest in sustainable infrastructure projects.

This offering is accretive to current shareholders, since the company’s book value per share was $9.22 in the most recent quarter, and this will raise the book value (and equity invested) to a bit more than $10 per share by my calculation. Since HASI is able to sustain a dividend of $0.88 per share using $9.20 in equity, they should be able to increase that to around $1 per share as they deploy the money over the next two quarters.

Considering that it took the company approximately a year to deploy the $167 million raised in the IPO, we should expect another secondary offering within six months.

2. PFB Corporation (TSX:PFB, OTC:PFBOF).

12/26/2013 Price: C$4.85. Low Target: C$4. High Target: C$6.

Annualized Dividend: C$0.24.

Current Price: C$5.75. YTD Total C$ Return: 19.8%. YTD Total US$ Return: 15.9%

Green building company PFB announced its 2013 results in March, but I neglected to cover them in the last update. Revenue and Funds From Operations recovered somewhat from the depressed levels in 2012, while earnings were boosted greatly by a one-time gain from a sale-leaseback transaction of PFB’s buildings.

3. Capstone Infrastructure Corp (TSX:CSE. OTC:MCQPF).

12/26/2013 Price: C$4.05. Low Target: C$3. High Target: C$5.

Annualized Dividend: C$0.30.

Current Price: C$4.06. YTD Total C$ Return: 18.6% . YTD Total US$ Return: 14.6%

A number of analysts upgraded independent power producer Capstone Infrastructure’s stock in response to the new power purchase agreement for its Cardinal plant which I wrote about last month. Four analysts now have a “Buy” rating on the stock, with three rating it “Hold.” Their average price target is C$4.64.

The company paid its regular quarterly dividend of C$0.075 on April 30th.

4. Primary Energy Recycling Corp (TSX:PRI, OTC:PENGF).

12/26/2013 Price: C$4.93. Low Target: C$4. High Target: C$7. Annualized Dividend: US$0.28.

Current Price: C$5.49. YTD Total C$ Return: 12.5% . YTD Total US$ Return: 8.7%

Waste heat recovery firm Primary Energy was also upgraded in response to its renewed Cokenergy contract, also discussed last month. Jacob Securities increased its rating from “Hold” to “Buy,” although this change was in part due to the firm’s lower expectations for returns for the overall market of Canadian stocks.

The company announced its first quarterly dividend at the new US$0.07 per share rate payable to investors of record as of May 14th. Note that although the stock trades in Canada, all of its operations are in the US, so it reduces exchange rate risk by paying dividends in US dollars.

5. Accell Group (Amsterdam:ACCEL, OTC:ACGPF).

12/26/2013 Price: €13.59. Annual Dividend €0.55 Low Target: €11.5. High Target: €18.

Current Price: €14.41. YTD Total € Return: 6.0% . YTD Total US$ Return: 6.2%

Bicycle manufacturer and distributor Accell Group gave a sale update. Favorable weather helped European sales, but the cold winter hurt sales in the US. Parts and accessories sales growth was good, leaving overall revenues in line with previous guidance. The company’s annual dividend was set at €0.55, payable to shareholders as of the end of April.

6. New Flyer Industries (TSX:NFI, OTC:NFYEF).

12/26/2013 Price: C$10.57. Low Target: C$8. High Target: C$16.

Annualized Di

vidend: C$0.585.

Current Price: C$11.84. YTD Total C$ Return: 13.9% . YTD Total US$ Return: 10.1%.

Leading transit bus manufacturer New Flyer announced its deliveries, orders and backlog for the first quarter. Financial results are scheduled for May 7th. The company delivered more buses and continued to refill its backlog as the industry recovers from its multi-year downturn. The first five of the company’s new MiDi® mid-sized buses entered production in the first quarter.

7. Ameresco, Inc. (NASD:AMRC).

12/26/2013 Price: $9.64. Low Target: $8. High Target: $16. No Dividend.

Current Price: $6.27 YTD Total US$ Return: -35%.

The stock of energy performance contracting firm Ameresco continued to decline in response to investor disappointment with forward guidance, as discussed in the last update. Company CEO George Sakellaris continues to take advantage of the depressed stock price to buy more of his company’s stock. Although I consider this a long-term play, I added to my own position as well.

8. Power REIT (NYSE:PW).

12/26/2013 Price: $8.42. Low Target: $7. High Target: $20. Dividend currently suspended.

Current Price: $9.25 YTD Total US$ Return: 9.9%

Solar and rail real estate investment trust Power REIT closed on the previously announced purchase of 450 acres of land which will host a 60 MW solar farm in Kern County, California. The farm is expected to be completed this year. It also obtained a $26.2 million credit facility which should allow the refinancing of the bridge loans used to finance the last transaction.

At the end of the month, Power REIT’s board granted CEO David Lesser an exemption from the requirement that no individual may own more than 10% of the company’s stock. The company’s bylaws require such an exemption because Power REIT would no longer qualify as a REIT under IRS rules if the top 5 shareholders own 50% or more of outstanding stock. Since no other individual owns more than the 5% limit after which a holding would have to be reported, Power REIT is not at risk of losing its REIT status as long as Lesser’s holding remains below 30%. Lesser told me that he wants the exemption so that he can continue buying the stock on the open market at what he believes are extremely depressed prices.

I was personally deposed as a “non-party” in the company’s ongoing civil case against the lessees of its rail asset, Norkfolk Southern Corporation (NYSE:NSC) and Wheeling and Lake Erie railway (WLE). The opposing attorney wasted a full four hours of everyone’s time asking me about practically every email I had ever exchanged with company Lesser, the articles I’ve written, and the underlying documents I provided to her. As far as I could tell, the only things she managed to prove through the exercise were that my articles should not be a basis for the eventual ruling in the case (not that this was ever at issue), and that she does not mind wasting her clients’ and Power REIT’s money pursuing wild goose chases.

Fortunately, it is my interpretation of the lease agreement that the lessees should be liable for both their own and Power REIT’s legal expenses. Not that my opinion is relevant; that will depend on the judge or the terms of an eventual settlement.

She did apologize for the rudeness of a server who showed up at my house 10pm to give me the summons, but not for wasting everyone’s time. Of course, wasting everyone’s time could be precisely what NSC and WLE want.

9. MiX Telematics Limited (NASD:MIXT).

12/26/2013 Price: $12.17. Low Target: $8. High Target: $25.

No Dividend.

Current Price: $10.65. YTD Total US$ Return: -12.5%

Global provider of software as a service fleet and mobile asset management, MiX Telematics introduced its web reporting suite “DynaMiX” to Europeans at the Commercial Vehicle Show 2014.

10. Alterra Power Corp. (TSX:AXY, OTC:MGMXF).

12/26/2013 Price: C$0.28. Low Target: C$0.20. High Target: C$0.60. No Dividend.

Current Price: C$0.31 YTD Total C$ Return: 10.7% . YTD Total US$ Return: 7.0%.

Renewable energy developer and operator Alterra Power announced a joint venture with its partner on a number of previous projects, Fiera Axium Infrastructure. Alterra will own 51% of the project and oversee construction.

Two Speculative Clean Energy Penny Stocks for 2014

Ram Power Corp (TSX:RPG, OTC:RAMPF)

12/26/2013 Price: C$0.08. Low Target: C$0.00. High Target: C$0.22. No Dividend.

Current Price: C$0.07 YTD Total C$ Return: -12.5% . YTD Total US$ Return: -14.7%.

Geothermal power developer Ram Power completed the sale of its Geysers Project to US Geothermal (NYSE:HTM.) The proceeds should help cover operating expenses while we await the results of the stabilization period and performance test of Ram’s marquee San Jacinto-Tizate project. Depending on the results of that test, Ram may be eligible for distributions from the project. The test is expected to conclude on May 25th.

Finavera Wind Energy (TSX-V:FVR, OTC:FNVRF).

12/26/2013 Price: C$0.075. Low Target: C$0.00. High Target: C$0.22. No Dividend.

Current Price: C$0.125 YTD Total C$ Return: 66.7% . YTD Total US$ Return: 62.7%.

Shares of wind project developer Finavera continued to appreciate slightly in response the completion of t

he assignment of its 184MW Miekle wind project to Pattern Energy Group (NASD:PEGI) which I discussed last month.

Final Thoughts

After the amazing run the stock markets had last year, it’s not surprising that this year is more subdued. The summer months tend to be particularly weak ones for the markets. Hence I expect my safer picks to continue to do relatively well, and I am starting to increase the size of my market hedges.

If I were to buy any of these stocks today, I’d be looking at Ram Power, because its performance is going to be all about the results of the geothermal capacity test due at the end of May, not about what the broad market is doing. While I’d be tempted to buy MiX Telematics and Ameresco at current prices, I would not want to do so without a market hedge, because I feel weak market conditions could easily drive either lower.

Disclosure: Long HASI, PFB, CSE, ACCEL, NFI, PRI, AMRC, MIXT, PW, AXY, RPG, FVR, PEGI.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.